找到

1087

篇与

heyuan

相关的结果

-

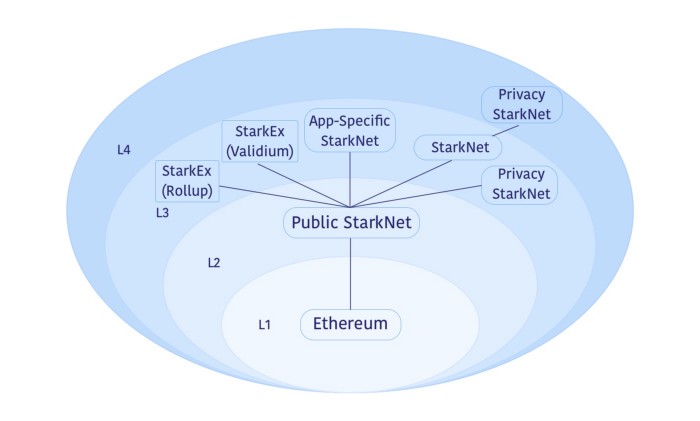

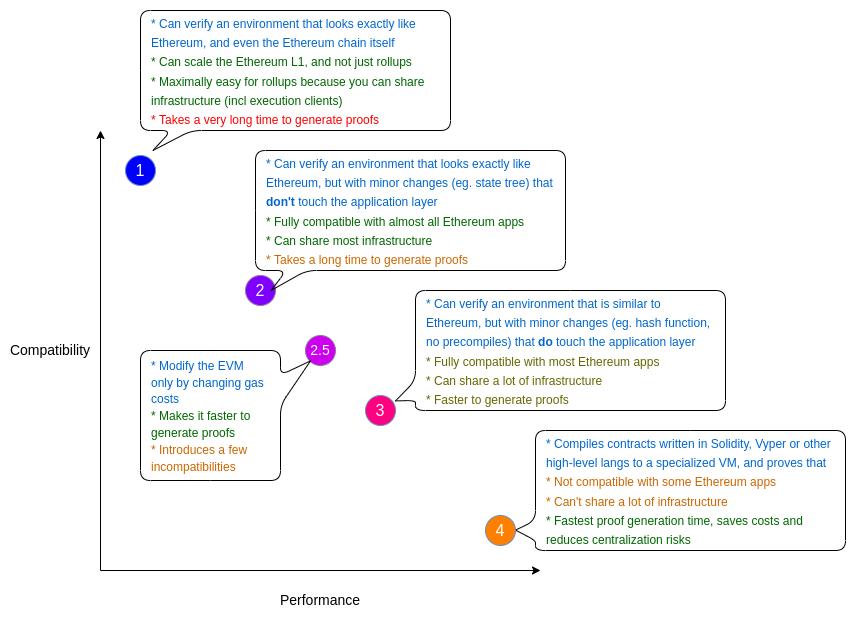

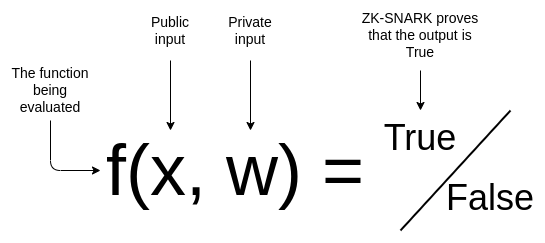

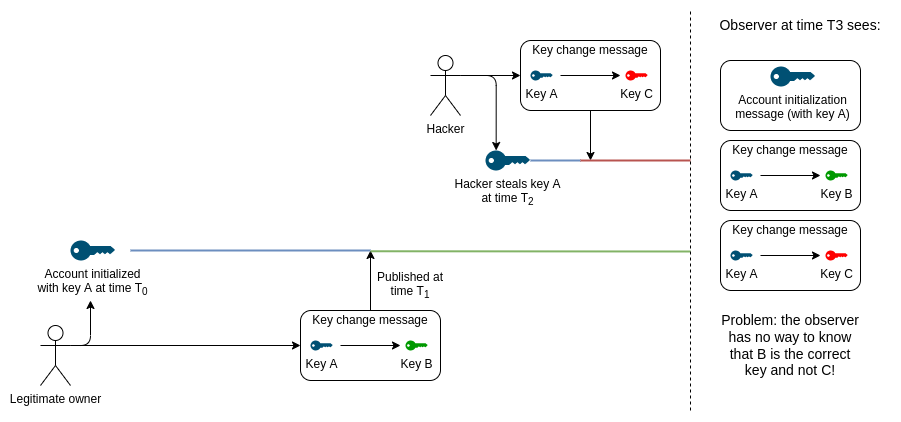

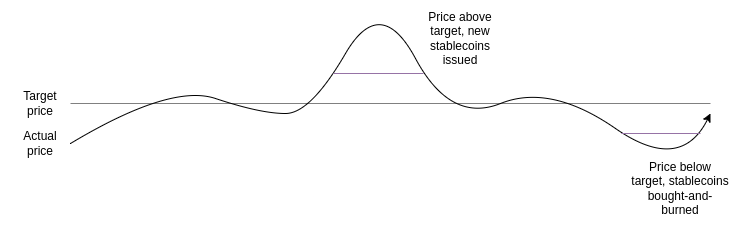

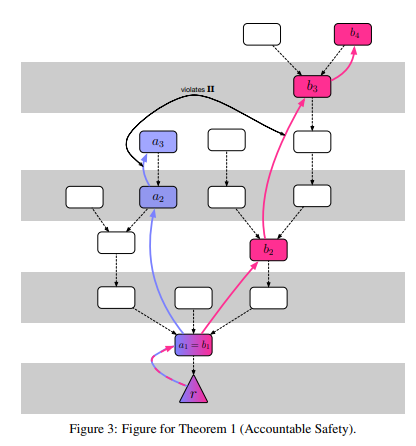

What kind of layer 3s make sense? What kind of layer 3s make sense?2022 Sep 17 See all posts What kind of layer 3s make sense? Special thanks to Georgios Konstantopoulos, Karl Floersch and the Starkware team for feedback and review.One topic that often re-emerges in layer-2 scaling discussions is the concept of "layer 3s". If we can build a layer 2 protocol that anchors into layer 1 for security and adds scalability on top, then surely we can scale even more by building a layer 3 protocol that anchors into layer 2 for security and adds even more scalability on top of that?A simple version of this idea goes: if you have a scheme that can give you quadratic scaling, can you stack the scheme on top of itself and get exponential scaling? Ideas like this include my 2015 scalability paper, the multi-layer scaling ideas in the Plasma paper, and many more. Unfortunately, such simple conceptions of layer 3s rarely quite work out that easily. There's always something in the design that's just not stackable, and can only give you a scalability boost once - limits to data availability, reliance on L1 bandwidth for emergency withdrawals, or many other issues.Newer ideas around layer 3s, such as the framework proposed by Starkware, are more sophisticated: they aren't just stacking the same thing on top of itself, they're assigning the second layer and the third layer different purposes. Some form of this approach may well be a good idea - if it's done in the right way. This post will get into some of the details of what might and might not make sense to do in a triple-layered architecture.Why you can't just keep scaling by stacking rollups on top of rollupsRollups (see my longer article on them here) are a scaling technology that combines different techniques to address the two main scaling bottlenecks of running a blockchain: computation and data. Computation is addressed by either fraud proofs or SNARKs, which rely on a very small number of actors to process and verify each block, requiring everyone else to perform only a tiny amount of computation to check that the proving process was done correctly. These schemes, especially SNARKs, can scale almost without limit; you really can just keep making "a SNARK of many SNARKs" to scale even more computation down to a single proof.Data is different. Rollups use a collection of compression tricks to reduce the amount of data that a transaction needs to store on-chain: a simple currency transfer decreases from ~100 to ~16 bytes, an ERC20 transfer in an EVM-compatible chain from ~180 to ~23 bytes, and a privacy-preserving ZK-SNARK transaction could be compressed from ~600 to ~80 bytes. About 8x compression in all cases. But rollups still need to make data available on-chain in a medium that users are guaranteed to be able to access and verify, so that users can independently compute the state of the rollup and join as provers if existing provers go offline. Data can be compressed once, but it cannot be compressed again - if it can, then there's generally a way to put the logic of the second compressor into the first, and get the same benefit by compressing once. Hence, "rollups on top of rollups" are not something that can actually provide large gains in scalability - though, as we will see below, such a pattern can serve other purposes.So what's the "sane" version of layer 3s?Well, let's look at what Starkware, in their post on layer 3s, advocates. Starkware is made up of very smart cryptographers who are actually sane, and so if they are advocating for layer 3s, their version will be much more sophisticated than "if rollups compress data 8x, then obviously rollups on top of rollups will compress data 64x".Here's a diagram from Starkware's post: A few quotes:An example of such an ecosystem is depicted in Diagram 1. Its L3s include:A StarkNet with Validium data availability, e.g., for general use by applications with extreme sensitivity to pricing. App-specific StarkNet systems customized for better application performance, e.g., by employing designated storage structures or data availability compression. StarkEx systems (such as those serving dYdX, Sorare, Immutable, and DeversiFi) with Validium or Rollup data availability, immediately bringing battle-tested scalability benefits to StarkNet. Privacy StarkNet instances (in this example also as an L4) to allow privacy-preserving transactions without including them in public StarkNets. We can compress the article down into three visions of what "L3s" are for:L2 is for scaling, L3 is for customized functionality, for example privacy. In this vision there is no attempt to provide "scalability squared"; rather, there is one layer of the stack that helps applications scale, and then separate layers for customized functionality needs of different use cases. L2 is for general-purpose scaling, L3 is for customized scaling. Customized scaling might come in different forms: specialized applications that use something other than the EVM to do their computation, rollups whose data compression is optimized around data formats for specific applications (including separating "data" from "proofs" and replacing proofs with a single SNARK per block entirely), etc. L2 is for trustless scaling (rollups), L3 is for weakly-trusted scaling (validiums). Validiums are systems that use SNARKs to verify computation, but leave data availability up to a trusted third party or committee. Validiums are in my view highly underrated: in particular, many "enterprise blockchain" applications may well actually be best served by a centralized server that runs a validium prover and regularly commits hashes to chain. Validiums have a lower grade of security than rollups, but can be vastly cheaper. All three of these visions are, in my view, fundamentally reasonable. The idea that specialized data compression requires its own platform is probably the weakest of the claims - it's quite easy to design a layer 2 with a general-purpose base-layer compression scheme that users can automatically extend with application-specific sub-compressors - but otherwise the use cases are all sound. But this still leaves open one large question: is a three-layer structure the right way to accomplish these goals? What's the point of validiums, and privacy systems, and customized environments, anchoring into layer 2 instead of just anchoring into layer 1? The answer to this question turns out to be quite complicated. Which one is actually better? Does depositing and withdrawing become cheaper and easier within a layer 2's sub-tree?One possible argument for the three-layer model over the two-layer model is: a three-layer model allows an entire sub-ecosystem to exist within a single rollup, which allows cross-domain operations within that ecosystem to happen very cheaply, without needing to go through the expensive layer 1.But as it turns out, you can do deposits and withdrawals cheaply even between two layer 2s (or even layer 3s) that commit to the same layer 1! The key realization is that tokens and other assets do not have to be issued in the root chain. That is, you can have an ERC20 token on Arbitrum, create a wrapper of it on Optimism, and move back and forth between the two without any L1 transactions!Let us examine how such a system works. There are two smart contracts: the base contract on Arbitrum, and the wrapper token contract on Optimism. To move from Arbitrum to Optimism, you would send your tokens to the base contract, which would generate a receipt. Once Arbitrum finalizes, you can take a Merkle proof of that receipt, rooted in L1 state, and send it into the wrapper token contract on Optimism, which verifies it and issues you a wrapper token. To move tokens back, you do the same thing in reverse. Even though the Merkle path needed to prove the deposit on Arbitrum goes through the L1 state, Optimism only needs to read the L1 state root to process the deposit - no L1 transactions required. Note that because data on rollups is the scarcest resource, a practical implementation of such a scheme would use a SNARK or a KZG proof, rather than a Merkle proof directly, to save space. Such a scheme has one key weakness compared to tokens rooted on L1, at least on optimistic rollups: depositing also requires waiting the fraud proof window. If a token is rooted on L1, withdrawing from Arbitrum or Optimism back to L1 takes a week delay, but depositing is instant. In this scheme, however, both depositing and withdrawing take a week delay. That said, it's not clear that a three-layer architecture on optimistic rollups is better: there's a lot of technical complexity in ensuring that a fraud proof game happening inside a system that itself runs on a fraud proof game is safe.Fortunately, neither of these issues will be a problem on ZK rollups. ZK rollups do not require a week-long waiting window for security reasons, but they do still require a shorter window (perhaps 12 hours with first-generation technology) for two other reasons. First, particularly the more complex general-purpose ZK-EVM rollups need a longer amount of time to cover non-parallelizable compute time of proving a block. Second, there is the economic consideration of needing to submit proofs rarely to minimize the fixed costs associated with proof transactions. Next-gen ZK-EVM technology, including specialized hardware, will solve the first problem, and better-architected batch verification can solve the second problem. And it's precisely the issue of optimizing and batching proof submission that we will get into next.Rollups and validiums have a confirmation time vs fixed cost tradeoff. Layer 3s can help fix this. But what else can?The cost of a rollup per transaction is cheap: it's just 16-60 bytes of data, depending on the application. But rollups also have to pay a high fixed cost every time they submit a batch of transactions to chain: 21000 L1 gas per batch for optimistic rollups, and more than 400,000 gas for ZK rollups (millions of gas if you want something quantum-safe that only uses STARKs).Of course, rollups could simply choose to wait until there's 10 million gas worth of L2 transactions to submit a batch, but this would give them very long batch intervals, forcing users to wait much longer until they get a high-security confirmation. Hence, they have a tradeoff: long batch intervals and optimum costs, or shorter batch intervals and greatly increased costs.To give us some concrete numbers, let us consider a ZK rollup that has 600,000 gas per-batch costs and processes fully optimized ERC20 transfers (23 bytes), which cost 368 gas per transaction. Suppose that this rollup is in early to mid stages of adoption, and is averaging 5 TPS. We can compute gas per transaction vs batch intervals:Batch interval Gas per tx (= tx cost + batch cost / (TPS * batch interval)) 12s (one per Ethereum block) 10368 1 min 2368 10 min 568 1 h 401 If we're entering a world with lots of customized validiums and application-specific environments, then many of them will do much less than 5 TPS. Hence, tradeoffs between confirmation time and cost start to become a very big deal. And indeed, the "layer 3" paradigm does solve this! A ZK rollup inside a ZK rollup, even implemented naively, would have fixed costs of only ~8,000 layer-1 gas (500 bytes for the proof). This changes the table above to:Batch interval Gas per tx (= tx cost + batch cost / (TPS * batch interval)) 12s (one per Ethereum block) 501 1 min 394 10 min 370 1 h 368 Problem basically solved. So are layer 3s good? Maybe. But it's worth noticing that there is a different approach to solving this problem, inspired by ERC 4337 aggregate verification.The strategy is as follows. Today, each ZK rollup or validium accepts a state root if it receives a proof proving that \(S_ = STF(S_, D)\): the new state root must be the result of correctly processing the transaction data or state deltas on top of the old state root. In this new scheme, the ZK rollup would accept a message from a batch verifier contract that says that it has verified a proof of a batch of statements, where each of those statements is of the form \(S_ = STF(S_, D)\). This batch proof could be constructed via a recursive SNARK scheme or Halo aggregation. This would be an open protocol: any ZK-rollup could join, and any batch prover could aggregate proofs from any compatible ZK-rollup, and would get compensated by the aggregator with a transaction fee. The batch handler contract would verify the proof once, and then pass off a message to each rollup with the \((S_, S_, D)\) triple for that rollup; the fact that the triple came from the batch handler contract would be evidence that the transition is valid.The cost per rollup in this scheme could be close to 8000 if it's well-optimized: 5000 for a state write adding the new update, 1280 for the old and new root, and an extra 1720 for miscellaneous data juggling. Hence, it would give us the same savings. Starkware actually has something like this already, called SHARP, though it is not (yet) a permissionless open protocol.One response to this style of approach might be: but isn't this actually just another layer 3 scheme? Instead of base layer

What kind of layer 3s make sense? What kind of layer 3s make sense?2022 Sep 17 See all posts What kind of layer 3s make sense? Special thanks to Georgios Konstantopoulos, Karl Floersch and the Starkware team for feedback and review.One topic that often re-emerges in layer-2 scaling discussions is the concept of "layer 3s". If we can build a layer 2 protocol that anchors into layer 1 for security and adds scalability on top, then surely we can scale even more by building a layer 3 protocol that anchors into layer 2 for security and adds even more scalability on top of that?A simple version of this idea goes: if you have a scheme that can give you quadratic scaling, can you stack the scheme on top of itself and get exponential scaling? Ideas like this include my 2015 scalability paper, the multi-layer scaling ideas in the Plasma paper, and many more. Unfortunately, such simple conceptions of layer 3s rarely quite work out that easily. There's always something in the design that's just not stackable, and can only give you a scalability boost once - limits to data availability, reliance on L1 bandwidth for emergency withdrawals, or many other issues.Newer ideas around layer 3s, such as the framework proposed by Starkware, are more sophisticated: they aren't just stacking the same thing on top of itself, they're assigning the second layer and the third layer different purposes. Some form of this approach may well be a good idea - if it's done in the right way. This post will get into some of the details of what might and might not make sense to do in a triple-layered architecture.Why you can't just keep scaling by stacking rollups on top of rollupsRollups (see my longer article on them here) are a scaling technology that combines different techniques to address the two main scaling bottlenecks of running a blockchain: computation and data. Computation is addressed by either fraud proofs or SNARKs, which rely on a very small number of actors to process and verify each block, requiring everyone else to perform only a tiny amount of computation to check that the proving process was done correctly. These schemes, especially SNARKs, can scale almost without limit; you really can just keep making "a SNARK of many SNARKs" to scale even more computation down to a single proof.Data is different. Rollups use a collection of compression tricks to reduce the amount of data that a transaction needs to store on-chain: a simple currency transfer decreases from ~100 to ~16 bytes, an ERC20 transfer in an EVM-compatible chain from ~180 to ~23 bytes, and a privacy-preserving ZK-SNARK transaction could be compressed from ~600 to ~80 bytes. About 8x compression in all cases. But rollups still need to make data available on-chain in a medium that users are guaranteed to be able to access and verify, so that users can independently compute the state of the rollup and join as provers if existing provers go offline. Data can be compressed once, but it cannot be compressed again - if it can, then there's generally a way to put the logic of the second compressor into the first, and get the same benefit by compressing once. Hence, "rollups on top of rollups" are not something that can actually provide large gains in scalability - though, as we will see below, such a pattern can serve other purposes.So what's the "sane" version of layer 3s?Well, let's look at what Starkware, in their post on layer 3s, advocates. Starkware is made up of very smart cryptographers who are actually sane, and so if they are advocating for layer 3s, their version will be much more sophisticated than "if rollups compress data 8x, then obviously rollups on top of rollups will compress data 64x".Here's a diagram from Starkware's post: A few quotes:An example of such an ecosystem is depicted in Diagram 1. Its L3s include:A StarkNet with Validium data availability, e.g., for general use by applications with extreme sensitivity to pricing. App-specific StarkNet systems customized for better application performance, e.g., by employing designated storage structures or data availability compression. StarkEx systems (such as those serving dYdX, Sorare, Immutable, and DeversiFi) with Validium or Rollup data availability, immediately bringing battle-tested scalability benefits to StarkNet. Privacy StarkNet instances (in this example also as an L4) to allow privacy-preserving transactions without including them in public StarkNets. We can compress the article down into three visions of what "L3s" are for:L2 is for scaling, L3 is for customized functionality, for example privacy. In this vision there is no attempt to provide "scalability squared"; rather, there is one layer of the stack that helps applications scale, and then separate layers for customized functionality needs of different use cases. L2 is for general-purpose scaling, L3 is for customized scaling. Customized scaling might come in different forms: specialized applications that use something other than the EVM to do their computation, rollups whose data compression is optimized around data formats for specific applications (including separating "data" from "proofs" and replacing proofs with a single SNARK per block entirely), etc. L2 is for trustless scaling (rollups), L3 is for weakly-trusted scaling (validiums). Validiums are systems that use SNARKs to verify computation, but leave data availability up to a trusted third party or committee. Validiums are in my view highly underrated: in particular, many "enterprise blockchain" applications may well actually be best served by a centralized server that runs a validium prover and regularly commits hashes to chain. Validiums have a lower grade of security than rollups, but can be vastly cheaper. All three of these visions are, in my view, fundamentally reasonable. The idea that specialized data compression requires its own platform is probably the weakest of the claims - it's quite easy to design a layer 2 with a general-purpose base-layer compression scheme that users can automatically extend with application-specific sub-compressors - but otherwise the use cases are all sound. But this still leaves open one large question: is a three-layer structure the right way to accomplish these goals? What's the point of validiums, and privacy systems, and customized environments, anchoring into layer 2 instead of just anchoring into layer 1? The answer to this question turns out to be quite complicated. Which one is actually better? Does depositing and withdrawing become cheaper and easier within a layer 2's sub-tree?One possible argument for the three-layer model over the two-layer model is: a three-layer model allows an entire sub-ecosystem to exist within a single rollup, which allows cross-domain operations within that ecosystem to happen very cheaply, without needing to go through the expensive layer 1.But as it turns out, you can do deposits and withdrawals cheaply even between two layer 2s (or even layer 3s) that commit to the same layer 1! The key realization is that tokens and other assets do not have to be issued in the root chain. That is, you can have an ERC20 token on Arbitrum, create a wrapper of it on Optimism, and move back and forth between the two without any L1 transactions!Let us examine how such a system works. There are two smart contracts: the base contract on Arbitrum, and the wrapper token contract on Optimism. To move from Arbitrum to Optimism, you would send your tokens to the base contract, which would generate a receipt. Once Arbitrum finalizes, you can take a Merkle proof of that receipt, rooted in L1 state, and send it into the wrapper token contract on Optimism, which verifies it and issues you a wrapper token. To move tokens back, you do the same thing in reverse. Even though the Merkle path needed to prove the deposit on Arbitrum goes through the L1 state, Optimism only needs to read the L1 state root to process the deposit - no L1 transactions required. Note that because data on rollups is the scarcest resource, a practical implementation of such a scheme would use a SNARK or a KZG proof, rather than a Merkle proof directly, to save space. Such a scheme has one key weakness compared to tokens rooted on L1, at least on optimistic rollups: depositing also requires waiting the fraud proof window. If a token is rooted on L1, withdrawing from Arbitrum or Optimism back to L1 takes a week delay, but depositing is instant. In this scheme, however, both depositing and withdrawing take a week delay. That said, it's not clear that a three-layer architecture on optimistic rollups is better: there's a lot of technical complexity in ensuring that a fraud proof game happening inside a system that itself runs on a fraud proof game is safe.Fortunately, neither of these issues will be a problem on ZK rollups. ZK rollups do not require a week-long waiting window for security reasons, but they do still require a shorter window (perhaps 12 hours with first-generation technology) for two other reasons. First, particularly the more complex general-purpose ZK-EVM rollups need a longer amount of time to cover non-parallelizable compute time of proving a block. Second, there is the economic consideration of needing to submit proofs rarely to minimize the fixed costs associated with proof transactions. Next-gen ZK-EVM technology, including specialized hardware, will solve the first problem, and better-architected batch verification can solve the second problem. And it's precisely the issue of optimizing and batching proof submission that we will get into next.Rollups and validiums have a confirmation time vs fixed cost tradeoff. Layer 3s can help fix this. But what else can?The cost of a rollup per transaction is cheap: it's just 16-60 bytes of data, depending on the application. But rollups also have to pay a high fixed cost every time they submit a batch of transactions to chain: 21000 L1 gas per batch for optimistic rollups, and more than 400,000 gas for ZK rollups (millions of gas if you want something quantum-safe that only uses STARKs).Of course, rollups could simply choose to wait until there's 10 million gas worth of L2 transactions to submit a batch, but this would give them very long batch intervals, forcing users to wait much longer until they get a high-security confirmation. Hence, they have a tradeoff: long batch intervals and optimum costs, or shorter batch intervals and greatly increased costs.To give us some concrete numbers, let us consider a ZK rollup that has 600,000 gas per-batch costs and processes fully optimized ERC20 transfers (23 bytes), which cost 368 gas per transaction. Suppose that this rollup is in early to mid stages of adoption, and is averaging 5 TPS. We can compute gas per transaction vs batch intervals:Batch interval Gas per tx (= tx cost + batch cost / (TPS * batch interval)) 12s (one per Ethereum block) 10368 1 min 2368 10 min 568 1 h 401 If we're entering a world with lots of customized validiums and application-specific environments, then many of them will do much less than 5 TPS. Hence, tradeoffs between confirmation time and cost start to become a very big deal. And indeed, the "layer 3" paradigm does solve this! A ZK rollup inside a ZK rollup, even implemented naively, would have fixed costs of only ~8,000 layer-1 gas (500 bytes for the proof). This changes the table above to:Batch interval Gas per tx (= tx cost + batch cost / (TPS * batch interval)) 12s (one per Ethereum block) 501 1 min 394 10 min 370 1 h 368 Problem basically solved. So are layer 3s good? Maybe. But it's worth noticing that there is a different approach to solving this problem, inspired by ERC 4337 aggregate verification.The strategy is as follows. Today, each ZK rollup or validium accepts a state root if it receives a proof proving that \(S_ = STF(S_, D)\): the new state root must be the result of correctly processing the transaction data or state deltas on top of the old state root. In this new scheme, the ZK rollup would accept a message from a batch verifier contract that says that it has verified a proof of a batch of statements, where each of those statements is of the form \(S_ = STF(S_, D)\). This batch proof could be constructed via a recursive SNARK scheme or Halo aggregation. This would be an open protocol: any ZK-rollup could join, and any batch prover could aggregate proofs from any compatible ZK-rollup, and would get compensated by the aggregator with a transaction fee. The batch handler contract would verify the proof once, and then pass off a message to each rollup with the \((S_, S_, D)\) triple for that rollup; the fact that the triple came from the batch handler contract would be evidence that the transition is valid.The cost per rollup in this scheme could be close to 8000 if it's well-optimized: 5000 for a state write adding the new update, 1280 for the old and new root, and an extra 1720 for miscellaneous data juggling. Hence, it would give us the same savings. Starkware actually has something like this already, called SHARP, though it is not (yet) a permissionless open protocol.One response to this style of approach might be: but isn't this actually just another layer 3 scheme? Instead of base layer -

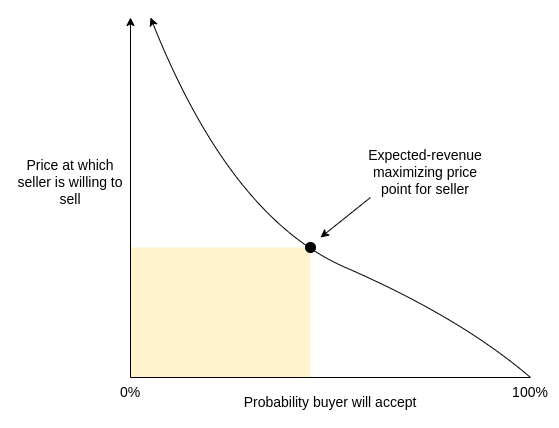

Should there be demand-based recurring fees on ENS domains? Should there be demand-based recurring fees on ENS domains?2022 Sep 09 See all posts Should there be demand-based recurring fees on ENS domains? Special thanks to Lars Doucet, Glen Weyl and Nick Johnson for discussion and feedback on various topics.ENS domains today are cheap. Very cheap. The cost to register and maintain a five-letter domain name is only $5 per year. This sounds reasonable from the perspective of one person trying to register a single domain, but it looks very different when you look at the situation globally: when ENS was younger, someone could have registered all 8938 five-letter words in the Scrabble wordlist (which includes exotic stuff like "BURRS", "FLUYT" and "ZORIL") and pre-paid their ownership for a hundred years, all for the price of a dozen lambos. And in fact, many people did: today, almost all of those five-letter words are already taken, many by squatters waiting for someone to buy the domain from them at a much higher price. A random scrape of OpenSea shows that about 40% of all these domains are for sale or have been sold on that platform alone.The question worth asking is: is this really the best way to allocate domains? By selling off these domains so cheaply, ENS DAO is almost certainly gathering far less revenue than it could, which limits its ability to act to improve the ecosystem. The status quo is also bad for fairness: being able to buy up all the domains cheaply was great for people in 2017, is okay in 2022, but the consequences may severely handicap the system in 2050. And given that buying a five-letter-word domain in practice costs anywhere from 0.1 to 500 ETH, the notionally cheap registration prices are not actually providing cost savings to users. In fact, there are deep economic reasons to believe that reliance on secondary markets makes domains more expensive than a well-designed in-protocol mechanism.Could we allocate ongoing ownership of domains in a better way? Is there a way to raise more revenue for ENS DAO, do a better job of ensuring domains go to those who can make best use of them, and at the same time preserve the credible neutrality and the accessible very strong guarantees of long-term ownership that make ENS valuable?Problem 1: there is a fundamental tradeoff between strength of property rights and fairnessSuppose that there are \(N\) "high-value names" (eg. five-letter words in the Scrabble dictionary, but could be any similar category). Suppose that each year, users grab up \(k\) names, and some portion \(p\) of them get grabbed by someone who's irrationally stubborn and not willing to give them up (\(p\) could be really low, it just needs to be greater than zero). Then, after \(\frac\) years, no one will be able to get a high-value name again.This is a two-line mathematical theorem, and it feels too simple to be saying anything important. But it actually gets at a crucial truth: time-unlimited allocation of a finite resource is incompatible with fairness across long time horizons. This is true for land; it's the reason why there have been so many land reforms throughout history, and it's a big part of why many advocate for land taxes today. It's also true for domains, though the problem in the traditional domain space has been temporarily alleviated by a "forced dilution" of early .com holders in the form of a mass introduction of .io, .me, .network and many other domains. ENS has soft-committed to not add new TLDs to avoid polluting the global namespace and rupturing its chances of eventual integration with mainstream DNS, so such a dilution is not an option.Fortunately, ENS charges not just a one-time fee to register a domain, but also a recurring annual fee to maintain it. Not all decentralized domain name systems had the foresight to implement this; Unstoppable Domains did not, and even goes so far as to proudly advertise its preference for short-term consumer appeal over long-term sustainability ("No renewal fees ever!"). The recurring fees in ENS and traditional DNS are a healthy mitigation to the worst excesses of a truly unlimited pay-once-own-forever model: at the very least, the recurring fees mean that no one will be able to accidentally lock down a domain forever through forgetfulness or carelessness. But it may not be enough. It's still possible to spend $500 to lock down an ENS domain for an entire century, and there are certainly some types of domains that are in high enough demand that this is vastly underpriced.Problem 2: speculators do not actually create efficient marketsOnce we admit that a first-come-first-serve model with low fixed fees has these problems, a common counterargument is to say: yes, many of the names will get bought up by speculators, but speculation is natural and good. It is a free market mechanism, where speculators who actually want to maximize their profit are motivated to resell the domain in such a way that it goes to whoever can make the best use of the domain, and their outsized returns are just compensation for this service.But as it turns out, there has been academic research on this topic, and it is not actually true that profit-maximizing auctioneers maximize social welfare! Quoting Myerson 1981:By announcing a reservation price of 50, the seller risks a probability \((1 / 2^n)\) of keeping the object even though some bidder is willing to pay more than \(t_0\) for it; but the seller also increases his expected revenue, because he can command a higher price when the object is sold.Thus the optimal auction may not be ex-post efficient. To see more clearly why this can happen, consider the example in the above paragraph, for the case when \(n = 1\) ... Ex post efficiency would require that the bidder must always get the object, as long as his value estimate is positive. But then the bidder would never admit to more than an infinitesimal value estimate, since any positive bid would win the object ... In fact the seller's optimal policy is to refuse to sell the object for less than 50.Translated into diagram form: Maximizing revenue for the seller almost always requires accepting some probability of never selling the domain at all, leaving it unused outright. One important nuance in the argument is that seller-revenue-maximizing auctions are at their most inefficient when there is one possible buyer (or at least, one buyer with a valuation far above the others), and the inefficiency decreases quickly once there are many competing potential buyers. But for a large class of domains, the first category is precisely the situation they are in. Domains that are simply some person, project or company's name, for example, have one natural buyer: that person or project. And so if a speculator buys up such a name, they will of course set the price high, accepting a large chance of never coming to a deal to maximize their revenue in the case where a deal does arise.Hence, we cannot say that speculators grabbing a large portion of domain allocation revenues is merely just compensation for them ensuring that the market is efficient. On the contrary, speculators can easily make the market worse than a well-designed mechanism in the protocol that encourages domains to be directly available for sale at fair prices.One cheer for stricter property rights: stability of domain ownership has positive externalitiesThe monopoly problems of overly-strict property rights on non-fungible assets have been known for a long time. Resolving this issue in a market-based way was the original goal of Harberger taxes: require the owner of each covered asset to set a price at which they are willing to sell it to anyone else, and charge an annual fee based on that price. For example, one could charge 0.5% of the sale price every year. Holders would be incentivized to leave the asset available for purchase at prices that are reasonable, "lazy" holders who refuse to sell would lose money every year, and hoarding assets without using them would in many cases become economically infeasible outright.But the risk of being forced to sell something at any time can have large economic and psychological costs, and it's for this reason that advocates of Harberger taxes generally focus on industrial property applications where the market participants are sophisticated. Where do domains fall on the spectrum? Let us consider the costs of a business getting "relocated", in three separate cases: a data center, a restaurant, and an ENS name. Data center Restaurant ENS name Confusion from people expecting old location An employee comes to the old location, and unexpectedly finds it closed. An employee or a customer comes to the old location, and unexpectedly finds it closed. Someone sends a big chunk of money to the wrong address. Loss of location-specific long-term investment Low The restaurant will probably lose many long-term customers for whom the new location is too far away The owner spent years building a brand around the old name that cannot easily carry over. As it turns out, domains do not hold up very well. Domain name owners are often not sophisticated, the costs of switching domain names are often high, and negative externalities of a name-change gone wrong can be large. The highest-value owner of coinbase.eth may not be Coinbase; it could just as easily be a scammer who would grab up the domain and then immediately make a fake charity or ICO claiming it's run by Coinbase and ask people to send that address their money. For these reasons, Harberger taxing domains is not a great idea.Alternative solution 1: demand-based recurring pricingMaintaining ownership over an ENS domain today requires paying a recurring fee. For most domains, this is a simple and very low $5 per year. The only exceptions are four-letter domains ($160 per year) and three-letter domains ($640 per year). But what if instead, we make the fee somehow depend on the actual level of market demand for the domain?This would not be a Harberger-like scheme where you have to make the domain available for immediate sale at a particular price. Rather, the initiative in the price-setting procedure would fall on the bidders. Anyone could bid on a particular domain, and if they keep an open bid for a sufficiently long period of time (eg. 4 weeks), the domain's valuation rises to that level. The annual fee on the domain would be proportional to the valuation (eg. it might be set to 0.5% of the valuation). If there are no bids, the fee might decay at a constant rate. When a bidder sends their bid amount into a smart contract to place a bid, the owner has two options: they could either accept the bid, or they could reject, though they may have to start paying a higher price. If a bidder bids a value higher than the actual value of the domain, the owner could sell to them, costing the bidder a huge amount of money.This property is important, because it means that "griefing" domain holders is risky and expensive, and may even end up benefiting the victim. If you own a domain, and a powerful actor wants to harass or censor you, they could try to make a very high bid for that domain to greatly increase your annual fee. But if they do this, you could simply sell to them and collect the massive payout.This already provides much more stability and is more noob-friendly than a Harberger tax. Domain owners don't need to constantly worry whether or not they're setting prices too low. Rather, they can simply sit back and pay the annual fee, and if someone offers to bid they can take 4 weeks to make a decision and either sell the domain or continue holding it and accept the higher fee. But even this probably does not provide quite enough stability. To go even further, we need a compromise on the compromise.Alternative solution 2: capped demand-based recurring pricingWe can modify the above scheme to offer even stronger guarantees to domain-name holders. Specifically, we can try to offer the following property:Strong time-bound ownership guarantee: for any fixed number of years, it's always possible to compute a fixed amount of money that you can pre-pay to unconditionally guarantee ownership for at least that number of years.In math language, there must be some function \(y = f(n)\) such that if you pay \(y\) dollars (or ETH), you get a hard guarantee that you will be able to hold on to the domain for at least \(n\) years, no matter what happens. \(f\) may also depend on other factors, such as what happened to the domain previously, as long as those factors are known at the time the transaction to register or extend a domain is made. Note that the maximum annual fee after \(n\) years would be the derivative \(f'(n)\).The new price after a bid would be capped at the implied maximum annual fee. For example, if \(f(n) = \fracn^2\), so \(f'(n) = n\), and you get a bid of $5 after 7 years, the annual fee would rise to $5, but if you get a bid of $10 after 7 years, the annual fee would only rise to $7. If no bids that raise the fee to the max are made for some length of time (eg. a full year), \(n\) resets. If a bid is made and rejected, \(n\) resets.And of course, we have a highly subjective criterion that \(f(n)\) must be "reasonable". We can create compromise proposals by trying different shapes for \(f\):Type \(f(n)\) (\(p_0\) = price of last sale or last rejected bid, or $1 if most recent event is a reset) In plain English Total cost to guarantee holding for >= 10 years Total cost to guarantee holding for >= 100 years Exponential fee growth \(f(n) = \int_0^n p_0 * 1.1^n\) The fee can grow by a maximum of 10% per year (with compounding). $836 $7.22m Linear fee growth \(f(n) = p_0 * n + \fracn^2\) The annual fee can grow by a maximum of $15 per year. $1250 $80k Capped annual fee \(f(n) = 640 * n\) The annual fee cannot exceed $640 per year. That is, a domain in high demand can start to cost as much as a three-letter domain, but not more. $6400 $64k Or in chart form: Note that the amounts in the table are only the theoretical maximums needed to guarantee holding a domain for that number of years. In practice, almost no domains would have bidders willing to bid very high amounts, and so holders of almost all domains would end up paying much less than the maximum.One fascinating property of the "capped annual fee" approach is that there are versions of it that are strictly more favorable to existing domain-name holders than the status quo. In particular, we could imagine a system where a domain that gets no bids does not have to pay any annual fee, and a bid could increase the annual fee to a maximum of $5 per year.Demand from external bids clearly provides some signal about how valuable a domain is (and therefore, to what extent an owner is excluding others by maintaining control over it). Hence, regardless of your views on what level of fees should be required to maintain a domain, I would argue that you should find some parameter choice for demand-based fees appealing.I will still make my case for why some superlinear \(f(n)\), a max annual fee that goes up over time, is a good idea. First, paying more for longer-term security is a common feature throughout the economy. Fixed-rate mortgages usually have higher interest rates than variable-rate mortgages. You can get higher interest by providing deposits that are locked up for longer periods of time; this is compensation the bank pays you for providing longer-term security to the bank. Similarly, longer-term government bonds typically have higher yields. Second, the annual fee should be able to eventually adjust to whatever the market value of the domain is; we just don't want that to happen too quickly.Superlinear \(f(n)\) values still make hard guarantees of ownership reasonably accessible over pretty long timescales: with the linear-fee-growth formula \(f(n) = p_0 * n + \fracn^2\), for only $6000 ($120 per year) you could ensure ownership of the domain for 25 years, and you would almost certainly pay much less. The ideal of "register and forget" for censorship-resistant services would still be very much available.From here to thereWeakening property norms, and increasing fees, is psychologically very unappealing to many people. This is true even when these fees make clear economic sense, and even when you can redirect fee revenue into a UBI and mathematically show that the majority of people would economically net-benefit from your proposal. Cities have a hard time adding congestion pricing, even when it's painfully clear that the only two choices are paying congestion fees in dollars and paying congestion fees in wasted time and weakened mental health driving in painfully slow traffic. Land value taxes, despite being in many ways one of the most effective and least harmful taxes out there, have a hard time getting adopted. Unstoppable Domains's loud and proud advertisement of "no renewal fees ever" is in my view very short-sighted, but it's clearly at least somewhat effective. So how could I possibly think that we have any chance of adding fees and conditions to domain name ownership?The crypto space is not going to solve deep challenges in human political psychology that humanity has failed at for centuries. But we do not have to. I see two possible answers that do have some realistic hope for success:Democratic legitimacy: come up with a compromise proposal that really is a sufficient compromise that it makes enough people happy, and perhaps even makes some existing domain name holders (not just potential domain name holders) better off than they are today.For example, we could implement demand-based annual fees (eg. setting the annual fee to 0.5% of the highest bid) with a fee cap of $640 per year for domains up to eight letters long, and $5 per year for longer domains, and let domain holders pay nothing if no one makes a bid. Many average users would save money under such a proposal. Market legitimacy: avoid the need to get legitimacy to overturn people's expectations in the existing system by instead creating a new system (or sub-system).In traditional DNS, this could be done just by creating a new TLD that would be as convenient as existing TLDs. In ENS, there is a stated desire to stick to .eth only to avoid conflicting with the existing domain name system. And using existing subdomains doesn't quite work: foo.bar.eth is much less nice than foo.eth. One possible middle route is for the ENS DAO to hand off single-letter domain names solely to projects that run some other kind of credibly-neutral marketplace for their subdomains, as long as they hand over at least 50% of the revenue to the ENS DAO.For example, perhaps x.eth could use one of my proposed pricing schemes for its subdomains, and t.eth could implement a mechanism where ENS DAO has the right to forcibly transfer subdomains for anti-fraud and trademark reasons. foo.x.eth just barely looks good enough to be sort-of a substitute for foo.eth; it will have to do. If making changes to ENS domain pricing itself are off the table, then the market-based approach of explicitly encouraging marketplaces with different rules in subdomains should be strongly considered.To me, the crypto space is not just about coins, and I admit my attraction to ENS does not center around some notion of unconditional and infinitely strict property-like ownership over domains. Rather, my interest in the space lies more in credible neutrality, and property rights that are strongly protected particularly against politically motivated censorship and arbitrary and targeted interference by powerful actors. That said, a high degree of guarantee of ownership is nevertheless very important for a domain name system to be able to function.The hybrid proposals I suggest above are my attempt at preserving total credible neutrality, continuing to provide a high degree of ownership guarantee, but at the same time increasing the cost of domain squatting, raising more revenue for the ENS DAO to be able to work on important public goods, and improving the chances that people who do not have the domain they want already will be able to get one.

Should there be demand-based recurring fees on ENS domains? Should there be demand-based recurring fees on ENS domains?2022 Sep 09 See all posts Should there be demand-based recurring fees on ENS domains? Special thanks to Lars Doucet, Glen Weyl and Nick Johnson for discussion and feedback on various topics.ENS domains today are cheap. Very cheap. The cost to register and maintain a five-letter domain name is only $5 per year. This sounds reasonable from the perspective of one person trying to register a single domain, but it looks very different when you look at the situation globally: when ENS was younger, someone could have registered all 8938 five-letter words in the Scrabble wordlist (which includes exotic stuff like "BURRS", "FLUYT" and "ZORIL") and pre-paid their ownership for a hundred years, all for the price of a dozen lambos. And in fact, many people did: today, almost all of those five-letter words are already taken, many by squatters waiting for someone to buy the domain from them at a much higher price. A random scrape of OpenSea shows that about 40% of all these domains are for sale or have been sold on that platform alone.The question worth asking is: is this really the best way to allocate domains? By selling off these domains so cheaply, ENS DAO is almost certainly gathering far less revenue than it could, which limits its ability to act to improve the ecosystem. The status quo is also bad for fairness: being able to buy up all the domains cheaply was great for people in 2017, is okay in 2022, but the consequences may severely handicap the system in 2050. And given that buying a five-letter-word domain in practice costs anywhere from 0.1 to 500 ETH, the notionally cheap registration prices are not actually providing cost savings to users. In fact, there are deep economic reasons to believe that reliance on secondary markets makes domains more expensive than a well-designed in-protocol mechanism.Could we allocate ongoing ownership of domains in a better way? Is there a way to raise more revenue for ENS DAO, do a better job of ensuring domains go to those who can make best use of them, and at the same time preserve the credible neutrality and the accessible very strong guarantees of long-term ownership that make ENS valuable?Problem 1: there is a fundamental tradeoff between strength of property rights and fairnessSuppose that there are \(N\) "high-value names" (eg. five-letter words in the Scrabble dictionary, but could be any similar category). Suppose that each year, users grab up \(k\) names, and some portion \(p\) of them get grabbed by someone who's irrationally stubborn and not willing to give them up (\(p\) could be really low, it just needs to be greater than zero). Then, after \(\frac\) years, no one will be able to get a high-value name again.This is a two-line mathematical theorem, and it feels too simple to be saying anything important. But it actually gets at a crucial truth: time-unlimited allocation of a finite resource is incompatible with fairness across long time horizons. This is true for land; it's the reason why there have been so many land reforms throughout history, and it's a big part of why many advocate for land taxes today. It's also true for domains, though the problem in the traditional domain space has been temporarily alleviated by a "forced dilution" of early .com holders in the form of a mass introduction of .io, .me, .network and many other domains. ENS has soft-committed to not add new TLDs to avoid polluting the global namespace and rupturing its chances of eventual integration with mainstream DNS, so such a dilution is not an option.Fortunately, ENS charges not just a one-time fee to register a domain, but also a recurring annual fee to maintain it. Not all decentralized domain name systems had the foresight to implement this; Unstoppable Domains did not, and even goes so far as to proudly advertise its preference for short-term consumer appeal over long-term sustainability ("No renewal fees ever!"). The recurring fees in ENS and traditional DNS are a healthy mitigation to the worst excesses of a truly unlimited pay-once-own-forever model: at the very least, the recurring fees mean that no one will be able to accidentally lock down a domain forever through forgetfulness or carelessness. But it may not be enough. It's still possible to spend $500 to lock down an ENS domain for an entire century, and there are certainly some types of domains that are in high enough demand that this is vastly underpriced.Problem 2: speculators do not actually create efficient marketsOnce we admit that a first-come-first-serve model with low fixed fees has these problems, a common counterargument is to say: yes, many of the names will get bought up by speculators, but speculation is natural and good. It is a free market mechanism, where speculators who actually want to maximize their profit are motivated to resell the domain in such a way that it goes to whoever can make the best use of the domain, and their outsized returns are just compensation for this service.But as it turns out, there has been academic research on this topic, and it is not actually true that profit-maximizing auctioneers maximize social welfare! Quoting Myerson 1981:By announcing a reservation price of 50, the seller risks a probability \((1 / 2^n)\) of keeping the object even though some bidder is willing to pay more than \(t_0\) for it; but the seller also increases his expected revenue, because he can command a higher price when the object is sold.Thus the optimal auction may not be ex-post efficient. To see more clearly why this can happen, consider the example in the above paragraph, for the case when \(n = 1\) ... Ex post efficiency would require that the bidder must always get the object, as long as his value estimate is positive. But then the bidder would never admit to more than an infinitesimal value estimate, since any positive bid would win the object ... In fact the seller's optimal policy is to refuse to sell the object for less than 50.Translated into diagram form: Maximizing revenue for the seller almost always requires accepting some probability of never selling the domain at all, leaving it unused outright. One important nuance in the argument is that seller-revenue-maximizing auctions are at their most inefficient when there is one possible buyer (or at least, one buyer with a valuation far above the others), and the inefficiency decreases quickly once there are many competing potential buyers. But for a large class of domains, the first category is precisely the situation they are in. Domains that are simply some person, project or company's name, for example, have one natural buyer: that person or project. And so if a speculator buys up such a name, they will of course set the price high, accepting a large chance of never coming to a deal to maximize their revenue in the case where a deal does arise.Hence, we cannot say that speculators grabbing a large portion of domain allocation revenues is merely just compensation for them ensuring that the market is efficient. On the contrary, speculators can easily make the market worse than a well-designed mechanism in the protocol that encourages domains to be directly available for sale at fair prices.One cheer for stricter property rights: stability of domain ownership has positive externalitiesThe monopoly problems of overly-strict property rights on non-fungible assets have been known for a long time. Resolving this issue in a market-based way was the original goal of Harberger taxes: require the owner of each covered asset to set a price at which they are willing to sell it to anyone else, and charge an annual fee based on that price. For example, one could charge 0.5% of the sale price every year. Holders would be incentivized to leave the asset available for purchase at prices that are reasonable, "lazy" holders who refuse to sell would lose money every year, and hoarding assets without using them would in many cases become economically infeasible outright.But the risk of being forced to sell something at any time can have large economic and psychological costs, and it's for this reason that advocates of Harberger taxes generally focus on industrial property applications where the market participants are sophisticated. Where do domains fall on the spectrum? Let us consider the costs of a business getting "relocated", in three separate cases: a data center, a restaurant, and an ENS name. Data center Restaurant ENS name Confusion from people expecting old location An employee comes to the old location, and unexpectedly finds it closed. An employee or a customer comes to the old location, and unexpectedly finds it closed. Someone sends a big chunk of money to the wrong address. Loss of location-specific long-term investment Low The restaurant will probably lose many long-term customers for whom the new location is too far away The owner spent years building a brand around the old name that cannot easily carry over. As it turns out, domains do not hold up very well. Domain name owners are often not sophisticated, the costs of switching domain names are often high, and negative externalities of a name-change gone wrong can be large. The highest-value owner of coinbase.eth may not be Coinbase; it could just as easily be a scammer who would grab up the domain and then immediately make a fake charity or ICO claiming it's run by Coinbase and ask people to send that address their money. For these reasons, Harberger taxing domains is not a great idea.Alternative solution 1: demand-based recurring pricingMaintaining ownership over an ENS domain today requires paying a recurring fee. For most domains, this is a simple and very low $5 per year. The only exceptions are four-letter domains ($160 per year) and three-letter domains ($640 per year). But what if instead, we make the fee somehow depend on the actual level of market demand for the domain?This would not be a Harberger-like scheme where you have to make the domain available for immediate sale at a particular price. Rather, the initiative in the price-setting procedure would fall on the bidders. Anyone could bid on a particular domain, and if they keep an open bid for a sufficiently long period of time (eg. 4 weeks), the domain's valuation rises to that level. The annual fee on the domain would be proportional to the valuation (eg. it might be set to 0.5% of the valuation). If there are no bids, the fee might decay at a constant rate. When a bidder sends their bid amount into a smart contract to place a bid, the owner has two options: they could either accept the bid, or they could reject, though they may have to start paying a higher price. If a bidder bids a value higher than the actual value of the domain, the owner could sell to them, costing the bidder a huge amount of money.This property is important, because it means that "griefing" domain holders is risky and expensive, and may even end up benefiting the victim. If you own a domain, and a powerful actor wants to harass or censor you, they could try to make a very high bid for that domain to greatly increase your annual fee. But if they do this, you could simply sell to them and collect the massive payout.This already provides much more stability and is more noob-friendly than a Harberger tax. Domain owners don't need to constantly worry whether or not they're setting prices too low. Rather, they can simply sit back and pay the annual fee, and if someone offers to bid they can take 4 weeks to make a decision and either sell the domain or continue holding it and accept the higher fee. But even this probably does not provide quite enough stability. To go even further, we need a compromise on the compromise.Alternative solution 2: capped demand-based recurring pricingWe can modify the above scheme to offer even stronger guarantees to domain-name holders. Specifically, we can try to offer the following property:Strong time-bound ownership guarantee: for any fixed number of years, it's always possible to compute a fixed amount of money that you can pre-pay to unconditionally guarantee ownership for at least that number of years.In math language, there must be some function \(y = f(n)\) such that if you pay \(y\) dollars (or ETH), you get a hard guarantee that you will be able to hold on to the domain for at least \(n\) years, no matter what happens. \(f\) may also depend on other factors, such as what happened to the domain previously, as long as those factors are known at the time the transaction to register or extend a domain is made. Note that the maximum annual fee after \(n\) years would be the derivative \(f'(n)\).The new price after a bid would be capped at the implied maximum annual fee. For example, if \(f(n) = \fracn^2\), so \(f'(n) = n\), and you get a bid of $5 after 7 years, the annual fee would rise to $5, but if you get a bid of $10 after 7 years, the annual fee would only rise to $7. If no bids that raise the fee to the max are made for some length of time (eg. a full year), \(n\) resets. If a bid is made and rejected, \(n\) resets.And of course, we have a highly subjective criterion that \(f(n)\) must be "reasonable". We can create compromise proposals by trying different shapes for \(f\):Type \(f(n)\) (\(p_0\) = price of last sale or last rejected bid, or $1 if most recent event is a reset) In plain English Total cost to guarantee holding for >= 10 years Total cost to guarantee holding for >= 100 years Exponential fee growth \(f(n) = \int_0^n p_0 * 1.1^n\) The fee can grow by a maximum of 10% per year (with compounding). $836 $7.22m Linear fee growth \(f(n) = p_0 * n + \fracn^2\) The annual fee can grow by a maximum of $15 per year. $1250 $80k Capped annual fee \(f(n) = 640 * n\) The annual fee cannot exceed $640 per year. That is, a domain in high demand can start to cost as much as a three-letter domain, but not more. $6400 $64k Or in chart form: Note that the amounts in the table are only the theoretical maximums needed to guarantee holding a domain for that number of years. In practice, almost no domains would have bidders willing to bid very high amounts, and so holders of almost all domains would end up paying much less than the maximum.One fascinating property of the "capped annual fee" approach is that there are versions of it that are strictly more favorable to existing domain-name holders than the status quo. In particular, we could imagine a system where a domain that gets no bids does not have to pay any annual fee, and a bid could increase the annual fee to a maximum of $5 per year.Demand from external bids clearly provides some signal about how valuable a domain is (and therefore, to what extent an owner is excluding others by maintaining control over it). Hence, regardless of your views on what level of fees should be required to maintain a domain, I would argue that you should find some parameter choice for demand-based fees appealing.I will still make my case for why some superlinear \(f(n)\), a max annual fee that goes up over time, is a good idea. First, paying more for longer-term security is a common feature throughout the economy. Fixed-rate mortgages usually have higher interest rates than variable-rate mortgages. You can get higher interest by providing deposits that are locked up for longer periods of time; this is compensation the bank pays you for providing longer-term security to the bank. Similarly, longer-term government bonds typically have higher yields. Second, the annual fee should be able to eventually adjust to whatever the market value of the domain is; we just don't want that to happen too quickly.Superlinear \(f(n)\) values still make hard guarantees of ownership reasonably accessible over pretty long timescales: with the linear-fee-growth formula \(f(n) = p_0 * n + \fracn^2\), for only $6000 ($120 per year) you could ensure ownership of the domain for 25 years, and you would almost certainly pay much less. The ideal of "register and forget" for censorship-resistant services would still be very much available.From here to thereWeakening property norms, and increasing fees, is psychologically very unappealing to many people. This is true even when these fees make clear economic sense, and even when you can redirect fee revenue into a UBI and mathematically show that the majority of people would economically net-benefit from your proposal. Cities have a hard time adding congestion pricing, even when it's painfully clear that the only two choices are paying congestion fees in dollars and paying congestion fees in wasted time and weakened mental health driving in painfully slow traffic. Land value taxes, despite being in many ways one of the most effective and least harmful taxes out there, have a hard time getting adopted. Unstoppable Domains's loud and proud advertisement of "no renewal fees ever" is in my view very short-sighted, but it's clearly at least somewhat effective. So how could I possibly think that we have any chance of adding fees and conditions to domain name ownership?The crypto space is not going to solve deep challenges in human political psychology that humanity has failed at for centuries. But we do not have to. I see two possible answers that do have some realistic hope for success:Democratic legitimacy: come up with a compromise proposal that really is a sufficient compromise that it makes enough people happy, and perhaps even makes some existing domain name holders (not just potential domain name holders) better off than they are today.For example, we could implement demand-based annual fees (eg. setting the annual fee to 0.5% of the highest bid) with a fee cap of $640 per year for domains up to eight letters long, and $5 per year for longer domains, and let domain holders pay nothing if no one makes a bid. Many average users would save money under such a proposal. Market legitimacy: avoid the need to get legitimacy to overturn people's expectations in the existing system by instead creating a new system (or sub-system).In traditional DNS, this could be done just by creating a new TLD that would be as convenient as existing TLDs. In ENS, there is a stated desire to stick to .eth only to avoid conflicting with the existing domain name system. And using existing subdomains doesn't quite work: foo.bar.eth is much less nice than foo.eth. One possible middle route is for the ENS DAO to hand off single-letter domain names solely to projects that run some other kind of credibly-neutral marketplace for their subdomains, as long as they hand over at least 50% of the revenue to the ENS DAO.For example, perhaps x.eth could use one of my proposed pricing schemes for its subdomains, and t.eth could implement a mechanism where ENS DAO has the right to forcibly transfer subdomains for anti-fraud and trademark reasons. foo.x.eth just barely looks good enough to be sort-of a substitute for foo.eth; it will have to do. If making changes to ENS domain pricing itself are off the table, then the market-based approach of explicitly encouraging marketplaces with different rules in subdomains should be strongly considered.To me, the crypto space is not just about coins, and I admit my attraction to ENS does not center around some notion of unconditional and infinitely strict property-like ownership over domains. Rather, my interest in the space lies more in credible neutrality, and property rights that are strongly protected particularly against politically motivated censorship and arbitrary and targeted interference by powerful actors. That said, a high degree of guarantee of ownership is nevertheless very important for a domain name system to be able to function.The hybrid proposals I suggest above are my attempt at preserving total credible neutrality, continuing to provide a high degree of ownership guarantee, but at the same time increasing the cost of domain squatting, raising more revenue for the ENS DAO to be able to work on important public goods, and improving the chances that people who do not have the domain they want already will be able to get one. -