找到

1087

篇与

heyuan

相关的结果

-

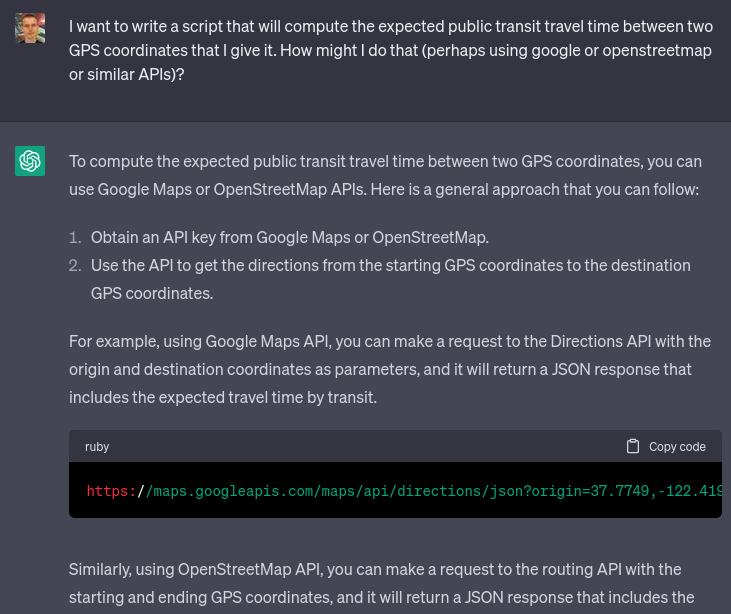

Travel time ~= 750 * distance ^ 0.6 Travel time ~= 750 * distance ^ 0.62023 Apr 14 See all posts Travel time ~= 750 * distance ^ 0.6 As another exercise in using ChatGPT 3.5 to do weird things and seeing what happens, I decided to explore an interesting question: how does the time it takes to travel from point A to point B scale with distance, in the real world? That is to say, if you sample randomly from positions where people are actually at (so, for example, 56% of points you choose would be in cities), and you use public transportation, how does travel time scale with distance?Obviously, travel time would grow slower than linearly: the further you have to go, the more opportunity you have to resort to forms of transportation that are faster, but have some fixed overhead. Outside of a very few lucky cases, there is no practical way to take a bus to go faster if your destination is 170 meters away, but if your destination is 170 kilometers away, you suddenly get more options. And if it's 1700 kilometers away, you get airplanes.So I asked ChatGPT for the ingredients I would need: I went with the GeoLife dataset. I did notice that while it claims to be about users around the world, primarily it seems to focus on people in Seattle and Beijing, though they do occasionally visit other cities. That said, I'm not a perfectionist and I was fine with it. I asked ChatGPT to write me a script to interpret the dataset and extract a randomly selected coordinate from each file: Amazingly, it almost succeeded on the first try. It did make the mistake of assuming every item in the list would be a number (values = [float(x) for x in line.strip().split(',')]), though perhaps to some extent that was my fault: when I said "the first two values" it probably interpreted that as implying that the entire line was made up of "values" (ie. numbers).I fixed the bug manually. Now, I have a way to get some randomly selected points where people are at, and I have an API to get the public transit travel time between the points.I asked it for more coding help:Asking how to get an API key for the Google Maps Directions API (it gave an answer that seems to be outdated, but that succeeded at immediately pointing me to the right place) Writing a function to compute the straight-line distance between two GPS coordinates (it gave the correct answer on the first try) Given a list of (distance, time) pairs, drawing a scatter plot, with time and distance as axes, both axes logarithmically scaled (it gave the correct answer on the first try) Doing a linear regression on the logarithms of distance and time to try to fit the data to a power law (it bugged on the first try, succeeded on the second) This gave me some really nice data (this is filtered for distances under 500km, as above 500km the best path almost certainly includes flying, and the Google Maps directions don't take into account flights): The power law fit that the linear regression gave is: travel_time = 965.8020738916074 * distance^0.6138556361612214 (time in seconds, distance in km).Now, I needed travel time data for longer distances, where the optimal route would include flights. Here, APIs could not help me: I asked ChatGPT if there were APIs that could do such a thing, and it did not give a satisfactory answer. I resorted to doing it manually:I used the same script, but modified it slightly to only output pairs of points which were more than 500km apart from each other. I took the first 8 results within the United States, and the first 8 with at least one end outside the United States, skipping over results that represented a city pair that had already been covered. For each result I manually obtained: to_airport: the public transit travel time from the starting point to the nearest airport, using Google Maps outside China and Baidu Maps inside China. from_airport: the public transit travel time to the end point from the nearest airport flight_time: the flight time from the starting point to the end point. I used Google Flights) and always took the top result, except in cases where the top result was completely crazy (more than 2x the length of the shortest), in which case I took the shortest. I computed the travel time as (to_airport) * 1.5 + (90 if international else 60) + flight_time + from_airport. The first part is a fairly aggressive formula (I personally am much more conservative than this) for when to leave for the airport: aim to arrive 60 min before if domestic and 90 min before if international, and multiply expected travel time by 1.5x in case there are any mishaps or delays. This was boring and I was not interested in wasting my time to do more than 16 of these; I presume if I was a serious researcher I would already have an account set up on TaskRabbit or some similar service that would make it easier to hire other people to do this for me and get much more data. In any case, 16 is enough; I put my resulting data here.Finally, just for fun, I added some data for how long it would take to travel to various locations in space: the moon (I added 12 hours to the time to take into account an average person's travel time to the launch site), Mars, Pluto and Alpha Centauri. You can find my complete code here.Here's the resulting chart: travel_time = 733.002223593754 * distance^0.591980777827876 WAAAAAT?!?!! From this chart it seems like there is a surprisingly precise relationship governing travel time from point A to point B that somehow holds across such radically different transit media as walking, subways and buses, airplanes and (!!) interplanetary and hypothetical interstellar spacecraft. I swear that I am not cherrypicking; I did not throw out any data that was inconvenient, everything (including the space stuff) that I checked I put on the chart.ChatGPT 3.5 worked impressively well this time; it certainly stumbled and fell much less than my previous misadventure, where I tried to get it to help me convert IPFS bafyhashes into hex. In general, ChatGPT seems uniquely good at teaching me about libraries and APIs I've never heard of before but that other people use all the time; this reduces the barrier to entry between amateurs and professionals which seems like a very positive thing.So there we go, there seems to be some kind of really weird fractal law of travel time. Of course, different transit technologies could change this relationship: if you replace public transit with cars and commercial flights with private jets, travel time becomes somewhat more linear. And once we upload our minds onto computer hardware, we'll be able to travel to Alpha Centauri on much crazier vehicles like ultralight craft propelled by Earth-based lightsails) that could let us go anywhere at a significant fraction of the speed of light. But for now, it does seem like there is a strangely consistent relationship that puts time much closer to the square root of distance.

Travel time ~= 750 * distance ^ 0.6 Travel time ~= 750 * distance ^ 0.62023 Apr 14 See all posts Travel time ~= 750 * distance ^ 0.6 As another exercise in using ChatGPT 3.5 to do weird things and seeing what happens, I decided to explore an interesting question: how does the time it takes to travel from point A to point B scale with distance, in the real world? That is to say, if you sample randomly from positions where people are actually at (so, for example, 56% of points you choose would be in cities), and you use public transportation, how does travel time scale with distance?Obviously, travel time would grow slower than linearly: the further you have to go, the more opportunity you have to resort to forms of transportation that are faster, but have some fixed overhead. Outside of a very few lucky cases, there is no practical way to take a bus to go faster if your destination is 170 meters away, but if your destination is 170 kilometers away, you suddenly get more options. And if it's 1700 kilometers away, you get airplanes.So I asked ChatGPT for the ingredients I would need: I went with the GeoLife dataset. I did notice that while it claims to be about users around the world, primarily it seems to focus on people in Seattle and Beijing, though they do occasionally visit other cities. That said, I'm not a perfectionist and I was fine with it. I asked ChatGPT to write me a script to interpret the dataset and extract a randomly selected coordinate from each file: Amazingly, it almost succeeded on the first try. It did make the mistake of assuming every item in the list would be a number (values = [float(x) for x in line.strip().split(',')]), though perhaps to some extent that was my fault: when I said "the first two values" it probably interpreted that as implying that the entire line was made up of "values" (ie. numbers).I fixed the bug manually. Now, I have a way to get some randomly selected points where people are at, and I have an API to get the public transit travel time between the points.I asked it for more coding help:Asking how to get an API key for the Google Maps Directions API (it gave an answer that seems to be outdated, but that succeeded at immediately pointing me to the right place) Writing a function to compute the straight-line distance between two GPS coordinates (it gave the correct answer on the first try) Given a list of (distance, time) pairs, drawing a scatter plot, with time and distance as axes, both axes logarithmically scaled (it gave the correct answer on the first try) Doing a linear regression on the logarithms of distance and time to try to fit the data to a power law (it bugged on the first try, succeeded on the second) This gave me some really nice data (this is filtered for distances under 500km, as above 500km the best path almost certainly includes flying, and the Google Maps directions don't take into account flights): The power law fit that the linear regression gave is: travel_time = 965.8020738916074 * distance^0.6138556361612214 (time in seconds, distance in km).Now, I needed travel time data for longer distances, where the optimal route would include flights. Here, APIs could not help me: I asked ChatGPT if there were APIs that could do such a thing, and it did not give a satisfactory answer. I resorted to doing it manually:I used the same script, but modified it slightly to only output pairs of points which were more than 500km apart from each other. I took the first 8 results within the United States, and the first 8 with at least one end outside the United States, skipping over results that represented a city pair that had already been covered. For each result I manually obtained: to_airport: the public transit travel time from the starting point to the nearest airport, using Google Maps outside China and Baidu Maps inside China. from_airport: the public transit travel time to the end point from the nearest airport flight_time: the flight time from the starting point to the end point. I used Google Flights) and always took the top result, except in cases where the top result was completely crazy (more than 2x the length of the shortest), in which case I took the shortest. I computed the travel time as (to_airport) * 1.5 + (90 if international else 60) + flight_time + from_airport. The first part is a fairly aggressive formula (I personally am much more conservative than this) for when to leave for the airport: aim to arrive 60 min before if domestic and 90 min before if international, and multiply expected travel time by 1.5x in case there are any mishaps or delays. This was boring and I was not interested in wasting my time to do more than 16 of these; I presume if I was a serious researcher I would already have an account set up on TaskRabbit or some similar service that would make it easier to hire other people to do this for me and get much more data. In any case, 16 is enough; I put my resulting data here.Finally, just for fun, I added some data for how long it would take to travel to various locations in space: the moon (I added 12 hours to the time to take into account an average person's travel time to the launch site), Mars, Pluto and Alpha Centauri. You can find my complete code here.Here's the resulting chart: travel_time = 733.002223593754 * distance^0.591980777827876 WAAAAAT?!?!! From this chart it seems like there is a surprisingly precise relationship governing travel time from point A to point B that somehow holds across such radically different transit media as walking, subways and buses, airplanes and (!!) interplanetary and hypothetical interstellar spacecraft. I swear that I am not cherrypicking; I did not throw out any data that was inconvenient, everything (including the space stuff) that I checked I put on the chart.ChatGPT 3.5 worked impressively well this time; it certainly stumbled and fell much less than my previous misadventure, where I tried to get it to help me convert IPFS bafyhashes into hex. In general, ChatGPT seems uniquely good at teaching me about libraries and APIs I've never heard of before but that other people use all the time; this reduces the barrier to entry between amateurs and professionals which seems like a very positive thing.So there we go, there seems to be some kind of really weird fractal law of travel time. Of course, different transit technologies could change this relationship: if you replace public transit with cars and commercial flights with private jets, travel time becomes somewhat more linear. And once we upload our minds onto computer hardware, we'll be able to travel to Alpha Centauri on much crazier vehicles like ultralight craft propelled by Earth-based lightsails) that could let us go anywhere at a significant fraction of the speed of light. But for now, it does seem like there is a strangely consistent relationship that puts time much closer to the square root of distance. -

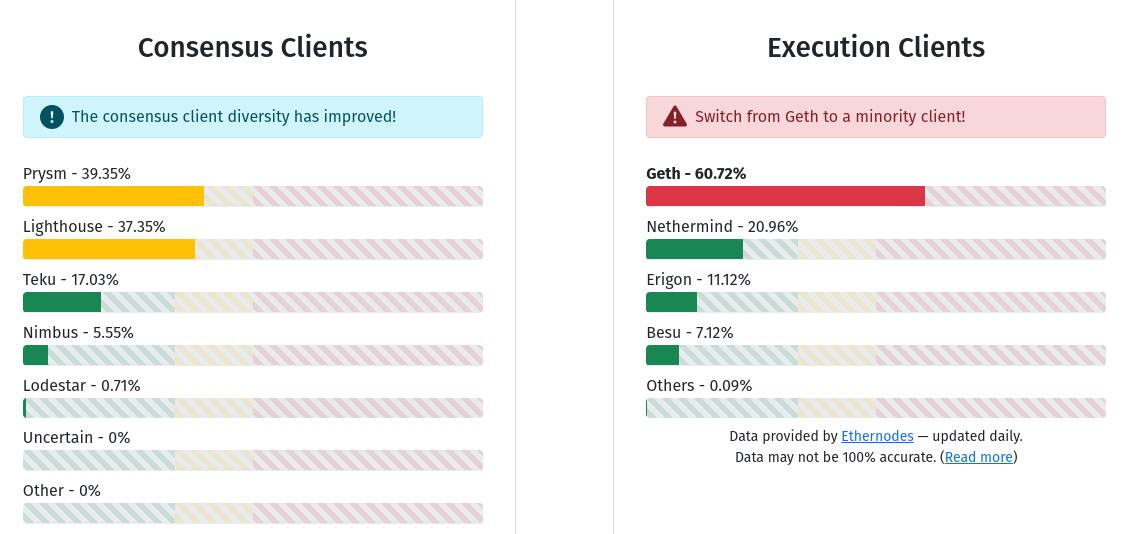

How will Ethereum's multi-client philosophy interact with ZK-EVMs? How will Ethereum's multi-client philosophy interact with ZK-EVMs?2023 Mar 31 See all posts How will Ethereum's multi-client philosophy interact with ZK-EVMs? Special thanks to Justin Drake for feedback and reviewOne underdiscussed, but nevertheless very important, way in which Ethereum maintains its security and decentralization is its multi-client philosophy. Ethereum intentionally has no "reference client" that everyone runs by default: instead, there is a collaboratively-managed specification (these days written in the very human-readable but very slow Python) and there are multiple teams making implementations of the spec (also called "clients"), which is what users actually run. Each Ethereum node runs a consensus client and an execution client. As of today, no consensus or execution client makes up more than 2/3 of the network. If a client with less than 1/3 share in its category has a bug, the network would simply continue as normal. If a client with between 1/3 and 2/3 share in its category (so, Prysm, Lighthouse or Geth) has a bug, the chain would continue adding blocks, but it would stop finalizing blocks, giving time for developers to intervene. One underdiscussed, but nevertheless very important, major upcoming transition in the way the Ethereum chain gets validated is the rise of ZK-EVMs. SNARKs proving EVM execution have been under development for years already, and the technology is actively being used by layer 2 protocols called ZK rollups. Some of these ZK rollups are active on mainnet today, with more coming soon. But in the longer term, ZK-EVMs are not just going to be for rollups; we want to use them to verify execution on layer 1 as well (see also: the Verge).Once that happens, ZK-EVMs de-facto become a third type of Ethereum client, just as important to the network's security as execution clients and consensus clients are today. And this naturally raises a question: how will ZK-EVMs interact with the multi-client philosophy? One of the hard parts is already done: we already have multiple ZK-EVM implementations that are being actively developed. But other hard parts remain: how would we actually make a "multi-client" ecosystem for ZK-proving correctness of Ethereum blocks? This question opens up some interesting technical challenges - and of course the looming question of whether or not the tradeoffs are worth it.What was the original motivation for Ethereum's multi-client philosophy?Ethereum's multi-client philosophy is a type of decentralization, and like decentralization in general, one can focus on either the technical benefits of architectural decentralization or the social benefits of political decentralization. Ultimately, the multi-client philosophy was motivated by both and serves both.Arguments for technical decentralizationThe main benefit of technical decentralization is simple: it reduces the risk that one bug in one piece of software leads to a catastrophic breakdown of the entire network. A historical situation that exemplifies this risk is the 2010 Bitcoin overflow bug. At the time, the Bitcoin client code did not check that the sum of the outputs of a transaction does not overflow (wrap around to zero by summing to above the maximum integer of \(2^ - 1\)), and so someone made a transaction that did exactly that, giving themselves billions of bitcoins. The bug was discovered within hours, and a fix was rushed through and quickly deployed across the network, but had there been a mature ecosystem at the time, those coins would have been accepted by exchanges, bridges and other structures, and the attackers could have gotten away with a lot of money. If there had been five different Bitcoin clients, it would have been very unlikely that all of them had the same bug, and so there would have been an immediate split, and the side of the split that was buggy would have probably lost.There is a tradeoff in using the multi-client approach to minimize the risk of catastrophic bugs: instead, you get consensus failure bugs. That is, if you have two clients, there is a risk that the clients have subtly different interpretations of some protocol rule, and while both interpretations are reasonable and do not allow stealing money, the disagreement would cause the chain to split in half. A serious split of that type happened once in Ethereum's history (there have been other much smaller splits where very small portions of the network running old versions of the code forked off). Defenders of the single-client approach point to consensus failures as a reason to not have multiple implementations: if there is only one client, that one client will not disagree with itself. Their model of how number of clients translates into risk might look something like this: I, of course, disagree with this analysis. The crux of my disagreement is that (i) 2010-style catastrophic bugs matter too, and (ii) you never actually have only one client. The latter point is made most obvious by the Bitcoin fork of 2013: a chain split occurred because of a disagreement between two different versions of the Bitcoin client, one of which turned out to have an accidental and undocumented limit on the number of objects that could be modified in a single block. Hence, one client in theory is often two clients in practice, and five clients in theory might be six or seven clients in practice - so we should just take the plunge and go on the right side of the risk curve, and have at least a few different clients.Arguments for political decentralizationMonopoly client developers are in a position with a lot of political power. If a client developer proposes a change, and users disagree, theoretically they could refuse to download the updated version, or create a fork without it, but in practice it's often difficult for users to do that. What if a disagreeable protocol change is bundled with a necessary security update? What if the main team threatens to quit if they don't get their way? Or, more tamely, what if the monopoly client team ends up being the only group with the greatest protocol expertise, leaving the rest of the ecosystem in a poor position to judge technical arguments that the client team puts forward, leaving the client team with a lot of room to push their own particular goals and values, which might not match with the broader community?Concern about protocol politics, particularly in the context of the 2013-14 Bitcoin OP_RETURN wars where some participants were openly in favor of discriminating against particular usages of the chain, was a significant contributing factor in Ethereum's early adoption of a multi-client philosophy, which was aimed to make it harder for a small group to make those kinds of decisions. Concerns specific to the Ethereum ecosystem - namely, avoiding concentration of power within the Ethereum Foundation itself - provided further support for this direction. In 2018, a decision was made to intentionally have the Foundation not make an implementation of the Ethereum PoS protocol (ie. what is now called a "consensus client"), leaving that task entirely to outside teams.How will ZK-EVMs come in on layer 1 in the future?Today, ZK-EVMs are used in rollups. This increases scaling by allowing expensive EVM execution to happen only a few times off-chain, with everyone else simply verifying SNARKs posted on-chain that prove that the EVM execution was computed correctly. It also allows some data (particularly signatures) to not be included on-chain, saving on gas costs. This gives us a lot of scalability benefits, and the combination of scalable computation with ZK-EVMs and scalable data with data availability sampling could let us scale very far.However, the Ethereum network today also has a different problem, one that no amount of layer 2 scaling can solve by itself: the layer 1 is difficult to verify, to the point where not many users run their own node. Instead, most users simply trust third-party providers. Light clients such as Helios and Succinct are taking steps toward solving the problem, but a light client is far from a fully verifying node: a light client merely verifies the signatures of a random subset of validators called the sync committee, and does not verify that the chain actually follows the protocol rules. To bring us to a world where users can actually verify that the chain follows the rules, we would have to do something different.Option 1: constrict layer 1, force almost all activity to move to layer 2We could over time reduce the layer 1 gas-per-block target down from 15 million to 1 million, enough for a block to contain a single SNARK and a few deposit and withdraw operations but not much else, and thereby force almost all user activity to move to layer 2 protocols. Such a design could still support many rollups committing in each block: we could use off-chain aggregation protocols run by customized builders to gather together SNARKs from multiple layer 2 protocols and combine them into a single SNARK. In such a world, the only function of layer 1 would be to be a clearinghouse for layer 2 protocols, verifying their proofs and occasionally facilitating large funds transfers between them. This approach could work, but it has several important weaknesses:It's de-facto backwards-incompatible, in the sense that many existing L1-based applications become economically nonviable. User funds up to hundreds or thousands of dollars could get stuck as fees become so high that they exceed the cost of emptying those accounts. This could be addressed by letting users sign messages to opt in to an in-protocol mass migration to an L2 of their choice (see some early implementation ideas here), but this adds complexity to the transition, and making it truly cheap enough would require some kind of SNARK at layer 1 anyway. I'm generally a fan of breaking backwards compatibility when it comes to things like the SELFDESTRUCT opcode, but in this case the tradeoff seems much less favorable. It might still not make verification cheap enough. Ideally, the Ethereum protocol should be easy to verify not just on laptops but also inside phones, browser extensions, and even inside other chains. Syncing the chain for the first time, or after a long time offline, should also be easy. A laptop node could verify 1 million gas in ~20 ms, but even that implies 54 seconds to sync after one day offline (assuming single slot finality increases slot times to 32s), and for phones or browser extensions it would take a few hundred milliseconds per block and might still be a non-negligible battery drain. These numbers are manageable, but they are not ideal. Even in an L2-first ecosystem, there are benefits to L1 being at least somewhat affordable. Validiums can benefit from a stronger security model if users can withdraw their funds if they notice that new state data is no longer being made available. Arbitrage becomes more efficient, especially for smaller tokens, if the minimum size of an economically viable cross-L2 direct transfer is smaller. Hence, it seems more reasonable to try to find a way to use ZK-SNARKs to verify the layer 1 itself.Option 2: SNARK-verify the layer 1A type 1 (fully Ethereum-equivalent) ZK-EVM can be used to verify the EVM execution of a (layer 1) Ethereum block. We could write more SNARK code to also verify the consensus side of a block. This would be a challenging engineering problem: today, ZK-EVMs take minutes to hours to verify Ethereum blocks, and generating proofs in real time would require one or more of (i) improvements to Ethereum itself to remove SNARK-unfriendly components, (ii) either large efficiency gains with specialized hardware, and (iii) architectural improvements with much more parallelization. However, there is no fundamental technological reason why it cannot be done - and so I expect that, even if it takes many years, it will be done.Here is where we see the intersection with the multi-client paradigm: if we use ZK-EVMs to verify layer 1, which ZK-EVM do we use?I see three options:Single ZK-EVM: abandon the multi-client paradigm, and choose a single ZK-EVM that we use to verify blocks. Closed multi ZK-EVM: agree on and enshrine in consensus a specific set of multiple ZK-EVMs, and have a consensus-layer protocol rule that a block needs proofs from more than half of the ZK-EVMs in that set to be considered valid. Open multi ZK-EVM: different clients have different ZK-EVM implementations, and each client waits for a proof that is compatible with its own implementation before accepting a block as valid. To me, (3) seems ideal, at least until and unless our technology improves to the point where we can formally prove that all of the ZK-EVM implementations are equivalent to each other, at which point we can just pick whichever one is most efficient. (1) would sacrifice the benefits of the multi-client paradigm, and (2) would close off the possibility of developing new clients and lead to a more centralized ecosystem. (3) has challenges, but those challenges seem smaller than the challenges of the other two options, at least for now.Implementing (3) would not be too hard: one might have a p2p sub-network for each type of proof, and a client that uses one type of proof would listen on the corresponding sub-network and wait until they receive a proof that their verifier recognizes as valid.The two main challenges of (3) are likely the following:The latency challenge: a malicious attacker could publish a block late, along with a proof valid for one client. It would realistically take a long time (even if eg. 15 seconds) to generate proofs valid for other clients. This time would be long enough to potentially create a temporary fork and disrupt the chain for a few slots. Data inefficiency: one benefit of ZK-SNARKs is that data that is only relevant to verification (sometimes called "witness data") could be removed from a block. For example, once you've verified a signature, you don't need to keep the signature in a block, you could just store a single bit saying that the signature is valid, along with a single proof in the block confirming that all of the valid signatures exist. However, if we want it to be possible to generate proofs of multiple types for a block, the original signatures would need to actually be published. The latency challenge could be addressed by being careful when designing the single-slot finality protocol. Single-slot finality protocols will likely require more than two rounds of consensus per slot, and so one could require the first round to include the block, and only require nodes to verify proofs before signing in the third (or final) round. This ensures that a significant time window is always available between the deadline for publishing a block and the time when it's expected for proofs to be available.The data efficiency issue would have to be addressed by having a separate protocol for aggregating verification-related data. For signatures, we could use BLS aggregation, which ERC-4337 already supports. Another major category of verification-related data is ZK-SNARKs used for privacy. Fortunately, these often tend to have their own aggregation protocols.It is also worth mentioning that SNARK-verifying the layer 1 has an important benefit: the fact that on-chain EVM execution no longer needs to be verified by every node makes it possible to greatly increase the amount of EVM execution taking place. This could happen either by greatly increasing the layer 1 gas limit, or by introducing enshrined rollups, or both.ConclusionsMaking an open multi-client ZK-EVM ecosystem work well will take a lot of work. But the really good news is that much of this work is happening or will happen anyway:We have multiple strong ZK-EVM implementations already. These implementations are not yet type 1 (fully Ethereum-equivalent), but many of them are actively moving in that direction. The work on light clients such as Helios and Succinct may eventually turn into a more full SNARK-verification of the PoS consensus side of the Ethereum chain. Clients will likely start experimenting with ZK-EVMs to prove Ethereum block execution on their own, especially once we have stateless clients and there's no technical need to directly re-execute every block to maintain the state. We will probably get a slow and gradual transition from clients verifying Ethereum blocks by re-executing them to most clients verifying Ethereum blocks by checking SNARK proofs. The ERC-4337 and PBS ecosystems are likely to start working with aggregation technologies like BLS and proof aggregation pretty soon, in order to save on gas costs. On BLS aggregation, work has already started. With these technologies in place, the future looks very good. Ethereum blocks would be smaller than today, anyone could run a fully verifying node on their laptop or even their phone or inside a browser extension, and this would all happen while preserving the benefits of Ethereum's multi-client philosophy.In the longer-term future, of course anything could happen. Perhaps AI will super-charge formal verification to the point where it can easily prove ZK-EVM implementations equivalent and identify all the bugs that cause differences between them. Such a project may even be something that could be practical to start working on now. If such a formal verification-based approach succeeds, different mechanisms would need to be put in place to ensure continued political decentralization of the protocol; perhaps at that point, the protocol would be considered "complete" and immutability norms would be stronger. But even if that is the longer-term future, the open multi-client ZK-EVM world seems like a natural stepping stone that is likely to happen anyway.In the nearer term, this is still a long journey. ZK-EVMs are here, but ZK-EVMs becoming truly viable at layer 1 would require them to become type 1, and make proving fast enough that it can happen in real time. With enough parallelization, this is doable, but it will still be a lot of work to get there. Consensus changes like raising the gas cost of KECCAK, SHA256 and other hash function precompiles will also be an important part of the picture. That said, the first steps of the transition may happen sooner than we expect: once we switch to Verkle trees and stateless clients, clients could start gradually using ZK-EVMs, and a transition to an "open multi-ZK-EVM" world could start happening all on its own.

How will Ethereum's multi-client philosophy interact with ZK-EVMs? How will Ethereum's multi-client philosophy interact with ZK-EVMs?2023 Mar 31 See all posts How will Ethereum's multi-client philosophy interact with ZK-EVMs? Special thanks to Justin Drake for feedback and reviewOne underdiscussed, but nevertheless very important, way in which Ethereum maintains its security and decentralization is its multi-client philosophy. Ethereum intentionally has no "reference client" that everyone runs by default: instead, there is a collaboratively-managed specification (these days written in the very human-readable but very slow Python) and there are multiple teams making implementations of the spec (also called "clients"), which is what users actually run. Each Ethereum node runs a consensus client and an execution client. As of today, no consensus or execution client makes up more than 2/3 of the network. If a client with less than 1/3 share in its category has a bug, the network would simply continue as normal. If a client with between 1/3 and 2/3 share in its category (so, Prysm, Lighthouse or Geth) has a bug, the chain would continue adding blocks, but it would stop finalizing blocks, giving time for developers to intervene. One underdiscussed, but nevertheless very important, major upcoming transition in the way the Ethereum chain gets validated is the rise of ZK-EVMs. SNARKs proving EVM execution have been under development for years already, and the technology is actively being used by layer 2 protocols called ZK rollups. Some of these ZK rollups are active on mainnet today, with more coming soon. But in the longer term, ZK-EVMs are not just going to be for rollups; we want to use them to verify execution on layer 1 as well (see also: the Verge).Once that happens, ZK-EVMs de-facto become a third type of Ethereum client, just as important to the network's security as execution clients and consensus clients are today. And this naturally raises a question: how will ZK-EVMs interact with the multi-client philosophy? One of the hard parts is already done: we already have multiple ZK-EVM implementations that are being actively developed. But other hard parts remain: how would we actually make a "multi-client" ecosystem for ZK-proving correctness of Ethereum blocks? This question opens up some interesting technical challenges - and of course the looming question of whether or not the tradeoffs are worth it.What was the original motivation for Ethereum's multi-client philosophy?Ethereum's multi-client philosophy is a type of decentralization, and like decentralization in general, one can focus on either the technical benefits of architectural decentralization or the social benefits of political decentralization. Ultimately, the multi-client philosophy was motivated by both and serves both.Arguments for technical decentralizationThe main benefit of technical decentralization is simple: it reduces the risk that one bug in one piece of software leads to a catastrophic breakdown of the entire network. A historical situation that exemplifies this risk is the 2010 Bitcoin overflow bug. At the time, the Bitcoin client code did not check that the sum of the outputs of a transaction does not overflow (wrap around to zero by summing to above the maximum integer of \(2^ - 1\)), and so someone made a transaction that did exactly that, giving themselves billions of bitcoins. The bug was discovered within hours, and a fix was rushed through and quickly deployed across the network, but had there been a mature ecosystem at the time, those coins would have been accepted by exchanges, bridges and other structures, and the attackers could have gotten away with a lot of money. If there had been five different Bitcoin clients, it would have been very unlikely that all of them had the same bug, and so there would have been an immediate split, and the side of the split that was buggy would have probably lost.There is a tradeoff in using the multi-client approach to minimize the risk of catastrophic bugs: instead, you get consensus failure bugs. That is, if you have two clients, there is a risk that the clients have subtly different interpretations of some protocol rule, and while both interpretations are reasonable and do not allow stealing money, the disagreement would cause the chain to split in half. A serious split of that type happened once in Ethereum's history (there have been other much smaller splits where very small portions of the network running old versions of the code forked off). Defenders of the single-client approach point to consensus failures as a reason to not have multiple implementations: if there is only one client, that one client will not disagree with itself. Their model of how number of clients translates into risk might look something like this: I, of course, disagree with this analysis. The crux of my disagreement is that (i) 2010-style catastrophic bugs matter too, and (ii) you never actually have only one client. The latter point is made most obvious by the Bitcoin fork of 2013: a chain split occurred because of a disagreement between two different versions of the Bitcoin client, one of which turned out to have an accidental and undocumented limit on the number of objects that could be modified in a single block. Hence, one client in theory is often two clients in practice, and five clients in theory might be six or seven clients in practice - so we should just take the plunge and go on the right side of the risk curve, and have at least a few different clients.Arguments for political decentralizationMonopoly client developers are in a position with a lot of political power. If a client developer proposes a change, and users disagree, theoretically they could refuse to download the updated version, or create a fork without it, but in practice it's often difficult for users to do that. What if a disagreeable protocol change is bundled with a necessary security update? What if the main team threatens to quit if they don't get their way? Or, more tamely, what if the monopoly client team ends up being the only group with the greatest protocol expertise, leaving the rest of the ecosystem in a poor position to judge technical arguments that the client team puts forward, leaving the client team with a lot of room to push their own particular goals and values, which might not match with the broader community?Concern about protocol politics, particularly in the context of the 2013-14 Bitcoin OP_RETURN wars where some participants were openly in favor of discriminating against particular usages of the chain, was a significant contributing factor in Ethereum's early adoption of a multi-client philosophy, which was aimed to make it harder for a small group to make those kinds of decisions. Concerns specific to the Ethereum ecosystem - namely, avoiding concentration of power within the Ethereum Foundation itself - provided further support for this direction. In 2018, a decision was made to intentionally have the Foundation not make an implementation of the Ethereum PoS protocol (ie. what is now called a "consensus client"), leaving that task entirely to outside teams.How will ZK-EVMs come in on layer 1 in the future?Today, ZK-EVMs are used in rollups. This increases scaling by allowing expensive EVM execution to happen only a few times off-chain, with everyone else simply verifying SNARKs posted on-chain that prove that the EVM execution was computed correctly. It also allows some data (particularly signatures) to not be included on-chain, saving on gas costs. This gives us a lot of scalability benefits, and the combination of scalable computation with ZK-EVMs and scalable data with data availability sampling could let us scale very far.However, the Ethereum network today also has a different problem, one that no amount of layer 2 scaling can solve by itself: the layer 1 is difficult to verify, to the point where not many users run their own node. Instead, most users simply trust third-party providers. Light clients such as Helios and Succinct are taking steps toward solving the problem, but a light client is far from a fully verifying node: a light client merely verifies the signatures of a random subset of validators called the sync committee, and does not verify that the chain actually follows the protocol rules. To bring us to a world where users can actually verify that the chain follows the rules, we would have to do something different.Option 1: constrict layer 1, force almost all activity to move to layer 2We could over time reduce the layer 1 gas-per-block target down from 15 million to 1 million, enough for a block to contain a single SNARK and a few deposit and withdraw operations but not much else, and thereby force almost all user activity to move to layer 2 protocols. Such a design could still support many rollups committing in each block: we could use off-chain aggregation protocols run by customized builders to gather together SNARKs from multiple layer 2 protocols and combine them into a single SNARK. In such a world, the only function of layer 1 would be to be a clearinghouse for layer 2 protocols, verifying their proofs and occasionally facilitating large funds transfers between them. This approach could work, but it has several important weaknesses:It's de-facto backwards-incompatible, in the sense that many existing L1-based applications become economically nonviable. User funds up to hundreds or thousands of dollars could get stuck as fees become so high that they exceed the cost of emptying those accounts. This could be addressed by letting users sign messages to opt in to an in-protocol mass migration to an L2 of their choice (see some early implementation ideas here), but this adds complexity to the transition, and making it truly cheap enough would require some kind of SNARK at layer 1 anyway. I'm generally a fan of breaking backwards compatibility when it comes to things like the SELFDESTRUCT opcode, but in this case the tradeoff seems much less favorable. It might still not make verification cheap enough. Ideally, the Ethereum protocol should be easy to verify not just on laptops but also inside phones, browser extensions, and even inside other chains. Syncing the chain for the first time, or after a long time offline, should also be easy. A laptop node could verify 1 million gas in ~20 ms, but even that implies 54 seconds to sync after one day offline (assuming single slot finality increases slot times to 32s), and for phones or browser extensions it would take a few hundred milliseconds per block and might still be a non-negligible battery drain. These numbers are manageable, but they are not ideal. Even in an L2-first ecosystem, there are benefits to L1 being at least somewhat affordable. Validiums can benefit from a stronger security model if users can withdraw their funds if they notice that new state data is no longer being made available. Arbitrage becomes more efficient, especially for smaller tokens, if the minimum size of an economically viable cross-L2 direct transfer is smaller. Hence, it seems more reasonable to try to find a way to use ZK-SNARKs to verify the layer 1 itself.Option 2: SNARK-verify the layer 1A type 1 (fully Ethereum-equivalent) ZK-EVM can be used to verify the EVM execution of a (layer 1) Ethereum block. We could write more SNARK code to also verify the consensus side of a block. This would be a challenging engineering problem: today, ZK-EVMs take minutes to hours to verify Ethereum blocks, and generating proofs in real time would require one or more of (i) improvements to Ethereum itself to remove SNARK-unfriendly components, (ii) either large efficiency gains with specialized hardware, and (iii) architectural improvements with much more parallelization. However, there is no fundamental technological reason why it cannot be done - and so I expect that, even if it takes many years, it will be done.Here is where we see the intersection with the multi-client paradigm: if we use ZK-EVMs to verify layer 1, which ZK-EVM do we use?I see three options:Single ZK-EVM: abandon the multi-client paradigm, and choose a single ZK-EVM that we use to verify blocks. Closed multi ZK-EVM: agree on and enshrine in consensus a specific set of multiple ZK-EVMs, and have a consensus-layer protocol rule that a block needs proofs from more than half of the ZK-EVMs in that set to be considered valid. Open multi ZK-EVM: different clients have different ZK-EVM implementations, and each client waits for a proof that is compatible with its own implementation before accepting a block as valid. To me, (3) seems ideal, at least until and unless our technology improves to the point where we can formally prove that all of the ZK-EVM implementations are equivalent to each other, at which point we can just pick whichever one is most efficient. (1) would sacrifice the benefits of the multi-client paradigm, and (2) would close off the possibility of developing new clients and lead to a more centralized ecosystem. (3) has challenges, but those challenges seem smaller than the challenges of the other two options, at least for now.Implementing (3) would not be too hard: one might have a p2p sub-network for each type of proof, and a client that uses one type of proof would listen on the corresponding sub-network and wait until they receive a proof that their verifier recognizes as valid.The two main challenges of (3) are likely the following:The latency challenge: a malicious attacker could publish a block late, along with a proof valid for one client. It would realistically take a long time (even if eg. 15 seconds) to generate proofs valid for other clients. This time would be long enough to potentially create a temporary fork and disrupt the chain for a few slots. Data inefficiency: one benefit of ZK-SNARKs is that data that is only relevant to verification (sometimes called "witness data") could be removed from a block. For example, once you've verified a signature, you don't need to keep the signature in a block, you could just store a single bit saying that the signature is valid, along with a single proof in the block confirming that all of the valid signatures exist. However, if we want it to be possible to generate proofs of multiple types for a block, the original signatures would need to actually be published. The latency challenge could be addressed by being careful when designing the single-slot finality protocol. Single-slot finality protocols will likely require more than two rounds of consensus per slot, and so one could require the first round to include the block, and only require nodes to verify proofs before signing in the third (or final) round. This ensures that a significant time window is always available between the deadline for publishing a block and the time when it's expected for proofs to be available.The data efficiency issue would have to be addressed by having a separate protocol for aggregating verification-related data. For signatures, we could use BLS aggregation, which ERC-4337 already supports. Another major category of verification-related data is ZK-SNARKs used for privacy. Fortunately, these often tend to have their own aggregation protocols.It is also worth mentioning that SNARK-verifying the layer 1 has an important benefit: the fact that on-chain EVM execution no longer needs to be verified by every node makes it possible to greatly increase the amount of EVM execution taking place. This could happen either by greatly increasing the layer 1 gas limit, or by introducing enshrined rollups, or both.ConclusionsMaking an open multi-client ZK-EVM ecosystem work well will take a lot of work. But the really good news is that much of this work is happening or will happen anyway:We have multiple strong ZK-EVM implementations already. These implementations are not yet type 1 (fully Ethereum-equivalent), but many of them are actively moving in that direction. The work on light clients such as Helios and Succinct may eventually turn into a more full SNARK-verification of the PoS consensus side of the Ethereum chain. Clients will likely start experimenting with ZK-EVMs to prove Ethereum block execution on their own, especially once we have stateless clients and there's no technical need to directly re-execute every block to maintain the state. We will probably get a slow and gradual transition from clients verifying Ethereum blocks by re-executing them to most clients verifying Ethereum blocks by checking SNARK proofs. The ERC-4337 and PBS ecosystems are likely to start working with aggregation technologies like BLS and proof aggregation pretty soon, in order to save on gas costs. On BLS aggregation, work has already started. With these technologies in place, the future looks very good. Ethereum blocks would be smaller than today, anyone could run a fully verifying node on their laptop or even their phone or inside a browser extension, and this would all happen while preserving the benefits of Ethereum's multi-client philosophy.In the longer-term future, of course anything could happen. Perhaps AI will super-charge formal verification to the point where it can easily prove ZK-EVM implementations equivalent and identify all the bugs that cause differences between them. Such a project may even be something that could be practical to start working on now. If such a formal verification-based approach succeeds, different mechanisms would need to be put in place to ensure continued political decentralization of the protocol; perhaps at that point, the protocol would be considered "complete" and immutability norms would be stronger. But even if that is the longer-term future, the open multi-client ZK-EVM world seems like a natural stepping stone that is likely to happen anyway.In the nearer term, this is still a long journey. ZK-EVMs are here, but ZK-EVMs becoming truly viable at layer 1 would require them to become type 1, and make proving fast enough that it can happen in real time. With enough parallelization, this is doable, but it will still be a lot of work to get there. Consensus changes like raising the gas cost of KECCAK, SHA256 and other hash function precompiles will also be an important part of the picture. That said, the first steps of the transition may happen sooner than we expect: once we switch to Verkle trees and stateless clients, clients could start gradually using ZK-EVMs, and a transition to an "open multi-ZK-EVM" world could start happening all on its own. -

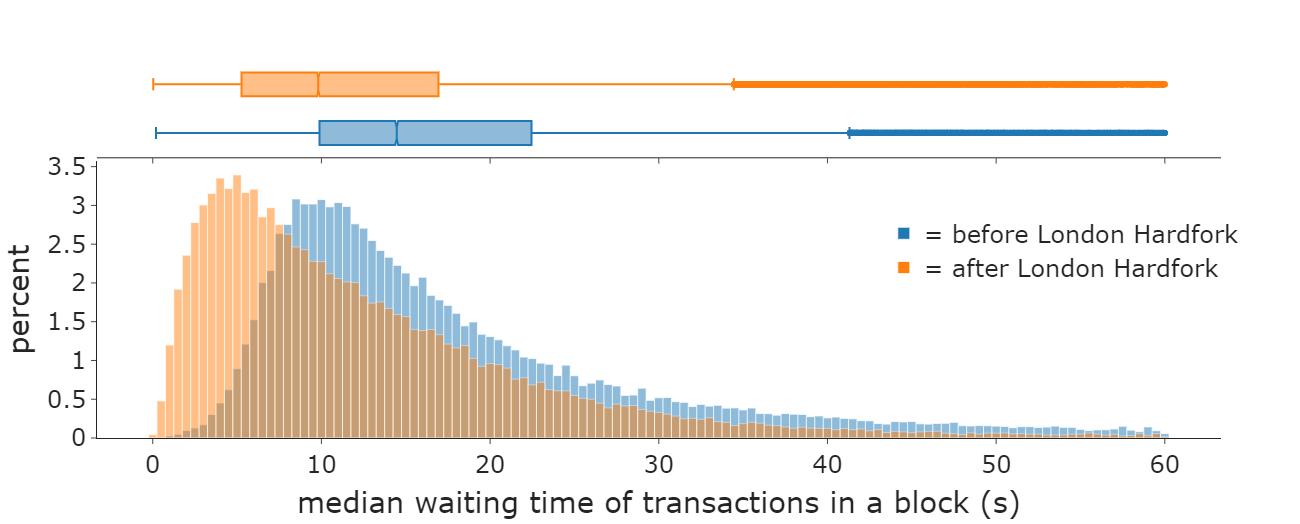

Some personal user experiences Some personal user experiences2023 Feb 28 See all posts Some personal user experiences In 2013, I went to a sushi restaurant beside the Internet Archive in San Francisco, because I had heard that it accepted bitcoin for payments and I wanted to try it out. When it came time to pay the bill, I asked to pay in BTC. I scanned the QR code, and clicked "send". To my surprise, the transaction did not go through; it appeared to have been sent, but the restaurant was not receiving it. I tried again, still no luck. I soon figured out that the problem was that my mobile internet was not working well at the time. I had to walk over 50 meters toward the Internet Archive nearby to access its wifi, which finally allowed me to send the transaction.Lesson learned: internet is not 100% reliable, and customer internet is less reliable than merchant internet. We need in-person payment systems to have some functionality (NFC, customer shows a QR code, whatever) to allow customers to transfer their transaction data directly to the merchant if that's the best way to get it broadcasted.In 2021, I attempted to pay for tea for myself and my friends at a coffee shop in Argentina. In their defense, they did not intentionally accept cryptocurrency: the owner simply recognized me, and showed me that he had an account at a cryptocurrency exchange, so I suggested to pay in ETH (using cryptocurrency exchange accounts as wallets is a standard way to do in-person payments in Latin America). Unfortunately, my first transaction of 0.003 ETH did not get accepted, probably because it was under the exchange's 0.01 ETH deposit minimum. I sent another 0.007 ETH. Soon, both got confirmed. (I did not mind the 3x overpayment and treated it as a tip).In 2022, I attempted to pay for tea at a different location. The first transaction failed, because the default transaction from my mobile wallet sent with only 21000 gas, and the receiving account was a contract that required extra gas to process the transfer. Attempts to send a second transaction failed, because a UI glitch in my phone wallet made it not possible to scroll down and edit the field that contained the gas limit.Lesson learned: simple-and-robust UIs are better than fancy-and-sleek ones. But also, most users don't even know what gas limits are, so we really just need to have better defaults.Many times, there has been a surprisingly long time delay between my transaction getting accepted on-chain, and the service acknowledging the transaction, even as "unconfirmed". Some of those times, I definitely got worried that there was some glitch with the payment system on their side.Many times, there has been a surprisingly long and unpredictable time delay between sending a transaction, and that transaction getting accepted in a block. Sometimes, a transaction would get accepted in a few seconds, but other times, it would take minutes or even hours. Recently, EIP-1559 significantly improved this, ensuring that most transactions get accepted into the next block, and even more recently the Merge improved things further by stabilizing block times. Diagram from this report by Yinhong (William) Zhao and Kartik Nayak. However, outliers still remain. If you send a transaction at the same time as when many others are sending transactions and the base fee is spiking up, you risk the base fee going too high and your transaction not getting accepted. Even worse, wallet UIs suck at showing this. There are no big red flashing alerts, and very little clear indication of what you're supposed to do to solve this problem. Even to an expert, who knows that in this case you're supposed to "speed up" the transaction by publishing a new transaction with identical data but a higher max-basefee, it's often not clear where the button to do that actually is.Lesson learned: UX around transaction inclusion needs to be improved, though there are fairly simple fixes. Credit to the Brave wallet team for taking my suggestions on this topic seriously, and first increasing the max-basefee tolerance from 12.5% to 33%, and more recently exploring ways to make stuck transactions more obvious in the UI.In 2019, I was testing out one of the earliest wallets that was attempting to provide social recovery. Unlike my preferred approach, which is smart-contract-based, their approach was to use Shamir's secret sharing to split up the private key to the account into five pieces, in such a way that any three of those pieces could be used to recover the private key. Users were expected to choose five friends ("guardians" in modern lingo), convince them to download a separate mobile application, and provide a confirmation code that would be used to create an encrypted connection from the user's wallet to the friend's application through Firebase and send them their share of the key.This approach quickly ran into problems for me. A few months later, something happened to my wallet and I needed to actually use the recovery procedure to recover it. I asked my friends to perform the recovery procedure with me through their apps - but it did not go as planned. Two of them lost their key shards, because they switched phones and forgot to move the recovery application over. For a third, the Firebase connection mechanism did not work for a long time. Eventually, we figured out how to fix the issue, and recover the key. A few months after that, however, the wallet broke again. This time, a regular software update somehow accidentally reset the app's storage and deleted its key. But I had not added enough recovery partners, because the Firebase connection mechanism was too broken and was not letting me successfully do that. I ended up losing a small amount of BTC and ETH.Lesson learned: secret-sharing-based off-chain social recovery is just really fragile and a bad idea unless there are no other options. Your recovery guardians should not have to download a separate application, because if you have an application only for an exceptional situation like recovery, it's too easy to forget about it and lose it. Additionally, requiring separate centralized communication channels comes with all kinds of problems. Instead, the way to add guardians should be to provide their ETH address, and recovery should be done by smart contract, using ERC-4337 account abstraction wallets. This way, the guardians would only need to not lose their Ethereum wallets, which is something that they already care much more about not losing for other reasons.In 2021, I was attempting to save on fees when using Tornado Cash, by using the "self-relay" option. Tornado Cash uses a "relay" mechanism where a third party pushes the transaction on-chain, because when you are withdrawing you generally do not yet have coins in your withdrawal address, and you don't want to pay for the transaction with your deposit address because that creates a public link between the two addresses, which is the whole problem that Tornado Cash is trying to prevent. The problem is that the relay mechanism is often expensive, with relays charging a percentage fee that could go far above the actual gas fee of the transaction.To save costs, one time I used the relay for a first small withdrawal that would charge lower fees, and then used the "self-relay" feature in Tornado Cash to send a second larger withdrawal myself without using relays. The problem is, I screwed up and accidentally did this while logged in to my deposit address, so the deposit address paid the fee instead of the withdrawal address. Oops, I created a public link between the two.Lesson learned: wallet developers should start thinking much more explicitly about privacy. Also, we need better forms of account abstraction to remove the need for centralized or even federated relays, and commoditize the relaying role.Miscellaneous stuffMany apps still do not work with the Brave wallet or the Status browser; this is likely because they didn't do their homework properly and rely on Metamask-specific APIs. Even Gnosis Safe did not work with these wallets for a long time, leading me to have to write my own mini Javascript dapp to make confirmations. Fortunately, the latest UI has fixed this issue. The ERC20 transfers pages on Etherscan (eg. https://etherscan.io/address/0xd8da6bf26964af9d7eed9e03e53415d37aa96045#tokentxns) are very easy to spam with fakes. Anyone can create a new ERC20 token with logic that can issue a log that claims that I or any other specific person sent someone else tokens. This is sometimes used to trick people into thinking that I support some scam token when I actually have never even heard of it. Uniswap used to offer the functionality of being able to swap tokens and have the output sent to a different address. This was really convenient for when I have to pay someone in USDC but I don't have any already on me. Now, the interface doesn't offer that function, and so I have to convert and then send in a separate transaction, which is less convenient and wastes more gas. I have since learned that Cowswap and Paraswap offer the functionality, though Paraswap... currently does not seem to work with the Brave wallet. Sign in with Ethereum is great, but it's still difficult to use if you are trying to sign in on multiple devices, and your Ethereum wallet is only available on one device. ConclusionsGood user experience is not about the average case, it is about the worst case. A UI that is clean and sleek, but does some weird and unexplainable thing 0.723% of the time that causes big problems, is worse than a UI that exposes more gritty details to the user but at least makes it easier to understand what's going on and fix any problem that does arise.Along with the all-important issue of high transaction fees due to scaling not yet being fully solved, user experience is a key reason why many Ethereum users, especially in the Global South, often opt for centralized solutions instead of on-chain decentralized alternatives that keep power in the hands of the user and their friends and family or local community. User experience has made great strides over the years - in particular, going from an average transaction taking minutes to get included before EIP-1559 to an average transaction taking seconds to get included after EIP-1559 and the merge, has been a night-and-day change to how pleasant it is to use Ethereum. But more still needs to be done.

Some personal user experiences Some personal user experiences2023 Feb 28 See all posts Some personal user experiences In 2013, I went to a sushi restaurant beside the Internet Archive in San Francisco, because I had heard that it accepted bitcoin for payments and I wanted to try it out. When it came time to pay the bill, I asked to pay in BTC. I scanned the QR code, and clicked "send". To my surprise, the transaction did not go through; it appeared to have been sent, but the restaurant was not receiving it. I tried again, still no luck. I soon figured out that the problem was that my mobile internet was not working well at the time. I had to walk over 50 meters toward the Internet Archive nearby to access its wifi, which finally allowed me to send the transaction.Lesson learned: internet is not 100% reliable, and customer internet is less reliable than merchant internet. We need in-person payment systems to have some functionality (NFC, customer shows a QR code, whatever) to allow customers to transfer their transaction data directly to the merchant if that's the best way to get it broadcasted.In 2021, I attempted to pay for tea for myself and my friends at a coffee shop in Argentina. In their defense, they did not intentionally accept cryptocurrency: the owner simply recognized me, and showed me that he had an account at a cryptocurrency exchange, so I suggested to pay in ETH (using cryptocurrency exchange accounts as wallets is a standard way to do in-person payments in Latin America). Unfortunately, my first transaction of 0.003 ETH did not get accepted, probably because it was under the exchange's 0.01 ETH deposit minimum. I sent another 0.007 ETH. Soon, both got confirmed. (I did not mind the 3x overpayment and treated it as a tip).In 2022, I attempted to pay for tea at a different location. The first transaction failed, because the default transaction from my mobile wallet sent with only 21000 gas, and the receiving account was a contract that required extra gas to process the transfer. Attempts to send a second transaction failed, because a UI glitch in my phone wallet made it not possible to scroll down and edit the field that contained the gas limit.Lesson learned: simple-and-robust UIs are better than fancy-and-sleek ones. But also, most users don't even know what gas limits are, so we really just need to have better defaults.Many times, there has been a surprisingly long time delay between my transaction getting accepted on-chain, and the service acknowledging the transaction, even as "unconfirmed". Some of those times, I definitely got worried that there was some glitch with the payment system on their side.Many times, there has been a surprisingly long and unpredictable time delay between sending a transaction, and that transaction getting accepted in a block. Sometimes, a transaction would get accepted in a few seconds, but other times, it would take minutes or even hours. Recently, EIP-1559 significantly improved this, ensuring that most transactions get accepted into the next block, and even more recently the Merge improved things further by stabilizing block times. Diagram from this report by Yinhong (William) Zhao and Kartik Nayak. However, outliers still remain. If you send a transaction at the same time as when many others are sending transactions and the base fee is spiking up, you risk the base fee going too high and your transaction not getting accepted. Even worse, wallet UIs suck at showing this. There are no big red flashing alerts, and very little clear indication of what you're supposed to do to solve this problem. Even to an expert, who knows that in this case you're supposed to "speed up" the transaction by publishing a new transaction with identical data but a higher max-basefee, it's often not clear where the button to do that actually is.Lesson learned: UX around transaction inclusion needs to be improved, though there are fairly simple fixes. Credit to the Brave wallet team for taking my suggestions on this topic seriously, and first increasing the max-basefee tolerance from 12.5% to 33%, and more recently exploring ways to make stuck transactions more obvious in the UI.In 2019, I was testing out one of the earliest wallets that was attempting to provide social recovery. Unlike my preferred approach, which is smart-contract-based, their approach was to use Shamir's secret sharing to split up the private key to the account into five pieces, in such a way that any three of those pieces could be used to recover the private key. Users were expected to choose five friends ("guardians" in modern lingo), convince them to download a separate mobile application, and provide a confirmation code that would be used to create an encrypted connection from the user's wallet to the friend's application through Firebase and send them their share of the key.This approach quickly ran into problems for me. A few months later, something happened to my wallet and I needed to actually use the recovery procedure to recover it. I asked my friends to perform the recovery procedure with me through their apps - but it did not go as planned. Two of them lost their key shards, because they switched phones and forgot to move the recovery application over. For a third, the Firebase connection mechanism did not work for a long time. Eventually, we figured out how to fix the issue, and recover the key. A few months after that, however, the wallet broke again. This time, a regular software update somehow accidentally reset the app's storage and deleted its key. But I had not added enough recovery partners, because the Firebase connection mechanism was too broken and was not letting me successfully do that. I ended up losing a small amount of BTC and ETH.Lesson learned: secret-sharing-based off-chain social recovery is just really fragile and a bad idea unless there are no other options. Your recovery guardians should not have to download a separate application, because if you have an application only for an exceptional situation like recovery, it's too easy to forget about it and lose it. Additionally, requiring separate centralized communication channels comes with all kinds of problems. Instead, the way to add guardians should be to provide their ETH address, and recovery should be done by smart contract, using ERC-4337 account abstraction wallets. This way, the guardians would only need to not lose their Ethereum wallets, which is something that they already care much more about not losing for other reasons.In 2021, I was attempting to save on fees when using Tornado Cash, by using the "self-relay" option. Tornado Cash uses a "relay" mechanism where a third party pushes the transaction on-chain, because when you are withdrawing you generally do not yet have coins in your withdrawal address, and you don't want to pay for the transaction with your deposit address because that creates a public link between the two addresses, which is the whole problem that Tornado Cash is trying to prevent. The problem is that the relay mechanism is often expensive, with relays charging a percentage fee that could go far above the actual gas fee of the transaction.To save costs, one time I used the relay for a first small withdrawal that would charge lower fees, and then used the "self-relay" feature in Tornado Cash to send a second larger withdrawal myself without using relays. The problem is, I screwed up and accidentally did this while logged in to my deposit address, so the deposit address paid the fee instead of the withdrawal address. Oops, I created a public link between the two.Lesson learned: wallet developers should start thinking much more explicitly about privacy. Also, we need better forms of account abstraction to remove the need for centralized or even federated relays, and commoditize the relaying role.Miscellaneous stuffMany apps still do not work with the Brave wallet or the Status browser; this is likely because they didn't do their homework properly and rely on Metamask-specific APIs. Even Gnosis Safe did not work with these wallets for a long time, leading me to have to write my own mini Javascript dapp to make confirmations. Fortunately, the latest UI has fixed this issue. The ERC20 transfers pages on Etherscan (eg. https://etherscan.io/address/0xd8da6bf26964af9d7eed9e03e53415d37aa96045#tokentxns) are very easy to spam with fakes. Anyone can create a new ERC20 token with logic that can issue a log that claims that I or any other specific person sent someone else tokens. This is sometimes used to trick people into thinking that I support some scam token when I actually have never even heard of it. Uniswap used to offer the functionality of being able to swap tokens and have the output sent to a different address. This was really convenient for when I have to pay someone in USDC but I don't have any already on me. Now, the interface doesn't offer that function, and so I have to convert and then send in a separate transaction, which is less convenient and wastes more gas. I have since learned that Cowswap and Paraswap offer the functionality, though Paraswap... currently does not seem to work with the Brave wallet. Sign in with Ethereum is great, but it's still difficult to use if you are trying to sign in on multiple devices, and your Ethereum wallet is only available on one device. ConclusionsGood user experience is not about the average case, it is about the worst case. A UI that is clean and sleek, but does some weird and unexplainable thing 0.723% of the time that causes big problems, is worse than a UI that exposes more gritty details to the user but at least makes it easier to understand what's going on and fix any problem that does arise.Along with the all-important issue of high transaction fees due to scaling not yet being fully solved, user experience is a key reason why many Ethereum users, especially in the Global South, often opt for centralized solutions instead of on-chain decentralized alternatives that keep power in the hands of the user and their friends and family or local community. User experience has made great strides over the years - in particular, going from an average transaction taking minutes to get included before EIP-1559 to an average transaction taking seconds to get included after EIP-1559 and the merge, has been a night-and-day change to how pleasant it is to use Ethereum. But more still needs to be done. -