找到

227

篇与

科普知识

相关的结果

-

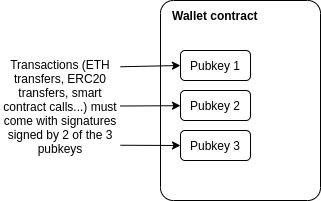

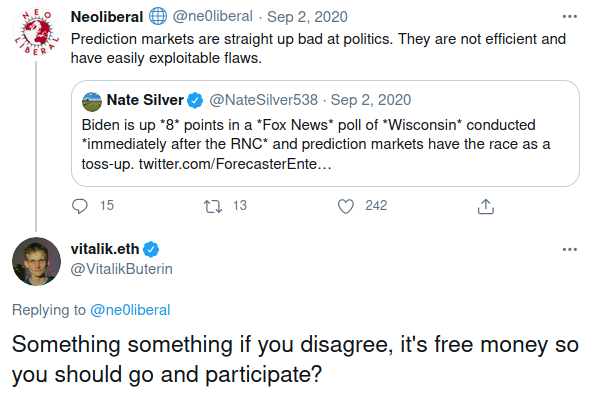

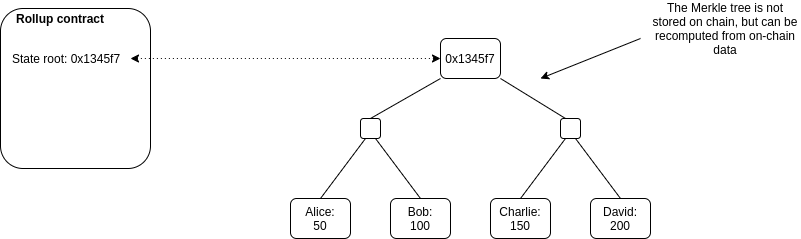

Why we need wide adoption of social recovery wallets Why we need wide adoption of social recovery wallets2021 Jan 11 See all posts Why we need wide adoption of social recovery wallets Special thanks to Itamar Lesuisse from Argent and Daniel Wang from Loopring for feedback.One of the great challenges with making cryptocurrency and blockchain applications usable for average users is security: how do we prevent users' funds from being lost or stolen? Losses and thefts are a serious issue, often costing innocent blockchain users thousands of dollars or even in some cases the majority of their entire net worth.There have been many solutions proposed over the years: paper wallets, hardware wallets, and my own one-time favorite: multisig wallets. And indeed they have led to significant improvements in security. However, these solutions have all suffered from various defects - sometimes providing far less extra protection against theft and loss than is actually needed, sometimes being cumbersome and difficult to use leading to very low adoption, and sometimes both. But recently, there is an emerging better alternative: a newer type of smart contract wallet called a social recovery wallet. These wallets can potentially provide a high level of security and much better usability than previous options, but there is still a way to go before they can be easily and widely deployed. This post will go through what social recovery wallets are, why they matter, and how we can and should move toward much broader adoption of them throughout the ecosystem.Wallet security is a really big problemWallet security issues have been a thorn in the side of the blockchain ecosystem almost since the beginning. Cryptocurrency losses and thefts were rampant even back in 2011 when Bitcoin was almost the only cryptocurrency out there; indeed, in my pre-Ethereum role as a cofounder and writer of Bitcoin Magazine, I wrote an entire article detailing the horrors of hacks and losses and thefts that were already happening at the time.Here is one sample:Last night around 9PM PDT, I clicked a link to go to CoinChat[.]freetzi[.]com – and I was prompted to run java. I did (thinking this was a legitimate chatoom), and nothing happened. I closed the window and thought nothing of it. I opened my bitcoin-qt wallet approx 14 minutes later, and saw a transaction that I did NOT approve go to wallet 1Es3QVvKN1qA2p6me7jLCVMZpQXVXWPNTC for almost my entire wallet...This person's losses were 2.07 BTC, worth $300 at the time, and over $70000 today. Here's another one:In June 2011, the Bitcointalk member "allinvain" lost 25,000 BTC (worth $500,000 at the time) after an unknown intruder somehow gained direct access to his computer. The attacker was able to access allinvain's wallet.dat file, and quickly empty out the wallet – either by sending a transaction from allinvain's computer itself, or by simply uploading the wallet.dat file and emptying it on his own machine.In present-day value, that's a loss of nearly one billion dollars. But theft is not the only concern; there are also losses from losing one's private keys. Here's Stefan Thomas:Bitcoin developer Stefan Thomas had three backups of his wallet – an encrypted USB stick, a Dropbox account and a Virtualbox virtual machine. However, he managed to erase two of them and forget the password to the third, forever losing access to 7,000 BTC (worth $125,000 at the time). Thomas's reaction: "[I'm] pretty dedicated to creating better clients since then."One analysis of the Bitcoin ecosystem suggests that 1500 BTC may be lost every day - over ten times more than what Bitcoin users spend on transaction fees, and over the years adding up to as much as 20% of the total supply. The stories and the numbers alike point to the same inescapable truth: the importance of the wallet security problem is great, and it should not be underestimated.It's easy to see the social and psychological reasons why wallet security is easy to underestimate: people naturally worry about appearing uncareful or dumb in front of an always judgemental public, and so many keep their experiences with their funds getting hacked to themselves. Loss of funds is even worse, as there is a pervasive (though in my opinion very incorrect) feeling that "there is no one to blame but yourself". But the reality is that the whole point of digital technology, blockchains included, is to make it easier for humans to engage in very complicated tasks without having to exert extreme mental effort or live in constant fear of making mistakes. An ecosystem whose only answer to losses and thefts is a combination of 12-step tutorials, not-very-secure half-measures and the not-so-occasional semi-sarcastic "sorry for your loss" is going to have a hard time getting broad adoption.So solutions that reduce the quantity of losses and thefts taking place, without requiring all cryptocurrency users to turn personal security into a full-time hobby, are highly valuable for the industry.Hardware wallets alone are not good enoughHardware wallets are often touted as the best-in-class technology for cryptocurrency funds management. A hardware wallet is a specialized hardware device which can be connected to your computer or phone (eg. through USB), and which contains a specialized chip that can only generate private keys and sign transactions. A transaction would be initiated on your computer or phone, must be confirmed on the hardware wallet before it can be sent. The private key stays on your hardware wallet, so an attacker that hacks into your computer or phone could not drain the funds.Hardware wallets are a significant improvement, and they certainly would have protected the Java chatroom victim, but they are not perfect. I see two main problems with hardware wallets:Supply chain attacks: if you buy a hardware wallet, you are trusting a number of actors that were involved in producing it - the company that designed the wallet, the factory that produced it, and everyone involved in shipping it who could have replaced it with a fake. Hardware wallets are potentially a magnet for such attacks: the ratio of funds stolen to number of devices compromised is very high. To their credit, hardware wallet manufacturers such as Ledger have put in many safeguards to protect against these risks, but some risks still remain. A hardware device fundamentally cannot be audited the same way a piece of open source software can. Still a single point of failure: if someone steals your hardware wallet right after they stand behind your shoulder and catch you typing in the PIN, they can steal your funds. If you lose your hardware wallet, then you lose your funds - unless the hardware wallet generates and outputs a backup at setup time, but as we will see those have problems of their own... Mnemonic phrases are not good enoughMany wallets, hardware and software alike, have a setup procedure during which they output a mnemonic phrase, which is a human-readable 12 to 24-word encoding of the wallet's root private key. A mnemonic phrase looks like this: vote dance type subject valley fall usage silk essay lunch endorse lunar obvious race ribbon key already arrow enable drama keen survey lesson cruelIf you lose your wallet but you have the mnemonic phrase, you can input the phrase when setting up a new wallet to recover your account, as the mnemonic phrase contains the root key from which all of your other keys can be generated.Mnemonic phrases are good for protecting against loss, but they do nothing against theft. Even worse, they add a new vector for theft: if you have the standard hardware wallet + mnemonic backup combo, then someone stealing either your hardware wallet + PIN or your mnemonic backup can steal your funds. Furthermore, maintaining a mnemonic phrase and not accidentally throwing it away is itself a non-trivial mental effort.The problems with theft can be alleviated if you split the phrase in half and give half to your friend, but (i) almost no one actually promotes this, (ii) there are security issues, as if the phrase is short (128 bits) then a sophisticated and motivated attacker who steals one piece may be able to brute-force through all \(2^\) possible combinations to find the other, and (iii) it increases the mental overhead even further.So what do we need?What we need is a wallet design which satisfies three key criteria:No single point of failure: there is no single thing (and ideally, no collection of things which travel together) which, if stolen, can give an attacker access to your funds, or if lost, can deny you access to your funds. Low mental overhead: as much as possible, it should not require users to learn strange new habits or exert mental effort to always remember to follow certain patterns of behavior. Maximum ease of transacting: most normal activities should not require much more effort than they do in regular wallets (eg. Status, Metamask...) Multisig is good!The best-in-class technology for solving these problems back in 2013 was multisig. You could have a wallet that has three keys, where any two of them are needed to send a transaction. This technology was originally developed within the Bitcoin ecosystem, but excellent multisig wallets (eg. see Gnosis Safe) now exist for Ethereum too. Multisig wallets have been highly successful within organizations: the Ethereum Foundation uses a 4-of-7 multisig wallet to store its funds, as do many other orgs in the Ethereum ecosystem.For a multisig wallet to hold the funds for an individual, the main challenge is: who holds the funds, and how are transactions approved? The most common formula is some variant of "two easily accessible, but separate, keys, held by you (eg. laptop and phone) and a third more secure but less accessible a backup, held offline or by a friend or institution".This is reasonably secure: there is no single device that can be lost or stolen that would lead to you losing access to your funds. But the security is far from perfect: if you can steal someone's laptop, it's often not that hard to steal their phone as well. The usability is also a challenge, as every transaction now requires two confirmations with two devices.Social recovery is betterThis gets us to my preferred method for securing a wallet: social recovery. A social recovery system works as follows:There is a single "signing key" that can be used to approve transactions There is a set of at least 3 (or a much higher number) of "guardians", of which a majority can cooperate to change the signing key of the account. The signing key has the ability to add or remove guardians, though only after a delay (often 1-3 days). Under all normal circumstances, the user can simply use their social recovery wallet like a regular wallet, signing messages with their signing key so that each transaction signed can fly off with a single confirmation click much like it would in a "traditional" wallet like Metamask.If a user loses their signing key, that is when the social recovery functionality would kick in. The user can simply reach out to their guardians and ask them to sign a special transaction to change the signing pubkey registered in the wallet contract to a new one. This is easy: they can simply go to a webpage such as security.loopring.io, sign in, see a recovery request and sign it. About as easy for each guardian as making a Uniswap trade.There are many possible choices for whom to select as a guardian. The three most common choices are:Other devices (or paper mnemonics) owned by the wallet holder themselves Friends and family members Institutions, which would sign a recovery message if they get a confirmation of your phone number or email or perhaps in high value cases verify you personally by video call Guardians are easy to add: you can add a guardian simply by typing in their ENS name or ETH address, though most social recovery wallets will require the guardian to sign a transaction in the recovery webpage to agree to be added. In any sanely designed social recovery wallet, the guardian does NOT need to download and use the same wallet; they can simply use their existing Ethereum wallet, whichever type of wallet it is. Given the high convenience of adding guardians, if you are lucky enough that your social circles are already made up of Ethereum users, I personally favor high guardian counts (ideally 7+) for increased security. If you already have a wallet, there is no ongoing mental effort required to be a guardian: any recovery operations that you do would be done through your existing wallet. If you not know many other active Ethereum users, then a smaller number of guardians that you trust to be technically competent is best.To reduce the risk of attacks on guardians and collusion, your guardians do not have to be publicly known: in fact, they do not need to know each other's identities. This can be accomplished in two ways. First, instead of the guardians' addresses being stored directly on chain, a hash of the list of addresses can be stored on chain, and the wallet owner would only need to publish the full list at recovery time. Second, each guardian can be asked to deterministically generate a new single-purpose address that they would use just for that particular recovery; they would not need to actually send any transactions with that address unless a recovery is actually required. To complement these technical protections, it's recommended to choose a diverse collection of guardians from different social circles (including ideally one institutional guardian); these recommendations together would make it extremely difficult for the guardians to be attacked simultaneously or collude.In the event that you die or are permanently incapacitated, it would be a socially agreed standard protocol that guardians can publicly announce themselves, so in that case they can find each other and recover your funds.Social recovery wallets are not a betrayal, but rather an expression, of "crypto values"One common response to suggestions to use any form of multisig, social recovery or otherwise, is the idea that this solution goes back to "trusting people", and so is a betrayal of the values of the blockchain and cryptocurrency industry. While I understand why one may think this at first glance, I would argue that this criticism stems from a fundamental misunderstanding of what crypto should be about.To me, the goal of crypto was never to remove the need for all trust. Rather, the goal of crypto is to give people access to cryptographic and economic building blocks that give people more choice in whom to trust, and furthermore allow people to build more constrained forms of trust: giving someone the power to do some things on your behalf without giving them the power to do everything. Viewed in this way, multisig and social recovery are a perfect expression of this principle: each participant has some influence over the ability to accept or reject transactions, but no one can move funds unilaterally. This more complex logic allows for a setup far more secure than what would be possible if there had to be one person or key that unilaterally controlled the funds.This fundamental idea, that human inputs should be wielded carefully but not thrown away outright, is powerful because it works well with the strengths and weaknesses of the human brain. The human brain is quite poorly suited for remembering passwords and tracking paper wallets, but it's an ASIC for keeping track of relationships with other people. This effect is even stronger for less technical users: they may have a harder time with wallets and passwords, but they are just as adept at social tasks like "choose 7 people who won't all gang up on me". If we can extract at least some information from human inputs into a mechanism, without those inputs turning into a vector for attack and exploitation, then we should figure out how. And social recovery is very robust: for a wallet with 7 guardians to be compromised, 4 of the 7 guardians would need to somehow discover each other and agree to steal the funds, without any of them tipping the owner off: certainly a much tougher challenge than attacking a wallet protected purely by a single individuals.How can social recovery protect against theft?Social recovery as explained above deals with the risk that you lose your wallet. But there is still the risk that your signing key gets stolen: someone hacks into your computer, sneaks up behind you while you're already logged in and hits you over the head, or even just uses some user interface glitch to trick you into signing a transaction that you did not intend to sign.We can extend social recovery to deal with such issues by adding a vault. Every social recovery wallet can come with an automatically generated vault. Assets can be moved to the vault just by sending them to the vault's address, but they can be moved out of the vault only with a 1 week delay. During that delay, the signing key (or, by extension, the guardians) can cancel the transaction. If desired, the vault could also be programmed so that some limited financial operations (eg. Uniswap trades between some whitelisted tokens) can be done without delay.Existing social recovery walletsCurrently, the two major wallets that have implemented social recovery are the Argent wallet and the Loopring wallet: The Argent wallet is the first major, and still the most popular, "smart contract wallet" currently in use, and social recovery is one of its main selling points. The Argent wallet includes an interface by which guardians can be added and removed: To protect against theft, the wallet has a daily limit: transactions up to that amount are instant but transactions above that amount require guardians to approve to finalize the withdrawal.The Loopring wallet is most known for being built by the developers of (and of course including support for) the Loopring protocol, a ZK rollup for payments and decentralized exchange. But the Loopring wallet also has a social recovery feature, which works very similarly to that in Argent. In both cases, the wallet companies provide one guardian for free, which relies on a confirmation code sent by mobile phone to authenticate you. For the other guardians, you can add either other users of the same wallet, or any Ethereum user by providing their Ethereum address.The user experience in both cases is surprisingly smooth. There were two main challenges. First, the smoothness in both cases relies on a central "relayer" run by the wallet maker that re-publishes signed messages as transactions. Second, the fees are high. Fortunately, both of these problems are surmountable.Migration to Layer 2 (rollups) can solve the remaining challengesAs mentioned above, there are two key challenges: (i) the dependence on relayers to solve transactions, and (ii) high transaction fees. The first challenge, dependence on relayers, is an increasingly common problem in Ethereum applications. The issue arises because there are two types of accounts in Ethereum: externally owned accounts (EOAs), which are accounts controlled by a single private key, and contracts. In Ethereum, there is a rule that every transaction must start from an EOA; the original intention was that EOAs represent "users" and contracts represent "applications", and an application can only run if a user talks to the application. If we want wallets with more complex policies, like multisig and social recovery, we need to use contracts to represent users. But this poses a challenge: if your funds are in a contract, you need to have some other account that has ETH that can pay to start each transaction, and it needs quite a lot of ETH just in case transaction fees get really high.Argent and Loopring get around this problem by personally running a "relayer". The relayer listens for off-chain digitally signed "messages" submitted by users, and wraps these messages in a transaction and publishes them to chain. But for the long run, this is a poor solution; it adds an extra point of centralization. If the relayer is down and a user really needs to send a transaction, they can always just send it from their own EOA, but it is nevertheless the case that a new tradeoff between centralization and inconvenience is introduced. There are efforts to solve this problem and get convenience without centralization; the main two categories revolve around either making a generalized decentralized relayer network or modifying the Ethereum protocol itself to allow transactions to begin from contracts. But neither of these solutions solve transaction fees, and in fact, they make the problem worse due to smart contracts' inherently greater complexity.Fortunately, we can solve both of these problems at the same time, by looking toward a third solution: moving the ecosystem onto layer 2 protocols such as optimistic rollups and ZK rollups. Optimistic and ZK rollups can both be designed with account abstraction built in, circumventing any need for relayers. Existing wallet developers are already looking into rollups, but ultimately migrating to rollups en masse is an ecosystem-wide challenge.An ecosystem-wide mass migration to rollups is as good an opportunity as any to reverse the Ethereum ecosystem's earlier mistakes and give multisig and smart contract wallets a much more central role in helping to secure users' funds. But this requires broader recognition that wallet security is a challenge, and that we have not gone nearly as far in trying to meet and challenge as we should. Multisig and social recovery need not be the end of the story; there may well be designs that work even better. But the simple reform of moving to rollups and making sure that these rollups treat smart contract wallets as first class citizens is an important step toward making that happen.

Why we need wide adoption of social recovery wallets Why we need wide adoption of social recovery wallets2021 Jan 11 See all posts Why we need wide adoption of social recovery wallets Special thanks to Itamar Lesuisse from Argent and Daniel Wang from Loopring for feedback.One of the great challenges with making cryptocurrency and blockchain applications usable for average users is security: how do we prevent users' funds from being lost or stolen? Losses and thefts are a serious issue, often costing innocent blockchain users thousands of dollars or even in some cases the majority of their entire net worth.There have been many solutions proposed over the years: paper wallets, hardware wallets, and my own one-time favorite: multisig wallets. And indeed they have led to significant improvements in security. However, these solutions have all suffered from various defects - sometimes providing far less extra protection against theft and loss than is actually needed, sometimes being cumbersome and difficult to use leading to very low adoption, and sometimes both. But recently, there is an emerging better alternative: a newer type of smart contract wallet called a social recovery wallet. These wallets can potentially provide a high level of security and much better usability than previous options, but there is still a way to go before they can be easily and widely deployed. This post will go through what social recovery wallets are, why they matter, and how we can and should move toward much broader adoption of them throughout the ecosystem.Wallet security is a really big problemWallet security issues have been a thorn in the side of the blockchain ecosystem almost since the beginning. Cryptocurrency losses and thefts were rampant even back in 2011 when Bitcoin was almost the only cryptocurrency out there; indeed, in my pre-Ethereum role as a cofounder and writer of Bitcoin Magazine, I wrote an entire article detailing the horrors of hacks and losses and thefts that were already happening at the time.Here is one sample:Last night around 9PM PDT, I clicked a link to go to CoinChat[.]freetzi[.]com – and I was prompted to run java. I did (thinking this was a legitimate chatoom), and nothing happened. I closed the window and thought nothing of it. I opened my bitcoin-qt wallet approx 14 minutes later, and saw a transaction that I did NOT approve go to wallet 1Es3QVvKN1qA2p6me7jLCVMZpQXVXWPNTC for almost my entire wallet...This person's losses were 2.07 BTC, worth $300 at the time, and over $70000 today. Here's another one:In June 2011, the Bitcointalk member "allinvain" lost 25,000 BTC (worth $500,000 at the time) after an unknown intruder somehow gained direct access to his computer. The attacker was able to access allinvain's wallet.dat file, and quickly empty out the wallet – either by sending a transaction from allinvain's computer itself, or by simply uploading the wallet.dat file and emptying it on his own machine.In present-day value, that's a loss of nearly one billion dollars. But theft is not the only concern; there are also losses from losing one's private keys. Here's Stefan Thomas:Bitcoin developer Stefan Thomas had three backups of his wallet – an encrypted USB stick, a Dropbox account and a Virtualbox virtual machine. However, he managed to erase two of them and forget the password to the third, forever losing access to 7,000 BTC (worth $125,000 at the time). Thomas's reaction: "[I'm] pretty dedicated to creating better clients since then."One analysis of the Bitcoin ecosystem suggests that 1500 BTC may be lost every day - over ten times more than what Bitcoin users spend on transaction fees, and over the years adding up to as much as 20% of the total supply. The stories and the numbers alike point to the same inescapable truth: the importance of the wallet security problem is great, and it should not be underestimated.It's easy to see the social and psychological reasons why wallet security is easy to underestimate: people naturally worry about appearing uncareful or dumb in front of an always judgemental public, and so many keep their experiences with their funds getting hacked to themselves. Loss of funds is even worse, as there is a pervasive (though in my opinion very incorrect) feeling that "there is no one to blame but yourself". But the reality is that the whole point of digital technology, blockchains included, is to make it easier for humans to engage in very complicated tasks without having to exert extreme mental effort or live in constant fear of making mistakes. An ecosystem whose only answer to losses and thefts is a combination of 12-step tutorials, not-very-secure half-measures and the not-so-occasional semi-sarcastic "sorry for your loss" is going to have a hard time getting broad adoption.So solutions that reduce the quantity of losses and thefts taking place, without requiring all cryptocurrency users to turn personal security into a full-time hobby, are highly valuable for the industry.Hardware wallets alone are not good enoughHardware wallets are often touted as the best-in-class technology for cryptocurrency funds management. A hardware wallet is a specialized hardware device which can be connected to your computer or phone (eg. through USB), and which contains a specialized chip that can only generate private keys and sign transactions. A transaction would be initiated on your computer or phone, must be confirmed on the hardware wallet before it can be sent. The private key stays on your hardware wallet, so an attacker that hacks into your computer or phone could not drain the funds.Hardware wallets are a significant improvement, and they certainly would have protected the Java chatroom victim, but they are not perfect. I see two main problems with hardware wallets:Supply chain attacks: if you buy a hardware wallet, you are trusting a number of actors that were involved in producing it - the company that designed the wallet, the factory that produced it, and everyone involved in shipping it who could have replaced it with a fake. Hardware wallets are potentially a magnet for such attacks: the ratio of funds stolen to number of devices compromised is very high. To their credit, hardware wallet manufacturers such as Ledger have put in many safeguards to protect against these risks, but some risks still remain. A hardware device fundamentally cannot be audited the same way a piece of open source software can. Still a single point of failure: if someone steals your hardware wallet right after they stand behind your shoulder and catch you typing in the PIN, they can steal your funds. If you lose your hardware wallet, then you lose your funds - unless the hardware wallet generates and outputs a backup at setup time, but as we will see those have problems of their own... Mnemonic phrases are not good enoughMany wallets, hardware and software alike, have a setup procedure during which they output a mnemonic phrase, which is a human-readable 12 to 24-word encoding of the wallet's root private key. A mnemonic phrase looks like this: vote dance type subject valley fall usage silk essay lunch endorse lunar obvious race ribbon key already arrow enable drama keen survey lesson cruelIf you lose your wallet but you have the mnemonic phrase, you can input the phrase when setting up a new wallet to recover your account, as the mnemonic phrase contains the root key from which all of your other keys can be generated.Mnemonic phrases are good for protecting against loss, but they do nothing against theft. Even worse, they add a new vector for theft: if you have the standard hardware wallet + mnemonic backup combo, then someone stealing either your hardware wallet + PIN or your mnemonic backup can steal your funds. Furthermore, maintaining a mnemonic phrase and not accidentally throwing it away is itself a non-trivial mental effort.The problems with theft can be alleviated if you split the phrase in half and give half to your friend, but (i) almost no one actually promotes this, (ii) there are security issues, as if the phrase is short (128 bits) then a sophisticated and motivated attacker who steals one piece may be able to brute-force through all \(2^\) possible combinations to find the other, and (iii) it increases the mental overhead even further.So what do we need?What we need is a wallet design which satisfies three key criteria:No single point of failure: there is no single thing (and ideally, no collection of things which travel together) which, if stolen, can give an attacker access to your funds, or if lost, can deny you access to your funds. Low mental overhead: as much as possible, it should not require users to learn strange new habits or exert mental effort to always remember to follow certain patterns of behavior. Maximum ease of transacting: most normal activities should not require much more effort than they do in regular wallets (eg. Status, Metamask...) Multisig is good!The best-in-class technology for solving these problems back in 2013 was multisig. You could have a wallet that has three keys, where any two of them are needed to send a transaction. This technology was originally developed within the Bitcoin ecosystem, but excellent multisig wallets (eg. see Gnosis Safe) now exist for Ethereum too. Multisig wallets have been highly successful within organizations: the Ethereum Foundation uses a 4-of-7 multisig wallet to store its funds, as do many other orgs in the Ethereum ecosystem.For a multisig wallet to hold the funds for an individual, the main challenge is: who holds the funds, and how are transactions approved? The most common formula is some variant of "two easily accessible, but separate, keys, held by you (eg. laptop and phone) and a third more secure but less accessible a backup, held offline or by a friend or institution".This is reasonably secure: there is no single device that can be lost or stolen that would lead to you losing access to your funds. But the security is far from perfect: if you can steal someone's laptop, it's often not that hard to steal their phone as well. The usability is also a challenge, as every transaction now requires two confirmations with two devices.Social recovery is betterThis gets us to my preferred method for securing a wallet: social recovery. A social recovery system works as follows:There is a single "signing key" that can be used to approve transactions There is a set of at least 3 (or a much higher number) of "guardians", of which a majority can cooperate to change the signing key of the account. The signing key has the ability to add or remove guardians, though only after a delay (often 1-3 days). Under all normal circumstances, the user can simply use their social recovery wallet like a regular wallet, signing messages with their signing key so that each transaction signed can fly off with a single confirmation click much like it would in a "traditional" wallet like Metamask.If a user loses their signing key, that is when the social recovery functionality would kick in. The user can simply reach out to their guardians and ask them to sign a special transaction to change the signing pubkey registered in the wallet contract to a new one. This is easy: they can simply go to a webpage such as security.loopring.io, sign in, see a recovery request and sign it. About as easy for each guardian as making a Uniswap trade.There are many possible choices for whom to select as a guardian. The three most common choices are:Other devices (or paper mnemonics) owned by the wallet holder themselves Friends and family members Institutions, which would sign a recovery message if they get a confirmation of your phone number or email or perhaps in high value cases verify you personally by video call Guardians are easy to add: you can add a guardian simply by typing in their ENS name or ETH address, though most social recovery wallets will require the guardian to sign a transaction in the recovery webpage to agree to be added. In any sanely designed social recovery wallet, the guardian does NOT need to download and use the same wallet; they can simply use their existing Ethereum wallet, whichever type of wallet it is. Given the high convenience of adding guardians, if you are lucky enough that your social circles are already made up of Ethereum users, I personally favor high guardian counts (ideally 7+) for increased security. If you already have a wallet, there is no ongoing mental effort required to be a guardian: any recovery operations that you do would be done through your existing wallet. If you not know many other active Ethereum users, then a smaller number of guardians that you trust to be technically competent is best.To reduce the risk of attacks on guardians and collusion, your guardians do not have to be publicly known: in fact, they do not need to know each other's identities. This can be accomplished in two ways. First, instead of the guardians' addresses being stored directly on chain, a hash of the list of addresses can be stored on chain, and the wallet owner would only need to publish the full list at recovery time. Second, each guardian can be asked to deterministically generate a new single-purpose address that they would use just for that particular recovery; they would not need to actually send any transactions with that address unless a recovery is actually required. To complement these technical protections, it's recommended to choose a diverse collection of guardians from different social circles (including ideally one institutional guardian); these recommendations together would make it extremely difficult for the guardians to be attacked simultaneously or collude.In the event that you die or are permanently incapacitated, it would be a socially agreed standard protocol that guardians can publicly announce themselves, so in that case they can find each other and recover your funds.Social recovery wallets are not a betrayal, but rather an expression, of "crypto values"One common response to suggestions to use any form of multisig, social recovery or otherwise, is the idea that this solution goes back to "trusting people", and so is a betrayal of the values of the blockchain and cryptocurrency industry. While I understand why one may think this at first glance, I would argue that this criticism stems from a fundamental misunderstanding of what crypto should be about.To me, the goal of crypto was never to remove the need for all trust. Rather, the goal of crypto is to give people access to cryptographic and economic building blocks that give people more choice in whom to trust, and furthermore allow people to build more constrained forms of trust: giving someone the power to do some things on your behalf without giving them the power to do everything. Viewed in this way, multisig and social recovery are a perfect expression of this principle: each participant has some influence over the ability to accept or reject transactions, but no one can move funds unilaterally. This more complex logic allows for a setup far more secure than what would be possible if there had to be one person or key that unilaterally controlled the funds.This fundamental idea, that human inputs should be wielded carefully but not thrown away outright, is powerful because it works well with the strengths and weaknesses of the human brain. The human brain is quite poorly suited for remembering passwords and tracking paper wallets, but it's an ASIC for keeping track of relationships with other people. This effect is even stronger for less technical users: they may have a harder time with wallets and passwords, but they are just as adept at social tasks like "choose 7 people who won't all gang up on me". If we can extract at least some information from human inputs into a mechanism, without those inputs turning into a vector for attack and exploitation, then we should figure out how. And social recovery is very robust: for a wallet with 7 guardians to be compromised, 4 of the 7 guardians would need to somehow discover each other and agree to steal the funds, without any of them tipping the owner off: certainly a much tougher challenge than attacking a wallet protected purely by a single individuals.How can social recovery protect against theft?Social recovery as explained above deals with the risk that you lose your wallet. But there is still the risk that your signing key gets stolen: someone hacks into your computer, sneaks up behind you while you're already logged in and hits you over the head, or even just uses some user interface glitch to trick you into signing a transaction that you did not intend to sign.We can extend social recovery to deal with such issues by adding a vault. Every social recovery wallet can come with an automatically generated vault. Assets can be moved to the vault just by sending them to the vault's address, but they can be moved out of the vault only with a 1 week delay. During that delay, the signing key (or, by extension, the guardians) can cancel the transaction. If desired, the vault could also be programmed so that some limited financial operations (eg. Uniswap trades between some whitelisted tokens) can be done without delay.Existing social recovery walletsCurrently, the two major wallets that have implemented social recovery are the Argent wallet and the Loopring wallet: The Argent wallet is the first major, and still the most popular, "smart contract wallet" currently in use, and social recovery is one of its main selling points. The Argent wallet includes an interface by which guardians can be added and removed: To protect against theft, the wallet has a daily limit: transactions up to that amount are instant but transactions above that amount require guardians to approve to finalize the withdrawal.The Loopring wallet is most known for being built by the developers of (and of course including support for) the Loopring protocol, a ZK rollup for payments and decentralized exchange. But the Loopring wallet also has a social recovery feature, which works very similarly to that in Argent. In both cases, the wallet companies provide one guardian for free, which relies on a confirmation code sent by mobile phone to authenticate you. For the other guardians, you can add either other users of the same wallet, or any Ethereum user by providing their Ethereum address.The user experience in both cases is surprisingly smooth. There were two main challenges. First, the smoothness in both cases relies on a central "relayer" run by the wallet maker that re-publishes signed messages as transactions. Second, the fees are high. Fortunately, both of these problems are surmountable.Migration to Layer 2 (rollups) can solve the remaining challengesAs mentioned above, there are two key challenges: (i) the dependence on relayers to solve transactions, and (ii) high transaction fees. The first challenge, dependence on relayers, is an increasingly common problem in Ethereum applications. The issue arises because there are two types of accounts in Ethereum: externally owned accounts (EOAs), which are accounts controlled by a single private key, and contracts. In Ethereum, there is a rule that every transaction must start from an EOA; the original intention was that EOAs represent "users" and contracts represent "applications", and an application can only run if a user talks to the application. If we want wallets with more complex policies, like multisig and social recovery, we need to use contracts to represent users. But this poses a challenge: if your funds are in a contract, you need to have some other account that has ETH that can pay to start each transaction, and it needs quite a lot of ETH just in case transaction fees get really high.Argent and Loopring get around this problem by personally running a "relayer". The relayer listens for off-chain digitally signed "messages" submitted by users, and wraps these messages in a transaction and publishes them to chain. But for the long run, this is a poor solution; it adds an extra point of centralization. If the relayer is down and a user really needs to send a transaction, they can always just send it from their own EOA, but it is nevertheless the case that a new tradeoff between centralization and inconvenience is introduced. There are efforts to solve this problem and get convenience without centralization; the main two categories revolve around either making a generalized decentralized relayer network or modifying the Ethereum protocol itself to allow transactions to begin from contracts. But neither of these solutions solve transaction fees, and in fact, they make the problem worse due to smart contracts' inherently greater complexity.Fortunately, we can solve both of these problems at the same time, by looking toward a third solution: moving the ecosystem onto layer 2 protocols such as optimistic rollups and ZK rollups. Optimistic and ZK rollups can both be designed with account abstraction built in, circumventing any need for relayers. Existing wallet developers are already looking into rollups, but ultimately migrating to rollups en masse is an ecosystem-wide challenge.An ecosystem-wide mass migration to rollups is as good an opportunity as any to reverse the Ethereum ecosystem's earlier mistakes and give multisig and smart contract wallets a much more central role in helping to secure users' funds. But this requires broader recognition that wallet security is a challenge, and that we have not gone nearly as far in trying to meet and challenge as we should. Multisig and social recovery need not be the end of the story; there may well be designs that work even better. But the simple reform of moving to rollups and making sure that these rollups treat smart contract wallets as first class citizens is an important step toward making that happen. -

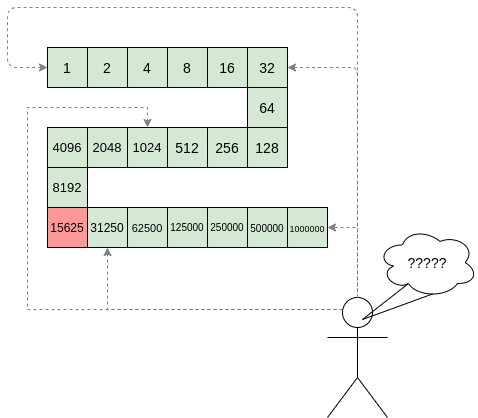

An approximate introduction to how zk-SNARKs are possible An approximate introduction to how zk-SNARKs are possible2021 Jan 26 See all posts An approximate introduction to how zk-SNARKs are possible Special thanks to Dankrad Feist, Karl Floersch and Hsiao-wei Wang for feedback and review.Perhaps the most powerful cryptographic technology to come out of the last decade is general-purpose succinct zero knowledge proofs, usually called zk-SNARKs ("zero knowledge succinct arguments of knowledge"). A zk-SNARK allows you to generate a proof that some computation has some particular output, in such a way that the proof can be verified extremely quickly even if the underlying computation takes a very long time to run. The "ZK" ("zero knowledge") part adds an additional feature: the proof can keep some of the inputs to the computation hidden.For example, you can make a proof for the statement "I know a secret number such that if you take the word ‘cow', add the number to the end, and SHA256 hash it 100 million times, the output starts with 0x57d00485aa". The verifier can verify the proof far more quickly than it would take for them to run 100 million hashes themselves, and the proof would also not reveal what the secret number is.In the context of blockchains, this has two very powerful applications:Scalability: if a block takes a long time to verify, one person can verify it and generate a proof, and everyone else can just quickly verify the proof instead Privacy: you can prove that you have the right to transfer some asset (you received it, and you didn't already transfer it) without revealing the link to which asset you received. This ensures security without unduly leaking information about who is transacting with whom to the public. But zk-SNARKs are quite complex; indeed, as recently as in 2014-17 they were still frequently called "moon math". The good news is that since then, the protocols have become simpler and our understanding of them has become much better. This post will try to explain how ZK-SNARKs work, in a way that should be understandable to someone with a medium level of understanding of mathematics.Note that we will focus on scalability; privacy for these protocols is actually relatively easy once the scalability is there, so we will get back to that topic at the end.Why ZK-SNARKs "should" be hardLet us take the example that we started with: we have a number (we can encode "cow" followed by the secret input as an integer), we take the SHA256 hash of that number, then we do that again another 99,999,999 times, we get the output, and we check what its starting digits are. This is a huge computation.A "succinct" proof is one where both the size of the proof and the time required to verify it grow much more slowly than the computation to be verified. If we want a "succinct" proof, we cannot require the verifier to do some work per round of hashing (because then the verification time would be proportional to the computation). Instead, the verifier must somehow check the whole computation without peeking into each individual piece of the computation.One natural technique is random sampling: how about we just have the verifier peek into the computation in 500 different places, check that those parts are correct, and if all 500 checks pass then assume that the rest of the computation must with high probability be fine, too?Such a procedure could even be turned into a non-interactive proof using the Fiat-Shamir heuristic: the prover computes a Merkle root of the computation, uses the Merkle root to pseudorandomly choose 500 indices, and provides the 500 corresponding Merkle branches of the data. The key idea is that the prover does not know which branches they will need to reveal until they have already "committed to" the data. If a malicious prover tries to fudge the data after learning which indices are going to be checked, that would change the Merkle root, which would result in a new set of random indices, which would require fudging the data again... trapping the malicious prover in an endless cycle.But unfortunately there is a fatal flaw in naively applying random sampling to spot-check a computation in this way: computation is inherently fragile. If a malicious prover flips one bit somewhere in the middle of a computation, they can make it give a completely different result, and a random sampling verifier would almost never find out. It only takes one deliberately inserted error, that a random check would almost never catch, to make a computation give a completely incorrect result.If tasked with the problem of coming up with a zk-SNARK protocol, many people would make their way to this point and then get stuck and give up. How can a verifier possibly check every single piece of the computation, without looking at each piece of the computation individually? But it turns out that there is a clever solution.PolynomialsPolynomials are a special class of algebraic expressions of the form:\(x + 5\) \(x^4\) \(x^3 + 3x^2 + 3x + 1\) \(628x^ + 318x^ + 530x^ + ... + 69x + 381\) i.e. they are a sum of any (finite!) number of terms of the form \(c x^k\).There are many things that are fascinating about polynomials. But here we are going to zoom in on a particular one: polynomials are a single mathematical object that can contain an unbounded amount of information (think of them as a list of integers and this is obvious). The fourth example above contained 816 digits of tau, and one can easily imagine a polynomial that contains far more.Furthermore, a single equation between polynomials can represent an unbounded number of equations between numbers. For example, consider the equation \(A(x) + B(x) = C(x)\). If this equation is true, then it's also true that:\(A(0) + B(0) = C(0)\) \(A(1) + B(1) = C(1)\) \(A(2) + B(2) = C(2)\) \(A(3) + B(3) = C(3)\) And so on for every possible coordinate. You can even construct polynomials to deliberately represent sets of numbers so you can check many equations all at once. For example, suppose that you wanted to check:12 + 1 = 13 10 + 8 = 18 15 + 8 = 23 15 + 13 = 28 You can use a procedure called Lagrange interpolation to construct polynomials \(A(x)\) that give (12, 10, 15, 15) as outputs at some specific set of coordinates (eg. (0, 1, 2, 3)), \(B(x)\) the outputs (1, 8, 8, 13) on those same coordinates, and so forth. In fact, here are the polynomials:\(A(x) = -2x^3 + \fracx^2 - \fracx + 12\) \(B(x) = 2x^3 - \fracx^2 + \fracx + 1\) \(C(x) = 5x + 13\) Checking the equation \(A(x) + B(x) = C(x)\) with these polynomials checks all four above equations at the same time.Comparing a polynomial to itselfYou can even check relationships between a large number of adjacent evaluations of the same polynomial using a simple polynomial equation. This is slightly more advanced. Suppose that you want to check that, for a given polynomial \(F\), \(F(x+2) = F(x) + F(x+1)\) within the integer range \(\\) (so if you also check \(F(0) = F(1) = 1\), then \(F(100)\) would be the 100th Fibonacci number).As polynomials, \(F(x+2) - F(x+1) - F(x)\) would not be exactly zero, as it could give arbitrary answers outside the range \(x = \\). But we can do something clever. In general, there is a rule that if a polynomial \(P\) is zero across some set \(S=\\) then it can be expressed as \(P(x) = Z(x) * H(x)\), where \(Z(x) =\) \((x - x_1) * (x - x_2) * ... * (x - x_n)\) and \(H(x)\) is also a polynomial. In other words, any polynomial that equals zero across some set is a (polynomial) multiple of the simplest (lowest-degree) polynomial that equals zero across that same set.Why is this the case? It is a nice corollary of polynomial long division: the factor theorem. We know that, when dividing \(P(x)\) by \(Z(x)\), we will get a quotient \(Q(x)\) and a remainer \(R(x)\) which satisfy \(P(x) = Z(x) * Q(x) + R(x)\), where the degree of the remainder \(R(x)\) is strictly less than that of \(Z(x)\). Since we know that \(P\) is zero on all of \(S\), it means that \(R\) has to be zero on all of \(S\) as well. So we can simply compute \(R(x)\) via polynomial interpolation, since it's a polynomial of degree at most \(n-1\) and we know \(n\) values (the zeroes at \(S\)). Interpolating a polynomial with all zeroes gives the zero polynomial, thus \(R(x) = 0\) and \(H(x)= Q(x)\).Going back to our example, if we have a polynomial \(F\) that encodes Fibonacci numbers (so \(F(x+2) = F(x) + F(x+1)\) across \(x = \\)), then I can convince you that \(F\) actually satisfies this condition by proving that the polynomial \(P(x) =\) \(F(x+2) - F(x+1) - F(x)\) is zero over that range, by giving you the quotient:\(H(x) = \frac\)Where \(Z(x) = (x - 0) * (x - 1) * ... * (x - 98)\).You can calculate \(Z(x)\) yourself (ideally you would have it precomputed), check the equation, and if the check passes then \(F(x)\) satisfies the condition!Now, step back and notice what we did here. We converted a 100-step-long computation (computing the 100th Fibonacci number) into a single equation with polynomials. Of course, proving the N'th Fibonacci number is not an especially useful task, especially since Fibonacci numbers have a closed form. But you can use exactly the same basic technique, just with some extra polynomials and some more complicated equations, to encode arbitrary computations with an arbitrarily large number of steps.Now, if only there was a way to verify equations with polynomials that's much faster than checking each coefficient...Polynomial commitmentsAnd once again, it turns out that there is an answer: polynomial commitments. A polynomial commitment is best viewed as a special way to "hash" a polynomial, where the hash has the additional property that you can check equations between polynomials by checking equations between their hashes. Different polynomial commitment schemes have different properties in terms of exactly what kinds of equations you can check.Here are some common examples of things you can do with various polynomial commitment schemes (we use \(com(P)\) to mean "the commitment to the polynomial \(P\)"):Add them: given \(com(P)\), \(com(Q)\) and \(com(R)\) check if \(P + Q = R\) Multiply them: given \(com(P)\), \(com(Q)\) and \(com(R)\) check if \(P * Q = R\) Evaluate at a point: given \(com(P)\), \(w\), \(z\) and a supplemental proof (or "witness") \(Q\), verify that \(P(w) = z\) It's worth noting that these primitives can be constructed from each other. If you can add and multiply, then you can evaluate: to prove that \(P(w) = z\), you can construct \(Q(x) = \frac\), and the verifier can check if \(Q(x) * (x - w) + z \stackrel P(x)\). This works because if such a polynomial \(Q(x)\) exists, then \(P(x) - z = Q(x) * (x - w)\), which means that \(P(x) - z\) equals zero at \(w\) (as \(x - w\) equals zero at \(w\)) and so \(P(x)\) equals \(z\) at \(w\).And if you can evaluate, you can do all kinds of checks. This is because there is a mathematical theorem that says, approximately, that if some equation involving some polynomials holds true at a randomly selected coordinate, then it almost certainly holds true for the polynomials as a whole. So if all we have is a mechanism to prove evaluations, we can check eg. our equation \(P(x + 2) - P(x + 1) - P(x) = Z(x) * H(x)\) using an interactive game: As I alluded to earlier, we can make this non-interactive using the Fiat-Shamir heuristic: the prover can compute r themselves by setting r = hash(com(P), com(H)) (where hash is any cryptographic hash function; it does not need any special properties). The prover cannot "cheat" by picking P and H that "fit" at that particular r but not elsewhere, because they do not know r at the time that they are picking P and H!A quick recap so farZK-SNARKs are hard because the verifier needs to somehow check millions of steps in a computation, without doing a piece of work to check each individual step directly (as that would take too long). We get around this by encoding the computation into polynomials. A single polynomial can contain an unboundedly large amount of information, and a single polynomial expression (eg. \(P(x+2) - P(x+1) - P(x) = Z(x) * H(x)\)) can "stand in" for an unboundedly large number of equations between numbers. If you can verify the equation with polynomials, you are implicitly verifying all of the number equations (replace \(x\) with any actual x-coordinate) simultaneously. We use a special type of "hash" of a polynomial, called a polynomial commitment, to allow us to actually verify the equation between polynomials in a very short amount of time, even if the underlying polynomials are very large. So, how do these fancy polynomial hashes work?There are three major schemes that are widely used at the moment: bulletproofs, Kate and FRI.Here is a description of Kate commitments by Dankrad Feist: https://dankradfeist.de/ethereum/2020/06/16/kate-polynomial-commitments.html Here is a description of bulletproofs by the curve25519-dalek team: https://doc-internal.dalek.rs/bulletproofs/notes/inner_product_proof/index.html, and here is an explanation-in-pictures by myself: https://twitter.com/VitalikButerin/status/1371844878968176647 Here is a description of FRI by... myself: ../../../2017/11/22/starks_part_2.html Whoa, whoa, take it easy. Try to explain one of them simply, without shipping me off to even more scary linksTo be honest, they're not that simple. There's a reason why all this math did not really take off until 2015 or so.Please?In my opinion, the easiest one to understand fully is FRI (Kate is easier if you're willing to accept elliptic curve pairings as a "black box", but pairings are really complicated, so altogether I find FRI simpler).Here is how a simplified version of FRI works (the real protocol has many tricks and optimizations that are missing here for simplicity). Suppose that you have a polynomial \(P\) with degree \(< n\). The commitment to \(P\) is a Merkle root of a set of evaluations to \(P\) at some set of pre-selected coordinates (eg. \(\\), though this is not the most efficient choice). Now, we need to add something extra to prove that this set of evaluations actually is a degree \(< n\) polynomial.Let \(Q\) be the polynomial only containing the even coefficients of \(P\), and \(R\) be the polynomial only containing the odd coefficients of \(P\). So if \(P(x) = x^4 + 4x^3 + 6x^2 + 4x + 1\), then \(Q(x) = x^2 + 6x + 1\) and \(R(x) = 4x + 4\) (note that the degrees of the coefficients get "collapsed down" to the range \([0...\frac)\)).Notice that \(P(x) = Q(x^2) + x * R(x^2)\) (if this isn't immediately obvious to you, stop and think and look at the example above until it is).We ask the prover to provide Merkle roots for \(Q(x)\) and \(R(x)\). We then generate a random number \(r\) and ask the prover to provide a "random linear combination" \(S(x) = Q(x) + r * R(x)\).We pseudorandomly sample a large set of indices (using the already-provided Merkle roots as the seed for the randomness as before), and ask the prover to provide the Merkle branches for \(P\), \(Q\), \(R\) and \(S\) at these indices. At each of these provided coordinates, we check that:\(P(x)\) actually does equal \(Q(x^2) + x * R(x^2)\) \(S(x)\) actually does equal \(Q(x) + r * R(x)\) If we do enough checks, then we can be convinced that the "expected" values of \(S(x)\) are different from the "provided" values in at most, say, 1% of cases.Notice that \(Q\) and \(R\) both have degree \(< \frac\). Because \(S\) is a linear combination of \(Q\) and \(R\), \(S\) also has degree \(< \frac\). And this works in reverse: if we can prove \(S\) has degree \(< \frac\), then the fact that it's a randomly chosen combination prevents the prover from choosing malicious \(Q\) and \(R\) with hidden high-degree coefficients that "cancel out", so \(Q\) and \(R\) must both be degree \(< \frac\), and because \(P(x) = Q(x^2) + x * R(x^2)\), we know that \(P\) must have degree \(< n\).From here, we simply repeat the game with \(S\), progressively "reducing" the polynomial we care about to a lower and lower degree, until it's at a sufficiently low degree that we can check it directly. As in the previous examples, "Bob" here is an abstraction, useful for cryptographers to mentally reason about the protocol. In reality, Alice is generating the entire proof herself, and to prevent her from cheating we use Fiat-Shamir: we choose each randomly samples coordinate or r value based on the hash of the data generated in the proof up until that point.A full "FRI commitment" to \(P\) (in this simplified protocol) would consist of:The Merkle root of evaluations of \(P\) The Merkle roots of evaluations of \(Q\), \(R\), \(S_1\) The randomly selected branches of \(P\), \(Q\), \(R\), \(S_1\) to check \(S_1\) is correctly "reduced from" \(P\) The Merkle roots and randomly selected branches just as in steps (2) and (3) for successively lower-degree reductions \(S_2\) reduced from \(S_1\), \(S_3\) reduced from \(S_2\), all the way down to a low-degree \(S_k\) (this gets repeated \(\approx log_2(n)\) times in total) The full Merkle tree of the evaluations of \(S_k\) (so we can check it directly) Each step in the process can introduce a bit of "error", but if you add enough checks, then the total error will be low enough that you can prove that \(P(x)\) equals a degree \(< n\) polynomial in at least, say, 80% of positions. And this is sufficient for our use cases. If you want to cheat in a zk-SNARK, you would need to make a polynomial commitment for a fractional expression (eg. to "prove" the false claim that \(x^2 + 2x + 3\) evaluated at \(4\) equals \(5\), you would need to provide a polynomial commitment for \(\frac = x + 6 + \frac\)). The set of evaluations for such a fractional expression would differ from the evaluations for any real degree \(< n\) polynomial in so many positions that any attempt to make a FRI commitment to them would fail at some step.Also, you can check carefully that the total number and size of the objects in the FRI commitment is logarithmic in the degree, so for large polynomials, the commitment really is much smaller than the polynomial itself.To check equations between different polynomial commitments of this type (eg. check \(A(x) + B(x) = C(x)\) given FRI commitments to \(A\), \(B\) and \(C\)), simply randomly select many indices, ask the prover for Merkle branches at each of those indices for each polynomial, and verify that the equation actually holds true at each of those positions.The above description is a highly inefficient protocol; there is a whole host of algebraic tricks that can increase its efficiency by a factor of something like a hundred, and you need these tricks if you want a protocol that is actually viable for, say, use inside a blockchain transaction. In particular, for example, \(Q\) and \(R\) are not actually necessary, because if you choose your evaluation points very cleverly, you can reconstruct the evaluations of \(Q\) and \(R\) that you need directly from evaluations of \(P\). But the above description should be enough to convince you that a polynomial commitment is fundamentally possible.Finite fieldsIn the descriptions above, there was a hidden assumption: that each individual "evaluation" of a polynomial was small. But when we are dealing with polynomials that are big, this is clearly not true. If we take our example from above, \(628x^ + 318x^ + 530x^ + ... + 69x + 381\), that encodes 816 digits of tau, and evaluate it at \(x=1000\), you get.... an 816-digit number containing all of those digits of tau. And so there is one more thing that we need to add. In a real implementation, all of the arithmetic that we are doing here would not be done using "regular" arithmetic over real numbers. Instead, it would be done using modular arithmetic.We redefine all of our arithmetic operations as follows. We pick some prime "modulus" p. The % operator means "take the remainder of": \(15\ \%\ 7 = 1\), \(53\ \%\ 10 = 3\), etc (note that the answer is always non-negative, so for example \(-1\ \%\ 10 = 9\)). We redefine\(x + y \Rightarrow (x + y)\) % \(p\)\(x * y \Rightarrow (x * y)\) % \(p\)\(x^y \Rightarrow (x^y)\) % \(p\)\(x - y \Rightarrow (x - y)\) % \(p\)\(x / y \Rightarrow (x * y ^)\) % \(p\)The above rules are all self-consistent. For example, if \(p = 7\), then:\(5 + 3 = 1\) (as \(8\) % \(7 = 1\)) \(1 - 3 = 5\) (as \(-2\) % \(7 = 5\)) \(2 \cdot 5 = 3\) \(3 / 5 = 2\) (as (\(3 \cdot 5^5\)) % \(7 = 9375\) % \(7 = 2\)) More complex identities such as the distributive law also hold: \((2 + 4) \cdot 3\) and \(2 \cdot 3 + 4 \cdot 3\) both evaluate to \(4\). Even formulas like \((a^2 - b^2)\) = \((a - b) \cdot (a + b)\) are still true in this new kind of arithmetic.Division is the hardest part; we can't use regular division because we want the values to always remain integers, and regular division often gives non-integer results (as in the case of \(3/5\)). We get around this problem using Fermat's little theorem, which states that for any nonzero \(x < p\), it holds that \(x^\) % \(p = 1\). This implies that \(x^\) gives a number which, if multiplied by \(x\) one more time, gives \(1\), and so we can say that \(x^\) (which is an integer) equals \(\frac\). A somewhat more complicated but faster way to evaluate this modular division operator is the extended Euclidean algorithm, implemented in python here. Because of how the numbers "wrap around", modular arithmetic is sometimes called "clock math"With modular math we've created an entirely new system of arithmetic, and it's self-consistent in all the same ways traditional arithmetic is self-consistent. Hence, we can talk about all of the same kinds of structures over this field, including polynomials, that we talk about in "regular math". Cryptographers love working in modular math (or, more generally, "finite fields") because there is a bound on the size of a number that can arise as a result of any modular math calculation - no matter what you do, the values will not "escape" the set \(\\). Even evaluating a degree-1-million polynomial in a finite field will never give an answer outside that set.What's a slightly more useful example of a computation being converted into a set of polynomial equations?Let's say we want to prove that, for some polynomial \(P\), \(0 \le P(n) < 2^\), without revealing the exact value of \(P(n)\). This is a common use case in blockchain transactions, where you want to prove that a transaction leaves a balance non-negative without revealing what that balance is.We can construct a proof for this with the following polynomial equations (assuming for simplicity \(n = 64\)):\(P(0) = 0\) \(P(x+1) = P(x) * 2 + R(x)\) across the range \(\\) \(R(x) \in \\) across the range \(\\) The latter two statements can be restated as "pure" polynomial equations as follows (in this context \(Z(x) = (x - 0) * (x - 1) * ... * (x - 63)\)):\(P(x+1) - P(x) * 2 - R(x) = Z(x) * H_1(x)\) \(R(x) * (1 - R(x)) = Z(x) * H_2(x)\) (notice the clever trick: \(y * (1-y) = 0\) if and only if \(y \in \\)) The idea is that successive evaluations of \(P(i)\) build up the number bit-by-bit: if \(P(4) = 13\), then the sequence of evaluations going up to that point would be: \(\\). In binary, 1 is 1, 3 is 11, 6 is 110, 13 is 1101; notice how \(P(x+1) = P(x) * 2 + R(x)\) keeps adding one bit to the end as long as \(R(x)\) is zero or one. Any number within the range \(0 \le x < 2^\) can be built up over 64 steps in this way, any number outside that range cannot.PrivacyBut there is a problem: how do we know that the commitments to \(P(x)\) and \(R(x)\) don't "leak" information that allows us to uncover the exact value of \(P(64)\), which we are trying to keep hidden?There is some good news: these proofs are small proofs that can make statements about a large amount of data and computation. So in general, the proof will very often simply not be big enough to leak more than a little bit of information. But can we go from "only a little bit" to "zero"? Fortunately, we can.Here, one fairly general trick is to add some "fudge factors" into the polynomials. When we choose \(P\), add a small multiple of \(Z(x)\) into the polynomial (that is, set \(P'(x) = P(x) + Z(x) * E(x)\) for some random \(E(x)\)). This does not affect the correctness of the statement (in fact, \(P'\) evaluates to the same values as \(P\) on the coordinates that "the computation is happening in", so it's still a valid transcript), but it can add enough extra "noise" into the commitments to make any remaining information unrecoverable. Additionally, in the case of FRI, it's important to not sample random points that are within the domain that computation is happening in (in this case \(\\)).Can we have one more recap, please??The three most prominent types of polynomial commitments are FRI, Kate and bulletproofs. Kate is the simplest conceptually but depends on the really complicated "black box" of elliptic curve pairings. FRI is cool because it relies only on hashes; it works by successively reducing a polynomial to a lower and lower-degree polynomial and doing random sample checks with Merkle branches to prove equivalence at each step. To prevent the size of individual numbers from blowing up, instead of doing arithmetic and polynomials over the integers, we do everything over a finite field (usually integers modulo some prime p) Polynomial commitments lend themselves naturally to privacy preservation because the proof is already much smaller than the polynomial, so a polynomial commitment can't reveal more than a little bit of the information in the polynomial anyway. But we can add some randomness to the polynomials we're committing to to reduce the information revealed from "a little bit" to "zero". What research questions are still being worked on?Optimizing FRI: there are already quite a few optimizations involving carefully selected evaluation domains, "DEEP-FRI", and a whole host of other tricks to make FRI more efficient. Starkware and others are working on this. Better ways to encode computation into polynomials: figuring out the most efficient way to encode complicated computations involving hash functions, memory access and other features into polynomial equations is still a challenge. There has been great progress on this (eg. see PLOOKUP), but we still need more, especially if we want to encode general-purpose virtual machine execution into polynomials. Incrementally verifiable computation: it would be nice to be able to efficiently keep "extending" a proof while a computation continues. This is valuable in the "single-prover" case, but also in the "multi-prover" case, particularly a blockchain where a different participant creates each block. See Halo for some recent work on this. I wanna learn more!My materialsSTARKs: part 1, part 2, part 3 Specific protocols for encoding computation into polynomials: PLONK Some key mathematical optimizations I didn't talk about here: Fast Fourier transforms Other people's materialsStarkware's online course Dankrad Feist on Kate commitments Bulletproofs