找到

227

篇与

科普知识

相关的结果

-

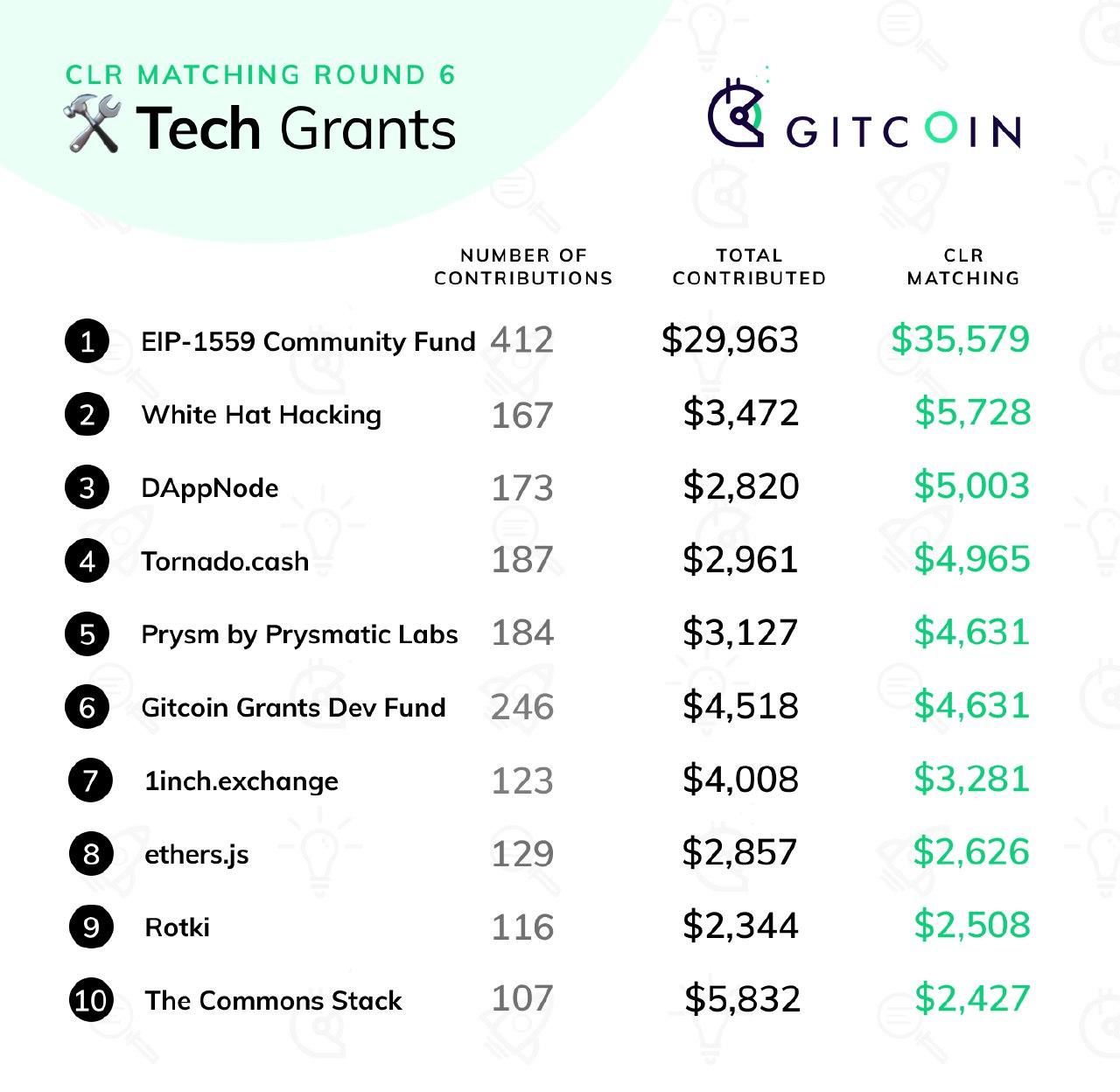

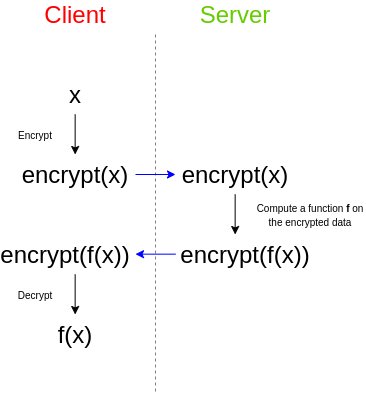

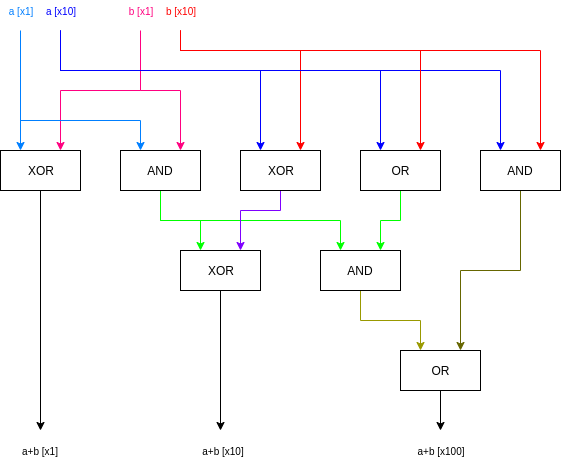

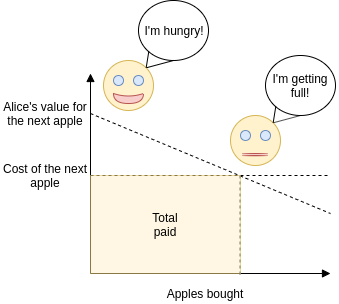

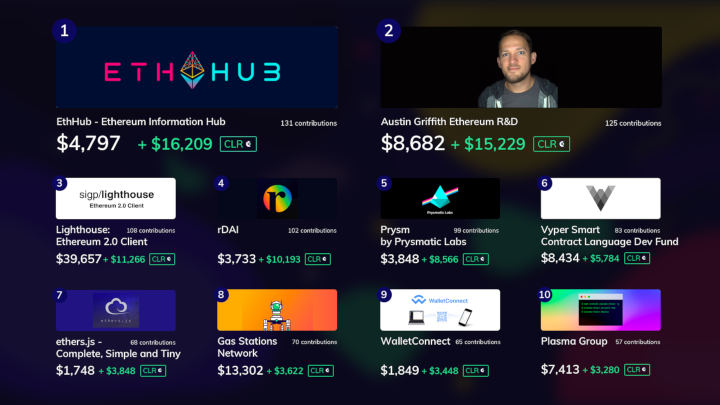

Gitcoin Grants Round 6 Retrospective Gitcoin Grants Round 6 Retrospective2020 Jul 22 See all posts Gitcoin Grants Round 6 Retrospective Round 6 of Gitcoin Grants has just finished, with $227,847 in contributions from 1,526 contributors and $175,000 in matched funds distributed across 695 projects. This time around, we had three categories: the two usual categories of "tech" and "community" (the latter renamed from "media" to reflect a desire for a broad emphasis), and the round-6-special category Crypto For Black Lives.First of all, here are the results, starting with the tech and community sections: Stability of incomeIn the last round, one concern I raised was stability of income. People trying to earn a livelihood off of quadratic funding grants would want to have some guarantee that their income isn't going to completely disappear in the next round just because the hive mind suddenly gets excited about something else.Round 6 had two mechanisms to try to provide more stability of income:A "shopping cart" interface for giving many contributions, with an explicit "repeat your contributions from the last round" feature A rule that the matching amounts are calculated using not just contributions from this round, but also "carrying over" 1/3 of the contributions from the previous round (ie. if you made a $10 grant in the previous round, the matching formula would pretend you made a $10 grant in the previous round and also a $3.33 grant this round) was clearly successful at one goal: increasing the total number of contributions. But its effect in ensuring stability of income is hard to measure. The effect of (2), on the other hand, is easy to measure, because we have stats for the actual matching amount as well as what the matching amount "would have been" if the 1/3 carry-over rule was not in place. First from the tech category: Now from the community category: Clearly, the rule helps reduce volatility, pretty much exactly as expected. That said, one could argue that this result is trivial: you could argue that all that's going on here is something very similar to grabbing part of the revenue from round N (eg. see how the new EIP-1559 Community Fund earned less than it otherwise would have) and moving it into round N+1. Sure, numerically speaking the revenues are more "stable", but individual projects could have just provided this stability to themselves by only spending 2/3 of the pot from each round, and using the remaining third later when some future round is unexpectedly low. Why should the quadratic funding mechanism significantly increase its complexity just to achieve a gain in stability that projects could simply provide for themselves?My instinct says that it would be best to try the next round with the "repeat last round" feature but without the 1/3 carryover, and see what happens. Particularly, note that the numbers seem to show that the media section would have been "stable enough" even without the carryover. The tech section was more volatile, but only because of the sudden entrance of the EIP 1559 community fund; it would be part of the experiment to see just how common that kind of situation is.About that EIP 1559 Community fund...The big unexpected winner of this round was the EIP 1559 community fund. EIP 1559 (EIP here, FAQ here, original paper here) is a major fee market reform proposal which far-reaching consequences; it aims to improve the user experience of sending Ethereum transactions, reduce economic inefficiencies, provide an accurate in-protocol gas price oracle and burn a portion of fee revenue.Many people in the Ethereum community are very excited about this proposal, though so far there has been fairly little funding toward getting it implemented. This gitcoin grant was a large community effort toward fixing this.The grant had quite a few very large contributions, including roughly $2,400 each from myself and Eric Conner, early on. Early in the round, one could clearly see the EIP 1559 community grant having an abnormally low ratio of matched funds to contributed funds; it was somewhere around $4k matched to $20k contributed. This was because while the amount contributed was large, it came from relatively few wealthier donors, and so the matching amount was less than it would have been had the same quantity of funds come from more diverse sources - the quadratic funding formula working as intended. However, a social media push advertising the grant then led to a large number of smaller contributors following along, which then quickly raised the match to its currently very high value ($35,578).Quadratic signalingUnexpectedly, this grant proved to have a double function. First, it provided $65,473 of much-needed funding to EIP 1559 implementation. Second, it served as a credible community signal of the level of demand for the proposal. The Ethereum community has long been struggling to find effective ways to determine what "the community" supports, especially in cases of controversy.Coin votes have been used in the past, and have the advantage that they come with an answer to the key problem of determining who is a "real community member" - the answer is, your membership in the Ethereum community is proportional to how much ETH you have. However, they are plutocratic; in the famous DAO coin vote, a single "yes" voter voted with more ETH than all "no" voters put together (~20% of the total). The alternative, looking at github, reddit and twitter comments and votes to measure sentiment (sometimes derided as "proof of social media") is egalitarian, but it is easily exploitable, comes with no skin-in-the-game, and frequently falls under criticisms of "foreign interference" (are those really ethereum community members disagreeing with the proposal, or just those dastardly bitcoiners coming in from across the pond to stir up trouble?).Quadratic funding falls perfectly in the middle: the need to contribute monetary value to vote ensures that the votes of those who really care about the project count more than the votes of less-concerned outsiders, and the square-root function ensures that the votes of individual ultra-wealthy "whales" cannot beat out a poorer, but broader, coalition. A diagram from my post on quadratic payments showing how quadratic payments is "in the middle" between the extremes of voting-like systems and money-like systems, and avoids the worst flaws of both.This raises the question: might it make sense to try to use explicit quadratic voting (with the ability to vote "yes" or "no" to a proposal) as an additional signaling tool to determine community sentiment for ethereum protocol proposals?How well are "guest categories" working?Since round 5, Gitcoin Grants has had three categories per round: tech, community (called "media" before), and some "guest" category that appears only during that specific round. In round 5 this was COVID relief; in round 6, it's Crypto For Black Lives. By far the largest recipient was Black Girls CODE, claiming over 80% of the matching pot. My guess for why this happened is simple: Black Girls CODE is an established project that has been participating in the grants for several rounds already, whereas the other projects were new entrants that few people in the Ethereum community knew well. In addition, of course, the Ethereum community "understands" the value of helping people code more than it understands chambers of commerce and bail funds.This raises the question: is Gitcoin's current approach of having a guest category each round actually working well? The case for "no" is basically this: while the individual causes (empowering black communities, and fighting covid) are certainly admirable, the Ethereum community is by and large not experts at these topics, and we're certainly not experts on those specific projects working on those challenges.If the goal is to try to bring quadratic funding to causes beyond Ethereum, the natural alternative is a separate funding round marketed specifically to those communities; https://downtownstimulus.com/ is a great example of this. If the goal is to get the Ethereum community interested in other causes, then perhaps running more than one round on each cause would work better. For example, "guest categories" could last for three rounds (~6 months), with $8,333 matching per round (and there could be two or three guest categories running simultaneously). In any case, it seems like some revision of the model makes sense.CollusionNow, the bad news. This round saw an unprecedented amount of attempted collusion and other forms of fraud. Here are a few of the most egregious examples.Blatant attempted bribery:Impersonation:Many contributions with funds clearly coming from a single address:The big question is: how much fraudulent activity can be prevented in a fully automated/technological way, without requiring detailed analysis of each and every case? If quadratic funding cannot survive such fraud without needing to resort to expensive case-by-case judgement, then regardless of its virtues in an ideal world, in reality it would not be a very good mechanism!Fortunately, there is a lot that we can do to reduce harmful collusion and fraud that we are not yet doing. Stronger identity systems is one example; in this round, Gitcoin added optional SMS verification, and it seems like the in this round the detected instances of collusion were mostly github-verified accounts and not SMS-verified accounts. In the next round, making some form of extra verification beyond a github account (whether SMS or something more decentralized, eg. BrightID) seems like a good idea. To limit bribery, MACI can help, by making it impossible for a briber to tell who actually voted for any particular project.Impersonation is not really a quadratic funding-specific challenge; this could be solved with manual verification, or if one wishes for a more decentralized solution one could try using Kleros or some similar system. One could even imagine incentivized reporting: anyone can lay down a deposit and flag a project as fraudulent, triggering an investigation; if the project turns out to be legitimate the deposit is lost but if the project turns out to be fraudulent, the challenger gets half of the funds that were sent to that project.ConclusionThe best news is the unmentioned news: many of the positive behaviors coming out of the quadratic funding rounds have stabilized. We're seeing valuable projects get funded in the tech and community categories, there has been less social media contention this round than in previous rounds, and people are getting better and better at understanding the mechanism and how to participate in it.That said, the mechanism is definitely at a scale where we are seeing the kinds of attacks and challenges that we would realistically see in a larger-scale context. There are some challenges that we have not yet worked through (one that I am particularly watching out for is: matched grants going to a project that one part of the community supports and another part of the community thinks is very harmful). That said, we've gotten as far as we have with fewer problems than even I had been anticipating.I recommend holding steady, focusing on security (and scalability) for the next few rounds, and coming up with ways to increase the size of the matching pots. And I continue to look forward to seeing valuable public goods get funded!

Gitcoin Grants Round 6 Retrospective Gitcoin Grants Round 6 Retrospective2020 Jul 22 See all posts Gitcoin Grants Round 6 Retrospective Round 6 of Gitcoin Grants has just finished, with $227,847 in contributions from 1,526 contributors and $175,000 in matched funds distributed across 695 projects. This time around, we had three categories: the two usual categories of "tech" and "community" (the latter renamed from "media" to reflect a desire for a broad emphasis), and the round-6-special category Crypto For Black Lives.First of all, here are the results, starting with the tech and community sections: Stability of incomeIn the last round, one concern I raised was stability of income. People trying to earn a livelihood off of quadratic funding grants would want to have some guarantee that their income isn't going to completely disappear in the next round just because the hive mind suddenly gets excited about something else.Round 6 had two mechanisms to try to provide more stability of income:A "shopping cart" interface for giving many contributions, with an explicit "repeat your contributions from the last round" feature A rule that the matching amounts are calculated using not just contributions from this round, but also "carrying over" 1/3 of the contributions from the previous round (ie. if you made a $10 grant in the previous round, the matching formula would pretend you made a $10 grant in the previous round and also a $3.33 grant this round) was clearly successful at one goal: increasing the total number of contributions. But its effect in ensuring stability of income is hard to measure. The effect of (2), on the other hand, is easy to measure, because we have stats for the actual matching amount as well as what the matching amount "would have been" if the 1/3 carry-over rule was not in place. First from the tech category: Now from the community category: Clearly, the rule helps reduce volatility, pretty much exactly as expected. That said, one could argue that this result is trivial: you could argue that all that's going on here is something very similar to grabbing part of the revenue from round N (eg. see how the new EIP-1559 Community Fund earned less than it otherwise would have) and moving it into round N+1. Sure, numerically speaking the revenues are more "stable", but individual projects could have just provided this stability to themselves by only spending 2/3 of the pot from each round, and using the remaining third later when some future round is unexpectedly low. Why should the quadratic funding mechanism significantly increase its complexity just to achieve a gain in stability that projects could simply provide for themselves?My instinct says that it would be best to try the next round with the "repeat last round" feature but without the 1/3 carryover, and see what happens. Particularly, note that the numbers seem to show that the media section would have been "stable enough" even without the carryover. The tech section was more volatile, but only because of the sudden entrance of the EIP 1559 community fund; it would be part of the experiment to see just how common that kind of situation is.About that EIP 1559 Community fund...The big unexpected winner of this round was the EIP 1559 community fund. EIP 1559 (EIP here, FAQ here, original paper here) is a major fee market reform proposal which far-reaching consequences; it aims to improve the user experience of sending Ethereum transactions, reduce economic inefficiencies, provide an accurate in-protocol gas price oracle and burn a portion of fee revenue.Many people in the Ethereum community are very excited about this proposal, though so far there has been fairly little funding toward getting it implemented. This gitcoin grant was a large community effort toward fixing this.The grant had quite a few very large contributions, including roughly $2,400 each from myself and Eric Conner, early on. Early in the round, one could clearly see the EIP 1559 community grant having an abnormally low ratio of matched funds to contributed funds; it was somewhere around $4k matched to $20k contributed. This was because while the amount contributed was large, it came from relatively few wealthier donors, and so the matching amount was less than it would have been had the same quantity of funds come from more diverse sources - the quadratic funding formula working as intended. However, a social media push advertising the grant then led to a large number of smaller contributors following along, which then quickly raised the match to its currently very high value ($35,578).Quadratic signalingUnexpectedly, this grant proved to have a double function. First, it provided $65,473 of much-needed funding to EIP 1559 implementation. Second, it served as a credible community signal of the level of demand for the proposal. The Ethereum community has long been struggling to find effective ways to determine what "the community" supports, especially in cases of controversy.Coin votes have been used in the past, and have the advantage that they come with an answer to the key problem of determining who is a "real community member" - the answer is, your membership in the Ethereum community is proportional to how much ETH you have. However, they are plutocratic; in the famous DAO coin vote, a single "yes" voter voted with more ETH than all "no" voters put together (~20% of the total). The alternative, looking at github, reddit and twitter comments and votes to measure sentiment (sometimes derided as "proof of social media") is egalitarian, but it is easily exploitable, comes with no skin-in-the-game, and frequently falls under criticisms of "foreign interference" (are those really ethereum community members disagreeing with the proposal, or just those dastardly bitcoiners coming in from across the pond to stir up trouble?).Quadratic funding falls perfectly in the middle: the need to contribute monetary value to vote ensures that the votes of those who really care about the project count more than the votes of less-concerned outsiders, and the square-root function ensures that the votes of individual ultra-wealthy "whales" cannot beat out a poorer, but broader, coalition. A diagram from my post on quadratic payments showing how quadratic payments is "in the middle" between the extremes of voting-like systems and money-like systems, and avoids the worst flaws of both.This raises the question: might it make sense to try to use explicit quadratic voting (with the ability to vote "yes" or "no" to a proposal) as an additional signaling tool to determine community sentiment for ethereum protocol proposals?How well are "guest categories" working?Since round 5, Gitcoin Grants has had three categories per round: tech, community (called "media" before), and some "guest" category that appears only during that specific round. In round 5 this was COVID relief; in round 6, it's Crypto For Black Lives. By far the largest recipient was Black Girls CODE, claiming over 80% of the matching pot. My guess for why this happened is simple: Black Girls CODE is an established project that has been participating in the grants for several rounds already, whereas the other projects were new entrants that few people in the Ethereum community knew well. In addition, of course, the Ethereum community "understands" the value of helping people code more than it understands chambers of commerce and bail funds.This raises the question: is Gitcoin's current approach of having a guest category each round actually working well? The case for "no" is basically this: while the individual causes (empowering black communities, and fighting covid) are certainly admirable, the Ethereum community is by and large not experts at these topics, and we're certainly not experts on those specific projects working on those challenges.If the goal is to try to bring quadratic funding to causes beyond Ethereum, the natural alternative is a separate funding round marketed specifically to those communities; https://downtownstimulus.com/ is a great example of this. If the goal is to get the Ethereum community interested in other causes, then perhaps running more than one round on each cause would work better. For example, "guest categories" could last for three rounds (~6 months), with $8,333 matching per round (and there could be two or three guest categories running simultaneously). In any case, it seems like some revision of the model makes sense.CollusionNow, the bad news. This round saw an unprecedented amount of attempted collusion and other forms of fraud. Here are a few of the most egregious examples.Blatant attempted bribery:Impersonation:Many contributions with funds clearly coming from a single address:The big question is: how much fraudulent activity can be prevented in a fully automated/technological way, without requiring detailed analysis of each and every case? If quadratic funding cannot survive such fraud without needing to resort to expensive case-by-case judgement, then regardless of its virtues in an ideal world, in reality it would not be a very good mechanism!Fortunately, there is a lot that we can do to reduce harmful collusion and fraud that we are not yet doing. Stronger identity systems is one example; in this round, Gitcoin added optional SMS verification, and it seems like the in this round the detected instances of collusion were mostly github-verified accounts and not SMS-verified accounts. In the next round, making some form of extra verification beyond a github account (whether SMS or something more decentralized, eg. BrightID) seems like a good idea. To limit bribery, MACI can help, by making it impossible for a briber to tell who actually voted for any particular project.Impersonation is not really a quadratic funding-specific challenge; this could be solved with manual verification, or if one wishes for a more decentralized solution one could try using Kleros or some similar system. One could even imagine incentivized reporting: anyone can lay down a deposit and flag a project as fraudulent, triggering an investigation; if the project turns out to be legitimate the deposit is lost but if the project turns out to be fraudulent, the challenger gets half of the funds that were sent to that project.ConclusionThe best news is the unmentioned news: many of the positive behaviors coming out of the quadratic funding rounds have stabilized. We're seeing valuable projects get funded in the tech and community categories, there has been less social media contention this round than in previous rounds, and people are getting better and better at understanding the mechanism and how to participate in it.That said, the mechanism is definitely at a scale where we are seeing the kinds of attacks and challenges that we would realistically see in a larger-scale context. There are some challenges that we have not yet worked through (one that I am particularly watching out for is: matched grants going to a project that one part of the community supports and another part of the community thinks is very harmful). That said, we've gotten as far as we have with fewer problems than even I had been anticipating.I recommend holding steady, focusing on security (and scalability) for the next few rounds, and coming up with ways to increase the size of the matching pots. And I continue to look forward to seeing valuable public goods get funded! -

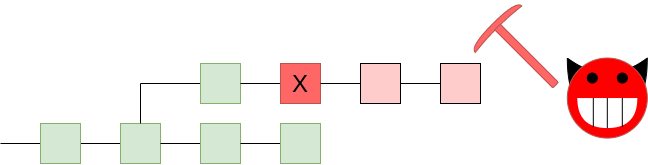

A Philosophy of Blockchain Validation A Philosophy of Blockchain Validation2020 Aug 17 See all posts A Philosophy of Blockchain Validation See also:A Proof of Stake Design Philosophy The Meaning of Decentralization Engineering Security through Coordination Problems One of the most powerful properties of a blockchain is the fact that every single part of the blockchain's execution can be independently validated. Even if a great majority of a blockchain's miners (or validators in PoS) get taken over by an attacker, if that attacker tries to push through invalid blocks, the network will simply reject them. Even those users that were not verifying blocks at that time can be (potentially automatically) warned by those who were, at which point they can check that the attacker's chain is invalid, and automatically reject it and coordinate on accepting a chain that follows the rules.But how much validation do we actually need? Do we need a hundred independent validating nodes, a thousand? Do we need a culture where the average person in the world runs software that checks every transaction? It's these questions that are a challenge, and a very important challenge to resolve especially if we want to build blockchains with consensus mechanisms better than the single-chain "Nakamoto" proof of work that the blockchain space originally started with.Why validate? A 51% attack pushing through an invalid block. We want the network to reject the chain!There are two main reasons why it's beneficial for a user to validate the chain. First, it maximizes the chance that the node can correctly determine and say on the canonical chain - the chain that the community accepts as legitimate. Typically, the canonical chain is defined as something like "the valid chain that has the most miners/validators supporting it" (eg. the "longest valid chain" in Bitcoin). Invalid chains are rejected by definition, and if there is a choice between multiple valid chains, the chain that has the most support from miners/validators wins out. And so if you have a node that verifies all the validity conditions, and hence detects which chains are valid and which chains are not, that maximizes your chances of correctly detecting what the canonical chain actually is.But there is also another deeper reason why validating the chain is beneficial. Suppose that a powerful actor tries to push through a change to the protocol (eg. changing the issuance), and has the support of the majority of miners. If no one else validates the chain, this attack can very easily succeed: everyone's clients will, by default, accept the new chain, and by the time anyone sees what is going on, it will be up to the dissenters to try to coordinate a rejection of that chain. But if average users are validating, then the coordination problem falls on the other side: it's now the responsibility of whoever is trying to change the protocol to convince the users to actively download the software patch to accept the protocol change.If enough users are validating, then instead of defaulting to victory, a contentious attempt to force a change of the protocol will default to chaos. Defaulting to chaos still causes a lot of disruption, and would require out-of-band social coordination to resolve, but it places a much larger barrier in front of the attacker, and makes attackers much less confident that they will be able to get away with a clean victory, making them much less motivated to even try to start an attack. If most users are validating (directly or indirectly), and an attack has only the support of the majority of miners, then the attack will outright default to failure - the best outcome of all.The definition view versus the coordination viewNote that this reasoning is very different from a different line of reasoning that we often hear: that a chain that changes the rules is somehow "by definition" not the correct chain, and that no matter how many other users accept some new set of rules, what matters is that you personally can stay on the chain with the old rules that you favor.Here is one example of the "by definition" perspective from Gavin Andresen:Here's another from the Wasabi wallet; this one comes even more directly from the perspective of explaining why full nodes are valuable:Notice two core components of this view:A version of the chain that does not accept the rules that you consider fundamental and non-negotiable is by definition not bitcoin (or not ethereum or whatever other chain), not matter how many other people accept that chain. What matters is that you remain on a chain that has rules that you consider acceptable. However, I believe this "individualist" view to be very wrong. To see why, let us take a look at the scenario that we are worried about: the vast majority of participants accept some change to protocol rules that you find unacceptable. For example, imagine a future where transaction fees are very low, and to keep the chain secure, almost everyone else agrees to change to a new set of rules that increases issuance. You stubbornly keep running a node that continues to enforce the old rules, and you fork off to a different chain than the majority.From your point of view, you still have your coins in a system that runs on rules that you accept. But so what? Other users will not accept your coins. Exchanges will not accept your coins. Public websites may show the price of the new coin as being some high value, but they're referring to the coins on the majority chain; your coins are valueless. Cryptocurrencies and blockchains are fundamentally social constructs; without other people believing in them, they mean nothing.So what is the alternative view? The core idea is to look at blockchains as engineering security through coordination problems.Normally, coordination problems in the world are a bad thing: while it would be better for most people if the English language got rid of its highly complex and irregular spelling system and made a phonetic one, or if the United States switched to metric, or if we could immediately drop all prices and wages by ten percent in the event of a recession, in practice this requires everyone to agree on the switch at the same time, and this is often very very hard.With blockchain applications, however, we are using coordination problems to our advantage. We are using the friction that coordination problems create as a bulwark against malfeasance by centralized actors. We can build systems that have property X, and we can guarantee that they will preserve property X because changing the rules from X to not-X would require a whole bunch of people to agree to update their software at the same time. Even if there is an actor that could force the change, doing so would be hard - much much harder than it would be if it were instead the responsibility of users to actively coordinate dissent to resist a change.Note one particular consequence of this view: it's emphatically not the case that the purpose of your full node is just to protect you, and in the case of a contentious hard fork, people with full nodes are safe and people without full nodes are vulnerable. Rather, the perspective here is much more one of herd immunity: the more people are validating, the more safe everyone is, and even if only some portion of people are validating, everyone gets a high level of protection as a result.Looking deeper into validationWe now get to the next topic, and one that is very relevant to topics such as light clients and sharding: what are we actually accomplishing by validating? To understand this, let us go back to an earlier point. If an attack happens, I would argue that we have the following preference order over how the attack goes: default to failure > default to chaos > default to victory The ">" here of course means "better than". The best is if an attack outright fails; the second best is if an attack leads to confusion, with everyone disagreeing on what the correct chain is, and the worst is if an attack succeeds. Why is chaos so much better than victory? This is a matter of incentives: chaos raises costs for the attacker, and denies them the certainty that they will even win, discouraging attacks from being attempted in the first place. A default-to-chaos environment means that an attacker needs to win both the blockchain war of making a 51% attack and the "social war" of convincing the community to follow along. This is much more difficult, and much less attractive, than just launching a 51% attack and claiming victory right there.The goal of validation is then to move away from default to victory to (ideally) default to failure or (less ideally) default to chaos. If you have a fully validating node, and an attacker tries to push through a chain with different rules, then the attack fails. If some people have a fully validating node but many others don't, the attack leads to chaos. But now we can think: are there other ways of achieving the same effect?Light clients and fraud proofsOne natural advancement in this regard is light clients with fraud proofs. Most blockchain light clients that exist today work by simply validating that the majority of miners support a particular block, and not bothering to check if the other protocol rules are being enforced. The client runs on the trust assumption that the majority of miners is honest. If a contentious fork happens, the client follows the majority chain by default, and it's up to users to take an active step if they want to follow the minority chain with the old rules; hence, today's light clients under attack default to victory. But with fraud proof technology, the situation starts to look very different.A fraud proof in its simplest form works as follows. Typically, a single block in a blockchain only touches a small portion of the blockchain "state" (account balances, smart contract code....). If a fully verifying node processes a block and finds that it is invalid, they can generate a package (the fraud proof) containing the block along with just enough data from the blockchain state to process the block. They broadcast this package to light clients. Light clients can then take the package and use that data to verify the block themselves, even if they have no other data from the chain. A single block in a blockchain touches only a few accounts. A fraud proof would contain the data in those accounts along with Merkle proofs proving that that data is correct. This technique is also sometimes known as stateless validation: instead of keeping a full database of the blockchain state, clients can keep only the block headers, and they can verify any block in real time by asking other nodes for a Merkle proof for any desired state entries that block validation is accessing.The power of this technique is that light clients can verify individual blocks only if they hear an alarm (and alarms are verifiable, so if a light client hears a false alarm, they can just stop listening to alarms from that node). Hence, under normal circumstances, the light client is still light, checking only which blocks are supported by the majority of miners/validators. But under those exceptional circumstances where the majority chain contains a block that the light client would not accept, as long as there is at least one honest node verifying the fraudulent block, that node will see that it is invalid, broadcast a fraud proof, and thereby cause the rest of the network to reject it.ShardingSharding is a natural extension of this: in a sharded system, there are too many transactions in the system for most people to be verifying directly all the time, but if the system is well designed then any individual invalid block can be detected and its invalidity proven with a fraud proof, and that proof can be broadcasted across the entire network. A sharded network can be summarized as everyone being a light client. And as long as each shard has some minimum threshold number of participants, the network has herd immunity.In addition, the fact that in a sharded system block production (and not just block verification) is highly accessible and can be done even on consumer laptops is also very important. The lack of dependence on high-performance hardware at the core of the network ensures that there is a low bar on dissenting minority chains being viable, making it even harder for a majority-driven protocol change to "win by default" and bully everyone else into submission.This is what auditability usually means in the real world: not that everyone is verifying everything all the time, but that (i) there are enough eyes on each specific piece that if there is an error it will get detected, and (ii) when an error is detected that fact that be made clear and visible to all.That said, in the long run blockchains can certainly improve on this. One particular source of improvements is ZK-SNARKs (or "validity proofs"): efficiently verifiably cryptographic proofs that allow block producers to prove to clients that blocks satisfy some arbitrarily complex validity conditions. Validity proofs are stronger than fraud proofs because they do not depend on an interactive game to catch fraud. Another important technology is data availability checks, which can protect against blocks whose data is not fully published. Data availability checks do rely on a very conservative assumption that there exists at least some small number of honest nodes somewhere in the network continues to apply, though the good news is that this minimum honesty threshold is low, and does not grow even if there is a very large number of attackers.Timing and 51% attacksNow, let us get to the most powerful consequence of the "default to chaos" mindset: 51% attacks themselves. The current norm in many communities is that if a 51% attack wins, then that 51% attack is necessarily the valid chain. This norm is often stuck to quite strictly; and a recent 51% attack on Ethereum Classic illustrated this quite well. The attacker reverted more than 3000 blocks (stealing 807,260 ETC in a double-spend in the process), which pushed the chain farther back in history than one of the two ETC clients (OpenEthereum) was technically able to revert; as a result, Geth nodes went with the attacker's chain but OpenEthereum nodes stuck with the original chain.We can say that the attack did in fact default to chaos, though this was an accident and not a deliberate design decision of the ETC community. Unfortunately, the community then elected to accept the (longer) attack chain as canonical, a move described by the eth_classic twitter as "following Proof of Work as intended". Hence, the community norms actively helped the attacker win.But we could instead agree on a definition of the canonical chain that works differently: particularly, imagine a rule that once a client has accepted a block as part of the canonical chain, and that block has more than 100 descendants, the client will from then on never accept a chain that does not include that block. Alternatively, in a finality-bearing proof of stake setup (which eg. ethereum 2.0 is), imagine a rule that once a block is finalized it can never be reverted. 5 block revert limit only for illustration purposes; in reality the limit could be something longer like 100-1000 blocks.To be clear, this introduces a significant change to how canonicalness is determined: instead of clients just looking at the data they receive by itself, clients also look at when that data was received. This introduces the possibility that, because of network latency, clients disagree: what if, because of a massive attack, two conflicting blocks A and B finalize at the same time, and some clients see A first and some see B first? But I would argue that this is good: it means that instead of defaulting to victory, even 51% attacks that just try to revert transactions default to chaos, and out-of-band emergency response can choose which of the two blocks the chain continues with. If the protocol is well-designed, forcing an escalation to out-of-band emergency response should be very expensive: in proof of stake, such a thing would require 1/3 of validators sacrificing their deposits and getting slashed.Potentially, we could expand this approach. We could try to make 51% attacks that censor transactions default to chaos too. Research on timeliness detectors pushes things further in the direction of attacks of all types defaulting to failure, though a little chaos remains because timeliness detectors cannot help nodes that are not well-connected and online.For a blockchain community that values immutability, implementing revert limits of this kind are arguably the superior path to take. It is difficult to honestly claim that a blockchain is immutable when no matter how long a transaction has been accepted in a chain, there is always the possibility that some unexpected activity by powerful actors can come along and revert it. Of course, I would claim that even BTC and ETC do already have a revert limit at the extremes; if there was an attack that reverted weeks of activity, the community would likely adopt a user-activated soft fork to reject the attackers' chain. But more definitively agreeing on and formalizing this seems like a step forward.ConclusionThere are a few "morals of the story" here. First, if we accept the legitimacy of social coordination, and we accept the legitimacy of indirect validation involving "1-of-N" trust models (that is, assuming that there exists one honest person in the network somewhere; NOT the same as assuming that one specific party, eg. Infura, is honest), then we can create blockchains that are much more scalable.Second, client-side validation is extremely important for all of this to work. A network where only a few people run nodes and everyone else really does trust them is a network that can easily be taken over by special interests. But avoiding such a fate does not require going to the opposite extreme and having everyone always validate everything! Systems that allow each individual block to be verified in isolation, so users only validate blocks if someone else raises an alarm, are totally reasonable and serve the same effect. But this requires accepting the "coordination view" of what validation is for.Third, if we allow the definition of canonicalness includes timing, then we open many doors in improving our ability to reject 51% attacks. The easiest property to gain is weak subjectivity: the idea that if clients are required to log on at least once every eg. 3 months, and refuse to revert longer than that, then we can add slashing to proof of stake and make attacks very expensive. But we can go further: we can reject chains that revert finalized blocks and thereby protect immutability, and even protect against censorship. Because the network is unpredictable, relying on timing does imply attacks "defaulting to chaos" in some cases, but the benefits are very much worth it.With all of these ideas in mind, we can avoid the traps of (i) over-centralization, (ii) overly redundant verification leading to inefficiency and (iii) misguided norms accidentally making attacks easier, and better work toward building more resilient, performant and secure blockchains.

A Philosophy of Blockchain Validation A Philosophy of Blockchain Validation2020 Aug 17 See all posts A Philosophy of Blockchain Validation See also:A Proof of Stake Design Philosophy The Meaning of Decentralization Engineering Security through Coordination Problems One of the most powerful properties of a blockchain is the fact that every single part of the blockchain's execution can be independently validated. Even if a great majority of a blockchain's miners (or validators in PoS) get taken over by an attacker, if that attacker tries to push through invalid blocks, the network will simply reject them. Even those users that were not verifying blocks at that time can be (potentially automatically) warned by those who were, at which point they can check that the attacker's chain is invalid, and automatically reject it and coordinate on accepting a chain that follows the rules.But how much validation do we actually need? Do we need a hundred independent validating nodes, a thousand? Do we need a culture where the average person in the world runs software that checks every transaction? It's these questions that are a challenge, and a very important challenge to resolve especially if we want to build blockchains with consensus mechanisms better than the single-chain "Nakamoto" proof of work that the blockchain space originally started with.Why validate? A 51% attack pushing through an invalid block. We want the network to reject the chain!There are two main reasons why it's beneficial for a user to validate the chain. First, it maximizes the chance that the node can correctly determine and say on the canonical chain - the chain that the community accepts as legitimate. Typically, the canonical chain is defined as something like "the valid chain that has the most miners/validators supporting it" (eg. the "longest valid chain" in Bitcoin). Invalid chains are rejected by definition, and if there is a choice between multiple valid chains, the chain that has the most support from miners/validators wins out. And so if you have a node that verifies all the validity conditions, and hence detects which chains are valid and which chains are not, that maximizes your chances of correctly detecting what the canonical chain actually is.But there is also another deeper reason why validating the chain is beneficial. Suppose that a powerful actor tries to push through a change to the protocol (eg. changing the issuance), and has the support of the majority of miners. If no one else validates the chain, this attack can very easily succeed: everyone's clients will, by default, accept the new chain, and by the time anyone sees what is going on, it will be up to the dissenters to try to coordinate a rejection of that chain. But if average users are validating, then the coordination problem falls on the other side: it's now the responsibility of whoever is trying to change the protocol to convince the users to actively download the software patch to accept the protocol change.If enough users are validating, then instead of defaulting to victory, a contentious attempt to force a change of the protocol will default to chaos. Defaulting to chaos still causes a lot of disruption, and would require out-of-band social coordination to resolve, but it places a much larger barrier in front of the attacker, and makes attackers much less confident that they will be able to get away with a clean victory, making them much less motivated to even try to start an attack. If most users are validating (directly or indirectly), and an attack has only the support of the majority of miners, then the attack will outright default to failure - the best outcome of all.The definition view versus the coordination viewNote that this reasoning is very different from a different line of reasoning that we often hear: that a chain that changes the rules is somehow "by definition" not the correct chain, and that no matter how many other users accept some new set of rules, what matters is that you personally can stay on the chain with the old rules that you favor.Here is one example of the "by definition" perspective from Gavin Andresen:Here's another from the Wasabi wallet; this one comes even more directly from the perspective of explaining why full nodes are valuable:Notice two core components of this view:A version of the chain that does not accept the rules that you consider fundamental and non-negotiable is by definition not bitcoin (or not ethereum or whatever other chain), not matter how many other people accept that chain. What matters is that you remain on a chain that has rules that you consider acceptable. However, I believe this "individualist" view to be very wrong. To see why, let us take a look at the scenario that we are worried about: the vast majority of participants accept some change to protocol rules that you find unacceptable. For example, imagine a future where transaction fees are very low, and to keep the chain secure, almost everyone else agrees to change to a new set of rules that increases issuance. You stubbornly keep running a node that continues to enforce the old rules, and you fork off to a different chain than the majority.From your point of view, you still have your coins in a system that runs on rules that you accept. But so what? Other users will not accept your coins. Exchanges will not accept your coins. Public websites may show the price of the new coin as being some high value, but they're referring to the coins on the majority chain; your coins are valueless. Cryptocurrencies and blockchains are fundamentally social constructs; without other people believing in them, they mean nothing.So what is the alternative view? The core idea is to look at blockchains as engineering security through coordination problems.Normally, coordination problems in the world are a bad thing: while it would be better for most people if the English language got rid of its highly complex and irregular spelling system and made a phonetic one, or if the United States switched to metric, or if we could immediately drop all prices and wages by ten percent in the event of a recession, in practice this requires everyone to agree on the switch at the same time, and this is often very very hard.With blockchain applications, however, we are using coordination problems to our advantage. We are using the friction that coordination problems create as a bulwark against malfeasance by centralized actors. We can build systems that have property X, and we can guarantee that they will preserve property X because changing the rules from X to not-X would require a whole bunch of people to agree to update their software at the same time. Even if there is an actor that could force the change, doing so would be hard - much much harder than it would be if it were instead the responsibility of users to actively coordinate dissent to resist a change.Note one particular consequence of this view: it's emphatically not the case that the purpose of your full node is just to protect you, and in the case of a contentious hard fork, people with full nodes are safe and people without full nodes are vulnerable. Rather, the perspective here is much more one of herd immunity: the more people are validating, the more safe everyone is, and even if only some portion of people are validating, everyone gets a high level of protection as a result.Looking deeper into validationWe now get to the next topic, and one that is very relevant to topics such as light clients and sharding: what are we actually accomplishing by validating? To understand this, let us go back to an earlier point. If an attack happens, I would argue that we have the following preference order over how the attack goes: default to failure > default to chaos > default to victory The ">" here of course means "better than". The best is if an attack outright fails; the second best is if an attack leads to confusion, with everyone disagreeing on what the correct chain is, and the worst is if an attack succeeds. Why is chaos so much better than victory? This is a matter of incentives: chaos raises costs for the attacker, and denies them the certainty that they will even win, discouraging attacks from being attempted in the first place. A default-to-chaos environment means that an attacker needs to win both the blockchain war of making a 51% attack and the "social war" of convincing the community to follow along. This is much more difficult, and much less attractive, than just launching a 51% attack and claiming victory right there.The goal of validation is then to move away from default to victory to (ideally) default to failure or (less ideally) default to chaos. If you have a fully validating node, and an attacker tries to push through a chain with different rules, then the attack fails. If some people have a fully validating node but many others don't, the attack leads to chaos. But now we can think: are there other ways of achieving the same effect?Light clients and fraud proofsOne natural advancement in this regard is light clients with fraud proofs. Most blockchain light clients that exist today work by simply validating that the majority of miners support a particular block, and not bothering to check if the other protocol rules are being enforced. The client runs on the trust assumption that the majority of miners is honest. If a contentious fork happens, the client follows the majority chain by default, and it's up to users to take an active step if they want to follow the minority chain with the old rules; hence, today's light clients under attack default to victory. But with fraud proof technology, the situation starts to look very different.A fraud proof in its simplest form works as follows. Typically, a single block in a blockchain only touches a small portion of the blockchain "state" (account balances, smart contract code....). If a fully verifying node processes a block and finds that it is invalid, they can generate a package (the fraud proof) containing the block along with just enough data from the blockchain state to process the block. They broadcast this package to light clients. Light clients can then take the package and use that data to verify the block themselves, even if they have no other data from the chain. A single block in a blockchain touches only a few accounts. A fraud proof would contain the data in those accounts along with Merkle proofs proving that that data is correct. This technique is also sometimes known as stateless validation: instead of keeping a full database of the blockchain state, clients can keep only the block headers, and they can verify any block in real time by asking other nodes for a Merkle proof for any desired state entries that block validation is accessing.The power of this technique is that light clients can verify individual blocks only if they hear an alarm (and alarms are verifiable, so if a light client hears a false alarm, they can just stop listening to alarms from that node). Hence, under normal circumstances, the light client is still light, checking only which blocks are supported by the majority of miners/validators. But under those exceptional circumstances where the majority chain contains a block that the light client would not accept, as long as there is at least one honest node verifying the fraudulent block, that node will see that it is invalid, broadcast a fraud proof, and thereby cause the rest of the network to reject it.ShardingSharding is a natural extension of this: in a sharded system, there are too many transactions in the system for most people to be verifying directly all the time, but if the system is well designed then any individual invalid block can be detected and its invalidity proven with a fraud proof, and that proof can be broadcasted across the entire network. A sharded network can be summarized as everyone being a light client. And as long as each shard has some minimum threshold number of participants, the network has herd immunity.In addition, the fact that in a sharded system block production (and not just block verification) is highly accessible and can be done even on consumer laptops is also very important. The lack of dependence on high-performance hardware at the core of the network ensures that there is a low bar on dissenting minority chains being viable, making it even harder for a majority-driven protocol change to "win by default" and bully everyone else into submission.This is what auditability usually means in the real world: not that everyone is verifying everything all the time, but that (i) there are enough eyes on each specific piece that if there is an error it will get detected, and (ii) when an error is detected that fact that be made clear and visible to all.That said, in the long run blockchains can certainly improve on this. One particular source of improvements is ZK-SNARKs (or "validity proofs"): efficiently verifiably cryptographic proofs that allow block producers to prove to clients that blocks satisfy some arbitrarily complex validity conditions. Validity proofs are stronger than fraud proofs because they do not depend on an interactive game to catch fraud. Another important technology is data availability checks, which can protect against blocks whose data is not fully published. Data availability checks do rely on a very conservative assumption that there exists at least some small number of honest nodes somewhere in the network continues to apply, though the good news is that this minimum honesty threshold is low, and does not grow even if there is a very large number of attackers.Timing and 51% attacksNow, let us get to the most powerful consequence of the "default to chaos" mindset: 51% attacks themselves. The current norm in many communities is that if a 51% attack wins, then that 51% attack is necessarily the valid chain. This norm is often stuck to quite strictly; and a recent 51% attack on Ethereum Classic illustrated this quite well. The attacker reverted more than 3000 blocks (stealing 807,260 ETC in a double-spend in the process), which pushed the chain farther back in history than one of the two ETC clients (OpenEthereum) was technically able to revert; as a result, Geth nodes went with the attacker's chain but OpenEthereum nodes stuck with the original chain.We can say that the attack did in fact default to chaos, though this was an accident and not a deliberate design decision of the ETC community. Unfortunately, the community then elected to accept the (longer) attack chain as canonical, a move described by the eth_classic twitter as "following Proof of Work as intended". Hence, the community norms actively helped the attacker win.But we could instead agree on a definition of the canonical chain that works differently: particularly, imagine a rule that once a client has accepted a block as part of the canonical chain, and that block has more than 100 descendants, the client will from then on never accept a chain that does not include that block. Alternatively, in a finality-bearing proof of stake setup (which eg. ethereum 2.0 is), imagine a rule that once a block is finalized it can never be reverted. 5 block revert limit only for illustration purposes; in reality the limit could be something longer like 100-1000 blocks.To be clear, this introduces a significant change to how canonicalness is determined: instead of clients just looking at the data they receive by itself, clients also look at when that data was received. This introduces the possibility that, because of network latency, clients disagree: what if, because of a massive attack, two conflicting blocks A and B finalize at the same time, and some clients see A first and some see B first? But I would argue that this is good: it means that instead of defaulting to victory, even 51% attacks that just try to revert transactions default to chaos, and out-of-band emergency response can choose which of the two blocks the chain continues with. If the protocol is well-designed, forcing an escalation to out-of-band emergency response should be very expensive: in proof of stake, such a thing would require 1/3 of validators sacrificing their deposits and getting slashed.Potentially, we could expand this approach. We could try to make 51% attacks that censor transactions default to chaos too. Research on timeliness detectors pushes things further in the direction of attacks of all types defaulting to failure, though a little chaos remains because timeliness detectors cannot help nodes that are not well-connected and online.For a blockchain community that values immutability, implementing revert limits of this kind are arguably the superior path to take. It is difficult to honestly claim that a blockchain is immutable when no matter how long a transaction has been accepted in a chain, there is always the possibility that some unexpected activity by powerful actors can come along and revert it. Of course, I would claim that even BTC and ETC do already have a revert limit at the extremes; if there was an attack that reverted weeks of activity, the community would likely adopt a user-activated soft fork to reject the attackers' chain. But more definitively agreeing on and formalizing this seems like a step forward.ConclusionThere are a few "morals of the story" here. First, if we accept the legitimacy of social coordination, and we accept the legitimacy of indirect validation involving "1-of-N" trust models (that is, assuming that there exists one honest person in the network somewhere; NOT the same as assuming that one specific party, eg. Infura, is honest), then we can create blockchains that are much more scalable.Second, client-side validation is extremely important for all of this to work. A network where only a few people run nodes and everyone else really does trust them is a network that can easily be taken over by special interests. But avoiding such a fate does not require going to the opposite extreme and having everyone always validate everything! Systems that allow each individual block to be verified in isolation, so users only validate blocks if someone else raises an alarm, are totally reasonable and serve the same effect. But this requires accepting the "coordination view" of what validation is for.Third, if we allow the definition of canonicalness includes timing, then we open many doors in improving our ability to reject 51% attacks. The easiest property to gain is weak subjectivity: the idea that if clients are required to log on at least once every eg. 3 months, and refuse to revert longer than that, then we can add slashing to proof of stake and make attacks very expensive. But we can go further: we can reject chains that revert finalized blocks and thereby protect immutability, and even protect against censorship. Because the network is unpredictable, relying on timing does imply attacks "defaulting to chaos" in some cases, but the benefits are very much worth it.With all of these ideas in mind, we can avoid the traps of (i) over-centralization, (ii) overly redundant verification leading to inefficiency and (iii) misguided norms accidentally making attacks easier, and better work toward building more resilient, performant and secure blockchains. -

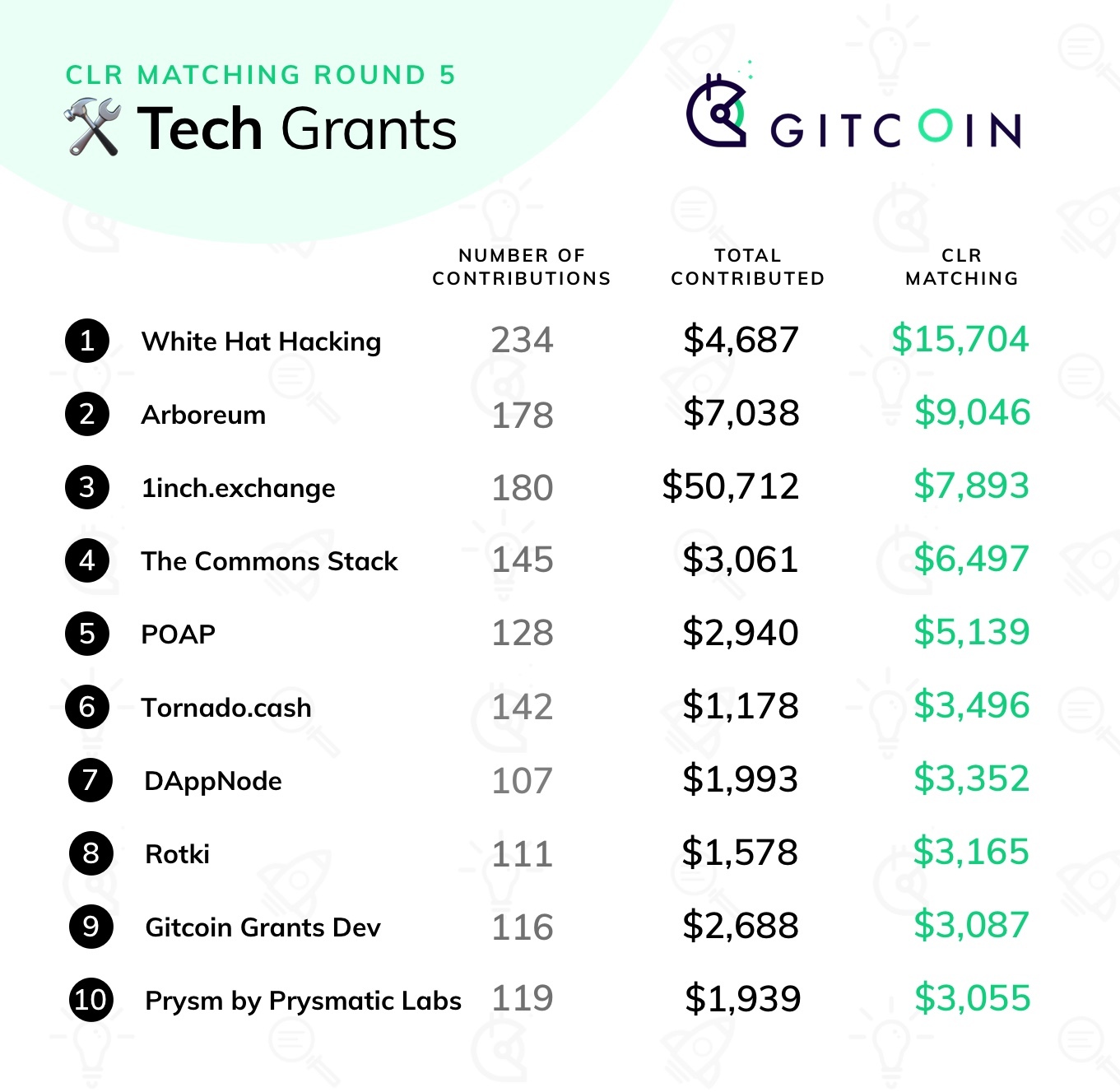

Gitcoin Grants Round 5 Retrospective Gitcoin Grants Round 5 Retrospective2020 Apr 30 See all posts Gitcoin Grants Round 5 Retrospective Special thanks to Kevin Owocki and Frank Chen for help and reviewRound 5 of Gitcoin Grants has just finished, with $250,000 of matching split between tech, media, and the new (non-Ethereum-centric) category of "public health". In general, it seems like the mechanism and the community are settling down into a regular rhythm. People know what it means to contribute, people know what to expect, and the results emerge in a relatively predictable pattern - even if which specific grants get the most funds is not so easy to predict. Stability of incomeSo let's go straight into the analysis. One important property worth looking at is stability of income across rounds: do projects that do well in round N also tend to do well in round N+1? Stability of income is very important if we want to support an ecosystem of "quadratic freelancers": we want people to feel comfortable relying on their income knowing that it will not completely disappear the next round. On the other hand, it would be harmful if some recipients became completely entrenched, with no opportunity for new projects to come in and compete for the pot, so there is a need for a balance.On the media side, we do see some balance between stability and dynamism: Week in Ethereum had the highest total amount received in both the previous round and the current round. EthHub and Bankless are also near the top in both the current round and the previous round. On the other hand, Antiprosynthesis, the (beloved? notorious? famous?) Twitter info-warrior, has decreased from $13,813 to $5,350, while Chris Blec's YouTube channel has increased from $5,851 to $12,803. So some churn, but also some continuity between rounds.On the tech side, we see much more churn in the winners, with a less clear relationship between income last round and income this round: Last round, the winner was Tornado Cash, claiming $30,783; this round, they are down to $8,154. This round, the three roughly-even winners are Samczsun ($4,631 contributions + $15,704 match = $20,335 total), Arboreum ($16,084 contributions + $9,046 match = $25,128 total) and 1inch.exchange ($58,566 contributions + $7,893 match = $66,459 total), in the latter case the bulk coming from one contribution: In the previous round, those three winners were not even in the top ten, and in some cases not even part of Gitcoin Grants at all.These numbers show us two things. First, large parts of the Gitcoin community seem to be in the mindset of treating grants not as a question of "how much do you deserve for your last two months of work?", but rather as a one-off reward for years of contributions in the past. This was one of the strongest rebuttals that I received to my criticism of Antiprosynthesis receiving $13,813 in the last round: that the people who contributed to that award did not see it as two months' salary, but rather as a reward for years of dedication and work for the Ethereum ecosystem. In the next round, contributors were content that the debt was sufficiently repaid, and so they moved on to give a similar gift of appreciation and gratitude to Chris Blec.That said, not everyone contributes in this way. For example, Prysm got $7,966 last round and $8,033 this round, and Week in Ethereum is consistently well-rewarded ($16,727 previous, $12,195 current), and EthHub saw less stability but still kept half its income ($13,515 previous, $6,705 current) even amid a 20% drop to the matching pool size as some funds were redirected to public health. So there definitely are some contributors that are getting almost a reasonable monthly salary from Gitcoin Grants (yes, even these amounts are all serious underpayment, but remember that the pool of funds Gitcoin Grants has to distribute in the first place is quite small, so there's no allocation that would not seriously underpay most people; the hope is that in the future we will find ways to make the matching pot grow bigger).Why didn't more people use recurring contributions?One feature that was tested this round to try to improve stability was recurring contributions: users could choose to split their contribution among multiple rounds. However, the feature was not used often: out of over 8,000 total contributions, only 120 actually made recurring contributions. I can think of three possible explanations for this:People just don't want to give recurring contributions; they genuinely prefer to freshly rethink who they are supporting every round. People would be willing to give more recurring contributions, but there is some kind of "market failure" stopping them; that is, it's collectively optimal for everyone to give more recurring contributions, but it's not any individual contributor's interest to be the first to do so. There's some UI inconveniences or other "incidental" obstacles preventing recurring contributions. In a recent call with the Gitcoin team, hypothesis (3) was mentioned frequently. A specific issue was that people were worried about making recurring contributions because they were concerned whether or not the money that they lock up for a recurring contribution would be safe. Improving the payment system and notification workflow may help with this. Another option is to move away from explicit "streaming" and instead simply have the UI provide an option for repeating the last round's contributions and making edits from there.Hypothesis (1) also should be taken seriously; there's genuine value in preventing ossification and allowing space for new entrants. But I want to zoom in particularly on hypothesis (2), the coordination failure hypothesis.My explanation of hypothesis (2) starts, interestingly enough, with a defense of (1): why ossification is genuinely a risk. Suppose that there are two projects, A and B, and suppose that they are equal quality. But A already has an established base of contributors; B does not (we'll say for illustration it only has a few existing contributors). Here's how much matching you are contributing by participating in each project:Contributing to A Contributing to B Clearly, you have more impact by supporting A, and so A gets even more contributors and B gets fewer; the rich get richer. Even if project B was somewhat better, the greater impact from supporting A could still create a lock-in that reinforces A's position. The current everyone-starts-from-zero-in-each-round mechanism greatly limits this type of entrenchment, because, well, everyone's matching gets reset and starts from zero.However, a very similar effect also is the cause behind the market failure preventing stable recurring contributions, and the every-round-reset actually exacerbates it. Look at the same picture above, except instead of thinking of A and B as two different projects, think of them as the same project in the current round and in the next round.We simplify the model as follows. An individual has two choices: contribute $10 in the current round, or contribute $5 in the current round and $5 in the next round. If the matchings in the two rounds were equal, then the latter option would actually be more favorable: because the matching is proportional to the square root of the donation size, the former might give you eg. a $200 match now, but the latter would give you $141 in the current round + $141 in the next round = $282. But if you see a large mass of people contributing in the current round, and you expect much fewer people to contribute in the second round, then the choice is not $200 versus $141 + $141, it might be $200 versus $141 + $5. And so you're better off joining the current round's frenzy. We can mathematically analyze the equilibrium: So there is a substantial region within which the bad equilibrium of everyone concentrating is sticky: if more than about 3/4 of contributors are expected to concentrate, it seems in your interest to also concentrate. A mathematically astute reader may note that there is always some intermediate strategy that involves splitting but at a ratio different from 50/50, which you can prove performs better than either full concentrating or the even split, but here we get back to hypothesis (3) above: the UI doesn't offer such a complex menu of choices, it just offers the choice of a one-time contribution or a recurring contribution, so people pick one or the other.How might we fix this? One option is to add a bit of continuity to matching ratios: when computing pairwise matches, match against not just the current round's contributors but, say, 1/3 of the previous round's contributors as well: This makes some philosophical sense: the objective of quadratic funding is to subsidize contributions to projects that are detected to be public goods because multiple people have contributed to them, and contributions in the previous round are certainly also evidence of a project's value, so why not reuse those? So here, moving away from everyone-starts-from-zero toward this partial carryover of matching ratios would mitigate the round concentration effect - but, of course, it would exacerbate the risk of entrenchment. Hence, some experimentation and balance may be in order. A broader philosophical question is, is there really a deep inherent tradeoff between risk of entrenchment and stability of income, or is there some way we could get both?Responses to negative contributionsThis round also introduced negative contributions, a feature proposed in my review of the previous round. But as with recurring contributions, very few people made negative contributions, to the point where their impact on the results was negligible. Also, there was active opposition to negative contributions: Source: honestly I have no idea, someone else sent it to me and they forgot where they found it. Sorry :( The main source of opposition was basically what I predicted in the previous round. Adding a mechanism that allows people to penalize others, even if deservedly so, can have tricky and easily harmful social consequences. Some people even opposed the negative contribution mechanism to the point where they took care to give positive contributions to everyone who received a negative contribution.How do we respond? To me it seems clear that, in the long run, some mechanism of filtering out bad projects, and ideally compensating for overexcitement into good projects, will have to exist. It doesn't necessarily need to be integrated as a symmetric part of the QF, but there does need to be a filter of some form. And this mechanism, whatever form it will take, invariably opens up the possibility of the same social dynamics. So there is a challenge that will have to be solved no matter how we do it.One approach would be to hide more information: instead of just hiding who made a negative contribution, outright hide the fact that a negative contribution was made. Many opponents of negative contributions explicitly indicated that they would be okay (or at least more okay) with such a model. And indeed (see the next section), this is a direction we will have to go anyway. But it would come at a cost - effectively hiding negative contributions would mean not giving as much real-time feedback into what projects got how much funds.Stepping up the fight against collusionThis round saw much larger-scale attempts at collusion: It does seem clear that, at current scales, stronger protections against manipulation are goingto be required. The first thing that can be done is adding a stronger identity verification layer than Github accounts; this is something that the Gitcoin team is already working on. There is definitely a complex tradeoff between security and inclusiveness to be worked through, but it is not especially difficult to implement a first version. And if the identity problem is solved to a reasonable extent, that will likely be enough to prevent collusion at current scales. But in the longer term, we are going to need protection not just against manipulating the system by making many fake accounts, but also against collusion via bribes (explicit and implicit).MACI is the solution that I proposed (and Barry Whitehat and co are implementing) to solve this problem. Essentially, MACI is a cryptographic construction that allows for contributions to projects to happen on-chain in a privacy-preserving, encrypted form, that allows anyone to cryptographically verify that the mechanism is being implemented correctly, but prevents participants from being able to prove to a third party that they made any particular contribution. Unprovability means that if someone tries to bribe others to contribute to their project, the bribe recipients would have no way to prove that they actually contributed to that project, making the bribe unenforceable. Benign "collusion" in the form of friends and family supporting each other would still happen, as people would not easily lie to each other at such small scales, but any broader collusion would be very difficult to maintain.However, we do need to think through some of the second-order consequences that integrating MACI would introduce. The biggest blessing, and curse, of using MACI is that contributions become hidden. Identities necessarily become hidden, but even the exact timing of contributions would need to be hidden to prevent deanonymization through timing (to prove that you contributed, make the total amount jump up between 17:40 and 17:42 today). Instead, for example, totals could be provided and updated once per day. Note that as a corollary negative contributions would be hidden as well; they would only appear if they exceeded all positive contributions for an entire day (and if even that is not desired then the mechanism for when balances are updated could be tweaked to further hide downward changes).The challenge with hiding contributions is that we lose the "social proof" motivator for contributing: if contributions are unprovable you can't as easily publicly brag about a contribution you made. My best proposal for solving this is for the mechanism to publish one extra number: the total amount that a particular participant contributed (counting only projects that have received at least 10 contributors to prevent inflating one's number by self-dealing). Individuals would then have a generic "proof-of-generosity" that they contributed some specific total amount, and could publicly state (without proof) what projects it was that they supported. But this is all a significant change to the user experience that will require multiple rounds of experimentation to get right.ConclusionsAll in all, Gitcoin Grants is establishing itself as a significant pillar of the Ethereum ecosystem that more and more projects are relying on for some or all of their support. While it has a relatively low amount of funding at present, and so inevitably underfunds almost everything it touches, we hope that over time we'll continue to see larger sources of funding for the matching pools appear. One option is MEV auctions, another is that new or existing token projects looking to do airdrops could provide the tokens to a matching pool. A third is transaction fees of various applications. With larger amounts of funding, Gitcoin Grants could serve as a more significant funding stream - though to get to that point, further iteration and work on fine-tuning the mechanism will be required. Additionally, this round saw Gitcoin Grants' first foray into applications beyond Ethereum with the health section. There is growing interest in quadratic funding from local government bodies and other non-blockchain groups, and it would be very valuable to see quadratic funding more broadly deployed in such contexts. That said, there are unique challenges there too. First, there's issues around onboarding people who do not already have cryptocurrency. Second, the Ethereum community is naturally expert in the needs of the Ethereum community, but neither it nor average people are expert in, eg. medical support for the coronavirus pandemic. We should expect quadratic funding to perform worse when the participants are not experts in the domain they're being asked to contribute to. Will non-blockchain uses of QF focus on domains where there's a clear local community that's expert in its own needs, or will people try larger-scale deployments soon? If we do see larger-scale deployments, how will those turn out? There's still a lot of questions to be answered.